by Craig Hemke, Sprott Money:

In our 2022 macrocast, it was stated that the only thing predictable about the year ahead would be its unpredictable nature and wild volatility. Well, at least we got that right.

So, one year ends and a new year begins. The year 2022 unfolded in a manner similar to years past when The Fed was allowed to pretend and promote the idea of responsibility, prudence and balance sheet reduction. You might have thought that, collectively, the markets would have learned by now to see through this nonsense and, in a way, it appears they have.

TRUTH LIVES on at https://sgtreport.tv/

If, in January of 2022, I had written that the dollar index was set to spike 25% and that nominal rates were going to double, triple or quadruple depending upon duration, I’m pretty sure that it would have come with a forecast of sharply lower precious metal prices. Instead, at the close of 2022, Comex gold prices were down just $2.50. Yes, you read that right. On the year, gold was down $2.50 or about 0.13%. Comex silver fared even better with a gain of 63¢ and a closing price of $24.01. That’s up 2.7% on the year.

Holders of other commodities and asset classes didn’t fare as well, as you can see below:

The late 2022 rally that drove gold and silver back into the green on the year is very likely the result of a “market” that did finally learn to see through The Fed’s blather and bluster. As 2023 begins, we’re set to witness another easing cycle and, eventually, QE program. Gold and silver can see this coming and have reacted in preparation. Other markets will soon do the same.

But this next cycle of Fed easing is not yet upon us and, therefore, the first three to six months of the new year may continue to frustrate all of us as we await the eventual breakout to the upside.

For 2022, I had expected The Fed to reverse course by mid-year and begin cutting rates by late year if the S&P fell by 20% and the yield on the 10-year note surpassed 3.25%. Well, the S&P did, in fact, fall 20% and the yield on the 10-year note reached 4.45% and yet, still no cuts. So what’s the deal?

What The Fed failed to predict was the Russian invasion of Ukraine on February 24. This new war added a whole new dynamic to the economic uncertainty that prevailed as 2022 began. As such, while The Fed may have intended to act more quickly to stem inflation by raising rates, they were forced to delay. This gave time for inflation to gain even more momentum and reach levels not seen in over forty years.

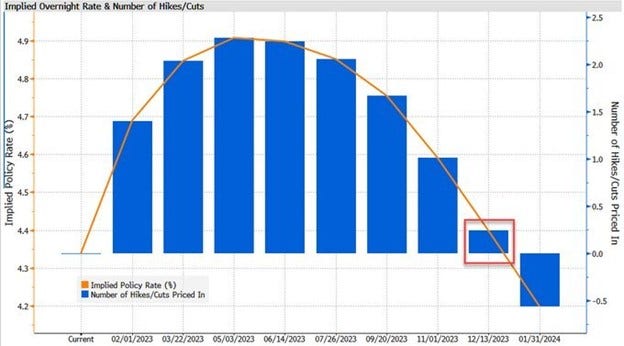

As The Fed persisted in their QE and waited too long to begin raising rates in 2022, they will be similarly persisting with rate hikes and waiting too long to restart QE in 2023. This will ultimately lead to a much sharper economic contraction than is currently expected and, once the Fed starts cutting again, it will then lead to much lower rates than currently forecast, too.

Think of it like a pendulum. However, instead of the swings becoming more narrow over time, in this case the swings become more wide. The paradigm-changing event was the initial QE program of March 2009. Since then, each subsequent rate cut and QE program has gotten larger and the inflationary impacts have gotten more substantial.

- QE 1: $600B in March 2009

- QE 2: $650B in November 2010

- QE 3: $1.1T in October 2012

- QE 4: $4.5T in March 2020

- QE 5: TBD beginning sometime late 2023 or early 2024.

In the simplest terms, how and why can we be so certain that the next QE program will be the largest yet? It’s just the math.

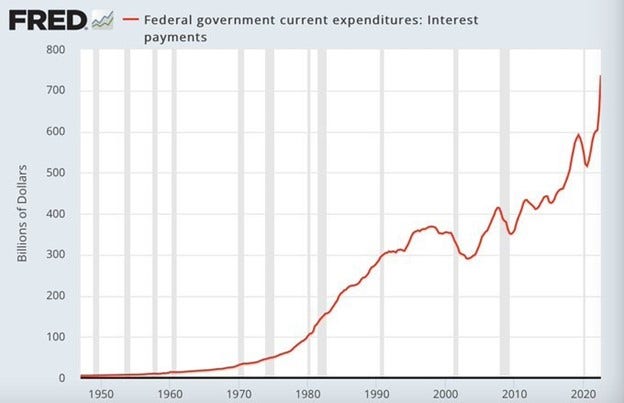

As rates rose in 2022, the budget line item of “interest on the national debt” ballooned to nearly $750B/year. If rates were to continue higher, this one expense would soon eclipse other “necessary” government outlays like social spending and defense. This cannot, and will not, be allowed.

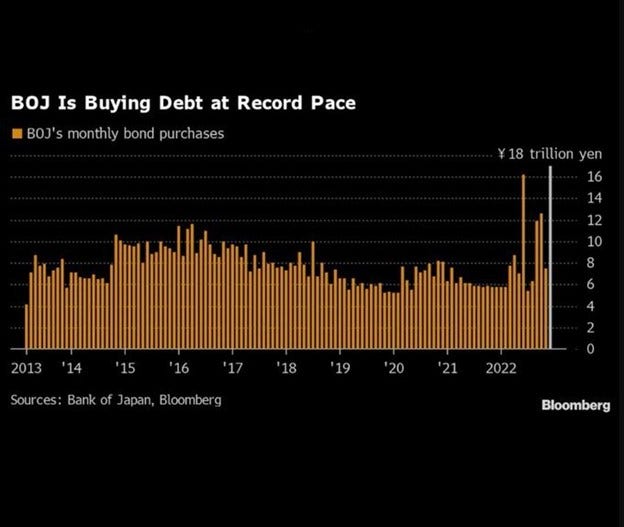

At present, rates have continued higher for the basic economic reason of bonds having more sellers than buyers. This leads to lower bond prices and higher rates. Traditional buyers have left the building. The ECB? Not buying treasuries. Neither is the PBOC nor the BoE. And you can forget about the BoJ coming back anytime soon as they’re desperate to manage their own bond market.

So The Fed eventually becomes the buyer of last resort at U.S. Treasury auctions, otherwise rates spike, the U.S. economy contracts dramatically, tax receipts plummet and the entire Ponzi-style debt scheme implodes. Wanting to forestall this collapse as long as possible is why QE has persisted as the dominant Fed policy since 2009 and it’s why The Fed will be forced to get back in the game much sooner than most 8-figure Wall Street economists expect.

Speaking of those Wall Street guys, we enter 2023 with many of them still employed after another year of dreadful forecasting and many of them making the same mistakes as 2019, which is the most recent year that’s analogous to the year ahead. As 2019 began, nearly every economist and sell-side analyst was forecasting higher rates in the months to come. The ignominious Jan Hatzius of Goldman Sachs was projecting the yield on the benchmark U.S. 10-year note to rise from 2.50% to 4.5-5.0% by year end. Instead, rates fell and finished the year at 1.50%. You’d think he’d have learned his lesson but here’s ole Jan making the same mistake in late 2022.