by Jeff Clark, Gold Seek:

Most price forecasts aren’t worth more than an umbrella in a hurricane. There are so many factors, so many ever-changing variables, that even the experts usually miss the mark.

But there is value in considering predictions. It can solidify why one has invested, point to factors that may have been overlooked, or compel one to revise their expectations.

So while we take predictions with a grain of salt, let’s look at what might be ahead for gold in 2023, as well as the next five years (you can look up the gold price here).

TRUTH LIVES on at https://sgtreport.tv/

I’ll start with a survey of analysts, then examine the individual factors that are likely to have the biggest impact on gold, and then conclude with the prices I see based on those factors, including some long-term projections.

This will be fun, so let’s jump in!

Gold Price Prediction Chart

Gold ended 2022 at $1,825 per ounce, so let’s see where some analysts forecast it goes this year.

These are predictions I gathered from analysts both inside and outside of the gold industry.

There were some interesting comments that accompanied these forecasts.

- Ole Hansen: “In general we are looking for a price friendly 2023, supported by recession and stock market valuation risks — an eventual peak in central bank rates combined with the prospect of a weaker dollar and inflation not returning to the expected sub-3% level by year-end — all adding support. The gold price will be higher once markets realize global inflation will remain hot despite monetary tightening.”

- Juerg Kiener wrote that many economies could face “a little bit of a recession” in the first quarter, which would lead to many central banks slowing their pace of interest rate hikes and make gold instantly more attractive. He added, “Gold is also the only asset which every central bank owns.”

- In the bank and institutional investor survey, we’ll note the group is notoriously bearish. That said, Bank of America wrote “gold could top $2,000 an ounce next year.” Citigroup analysts said, “elevated risks of a global recession could boost inflows into gold funds, with prices potentially breaking out by mid-2023 to average more than $1,900.”

- JC Parets’ prediction is interesting because he’s known as a long-time gold bear. “There is a good chance the gold market sees a major move, it’s not going to be just 10% or 20%, but a move that will really make new highs… the fact that bullion prices haven’t sunk means there are buyers who are helping keep the price robust… from less than $425 in 2004 to $1,900 in 2011, gold gained around 350%. A similar move would see prices above $8,000.”

- Frank Holmes wrote, “Since the year 2000, gold has been up 80% of the time.”

- Eric Strand: “It is our opinion that central banks will pivot on their rate hikes and become dovish during 2023, which will ignite an explosive move for gold for years to come. We therefore believe gold will end 2023 at least 20% higher.”

- George Milling-Stanley: “Gold has nothing to fear from interest-rate hikes. It’s the impact of rate increases on the dollar that is important. If the dollar has peaked, I expect to see gold above $2,000 again this year… history suggests that when gold is in a sustainable long-term uptrend, which has been in place since the price last touched $250 in 2001, prices tend to move up stepwise, consolidating at every stage in the upward march.”

There were some bearish predictions too, of course, the most common reason cited was the belief that interest rates will continue to rise and inflation will fall, each of which they believe will soften demand.

Gold Price Predictions for Next 5 Years

Let’s examine the factors that are most likely to impact gold in 2023 and the next few years and see if we can come up with a reasonable expectation. We’ll start with the big three—inflation, recession, and interest rates…

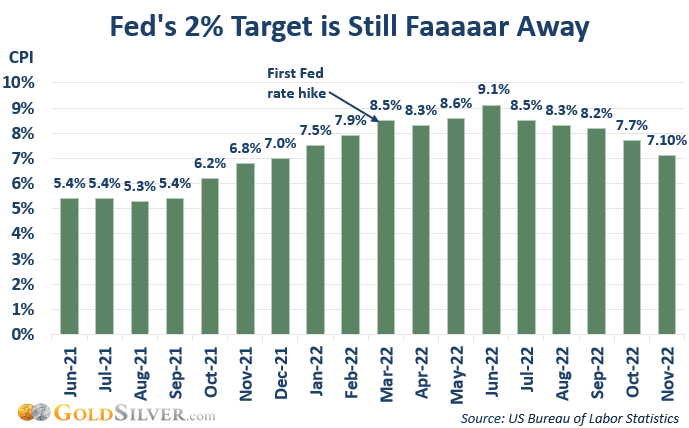

Inflation. One big question is how far inflation might fall. The CPI peaked at 9.1% last June, the highest rate in almost 40 years, and ended the year at 7.1%.

This chart shows the CPI reading for the last 18 months. As a reminder, the Fed and government economists said inflation would be “transitory” in April 2021—which was obviously wrong.

Further complicating the inflation question is the Fed’s insistence that it will lower the CPI to 2%. But…

This begs us to ask… can we trust their forecasts? How effective will the Fed’s aggressive rate hikes be? And what if inflation remains above their 2% target for—gulp—years?

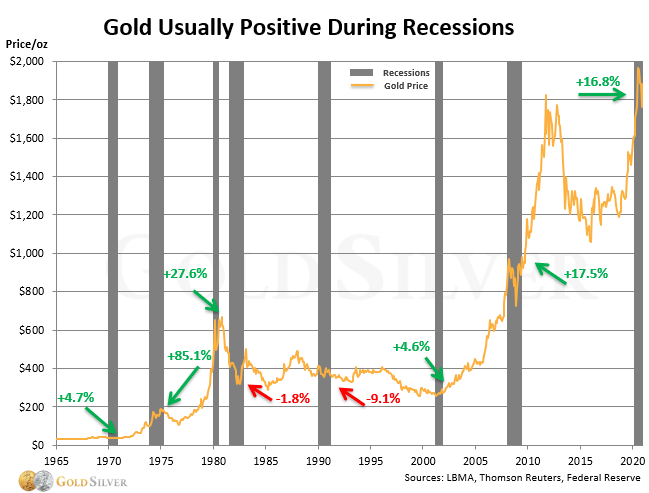

Recession. The odds of a recession are high; the most reliable indicator of an upcoming recession is a negative yield curve (10-Year Treasury minus 2-year), and it went negative in Q3 last year.

How does gold perform during recessions?

Gold has historically risen during recessions. In some cases the gains were substantial, and the only two declines were single digits.

Interest Rates. How much more can the Fed realistically raise rates?