by Rhoda Wilson, Daily Expose:

The latent multinational corporate state technocracy has gifted itself a secret tool, little discussed in electoral politics: the Investor-State Dispute Settlement (“ISDS”).

With its wonky, innocuous-sounding name, the ISDS framework for governing trade disputes is designed to garner as little interest, and therefore as little pushback, as possible from the public.

TRUTH LIVES on at https://sgtreport.tv/

ISDS is defined by Thomson Reuters as:

A procedural mechanism that allows an investor from one country to bring arbitral proceedings directly against the country in which it has invested.

ISDS provisions are contained in many international agreements including free trade agreements, bilateral investment treaties, multilateral investment agreements, national investment laws, and investment contracts. If an investor from one country (the “home state”) invests in another country (the “host state”), both of which have agreed to ISDS, and the host state violates the rights granted to the investor under public international law (such as the right not to have property expropriated without prompt, adequate, and effective compensation), then that investor may sue the host state in neutral arbitration rather than in the domestic courts of the host state. (Emphasis our own)

In non-academic, practical language, nation-states such as the US no longer exercise ultimate authority over the economic goings-on within their own borders. In theory, foreign actors, normally well-endowed corporations, can sue the US government if it doesn’t satisfy their economic interests. In reality, the US government is sufficiently captured that it would never likely challenge the multinational corporations that wrote the ISDS into legislation themselves through the politicians they purchased. The ISDS is merely extra assurance of compliance, in case a true nationalist ever seized power.

Globalisation – the disintegration of economic borders – drove the development of ISDS. So-called “free trade” agreements like NAFTA and GATT instantiated the concept into law. As academic Magdalena Bas explains:

The element that differentiates the State from any other subject of International Law or any other actor in international relations is sovereignty and, as a response, States recognise each other as legally equal. Although sovereignty remains “a ticket of general admission to the international arena” ( Fowler and Bunck, 1995 ), its concept has evolved throughout history and has even come into tension with hyper-globalisation ( Rodrik, 2011 ). One of the areas that illustrates this tension is Investor-State Dispute Settlement (ISDS).

If a state has no say in how business gets done in its territories, it’s not a state. It’s a proxy for a larger power.

As far as I can suss out, there are two main reasons that most voters have never heard of the ISDS, much less thought about its implications for their lives:

- it’s boring technical stuff; citizens are conditioned to get emotionally worked up about tribal culture war issues instead of focusing on the historic robbery underway by the parasitic elite class, and

- it’s great for multinational corporations that actually run US policy (the aforementioned parasitic elites).

Incrementally, methodically, and ruthlessly, the multinational corporate state, headed by the World Economic Forum, coalesces in the shadows. Once it’s fully completed, backed by legal constructs like ISDS and buttressed by the budding technetronic police state, resistance will be virtually impossible.

The above has been adapted from an article published by Global Research

The World Bank’s International Settlement for Investor Disputes (“ICSID”) governs most of the ISDS cases. Public Citizen noted that this means multinational corporations can sue governments before a panel of three corporate lawyers. These lawyers can award the corporations unlimited sums to be paid by taxpayers, including for the loss of expected future profits, on claims that a nation’s policy violates their rights. Their decisions cannot be appealed. Writing from an American perspective, the Public Citizen continued:

Not only do corporations get a special system of “justice” outside our courts, but it’s totally rigged in their favour.

Increasingly, the tribunals of lawyers are ordering massive payments. A tribunal ordered payment of more than $1.4 billion to a multinational oil firm after it violated the terms of its contract with the Ecuadorian government to explore for oil in the Amazon. TransCanada demanded $15 billion from the US when the Obama administration rejected the Keystone XL pipeline.

Just under US deals, tens of billions remain pending in corporate claims against climate and energy laws, medicine patent policies, pollution clean-up requirements, and other public interest policies we rely on to protect the environment, our health, safety and financial stability.

More Information on Investor-State Dispute Settlement, Public Citizen

Corporations from Which Countries are Suing Which Countries

It is not only the US that should be concerned about ISDS. In fact, citizens of other countries, particularly in the poorer nations, have just as much to be concerned about.

The United Nations Conference on Trade and Development (“UNCTAD”) produces annual reports on the “facts and figures” of publicly known ISDS cases. Unfortunately, the reports give an overview of the number of cases only and give no indication of the monetary value of the claims. ICSID lists cases in an online database which shows more details on individual cases but, again, no monetary value.

According to UNCTAD’s report published in September 2021, during 2020, investors initiated 68 cases against 43 countries. Peru and Croatia had the highest number of cases brought against them, with six and four cases respectively. “As in previous years, the majority of new cases (about 75 per cent) were brought against developing countries and transition economies,” the report stated. Adding that:

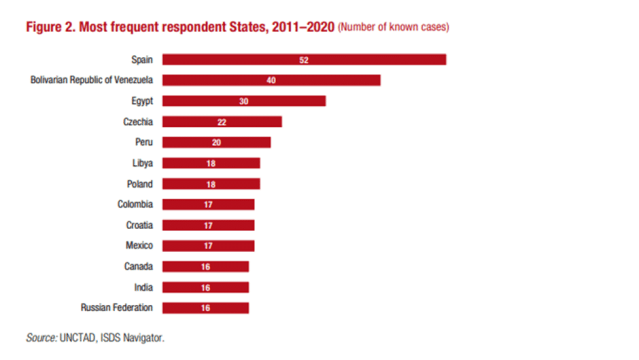

In the past 10 years, Spain, Venezuela and Egypt have received the largest share of claims. Looking at the 1,104 known ISDS cases filed since 1987 (the year of the first treaty-based ISDS case), Argentina (with 62 cases), Venezuela (54) and Spain (53) have been the most frequent respondent States.

Investor-State Dispute Settlement Cases: Facts and Figures 2020, UNCTAD, September 2020

The report also noted the home States of the investors or corporations making the claims. Of the cases in 2020, 70% were made by investors from developed countries:

The highest numbers of cases [in 2020] were brought by investors from the United States (10 cases), the Netherlands (7 cases) and the United Kingdom (5 cases).

In the past 10 years, investors from the United States, the Netherlands and the United Kingdom have filed the largest number of claims. Overall, these three countries have been the three most frequent home States of claimants in known ISDS cases filed from 1987 to 2020.

Investor-State Dispute Settlement Cases: Facts and Figures 2020, UNCTAD, September 2020

The UNCTAD’s latest report published in July 2022 related to cases initiated during 2021. Investors brought 68 ISDS cases against 42 countries. Peru again had the largest number, with six, followed by Egypt and Ukraine with four cases each. Following the trend of previous years, about 65% of new cases were brought against developing countries. And, 75% were initiated by investors from developed countries – the highest numbers of cases were brought by claimants from the United States (10 cases).

It’s no wonder that some countries are challenging this outrageous system. Public Citizen noted that South Africa, Indonesia, India and Ecuador are terminating or renegotiating their treaties with ISDS provisions. Venezuela and Bolivia have already done so.

Climate Change ISDS Cases

While the ISDS scheme undermines national sovereignty and nations should put an end this corporate power grab, there is perhaps a flicker of a silver lining in the interim. Perhaps ISDS could become an Achilles’ heel for the climate change/net zero zealots – although it could go the other way and be used as a stick to beat countries into submission, depending which investment treaty the corporation used when they invested in a country.