by Richard (Rick) Mills, Silver Seek:

Silver, like gold, is a precious metal that offers investors protection during times of economic and political uncertainty.

After Russia’s invasion of Ukraine earlier this year, the flight to safety subsequently sent silver prices past the $26/oz mark, which was last seen in August, 2021.

This silver rally proved to be a flash in the pan, however. An aggressive interest rate hike campaign by the US Federal Reserve, along with a high US dollar, has kept the safe-haven metal in check.

TRUTH LIVES on at https://sgtreport.tv/

Still, there are multiple reasons to believe that longer term, silver will rebound — possibly returning to levels last seen during the early 2021 Reddit-fueled silver frenzy.

Spot silver has already gained 20% over the last three months.

Source: Kitco

Source: Kitco

The potential forces behind silver’s next rally include: monetary demand, industrial demand, low inventories, physical market tightness, peak silver, and the gold-silver ratio.

Monetary demand

Soaring bond yields indicate that investors think the US Federal Reserve will do whatever is necessary to bring down inflation, and will succeed, without crashing the economy. But, once the Fed can no longer deny that it’s wrong about being able to control inflation, and that the economy is weaker than they think, it will go back to loose monetary policy, i.e., quantitative easing (good for gold & silver).

Gold is often touted as a smart means of portfolio diversification, beyond traditional stocks and bonds. However, new research by Oxford Economics advises that silver should also be included within a multi-asset investment portfolio.

The firm found investors would benefit from a 4 to 6% silver allocation, which is significantly higher than current holdings of silver by most institutional and retail investors.

Now, imo, would be an especially good time to start accumulating silver, or adding to an existing position, considering the inflationary environment we find ourselves in. Silver, like gold, is considered an excellent inflation hedge; unlike fiat currencies, silver does not lose its value when inflation erodes the purchasing power of a unit of currency.

Inflation is the fourth horseman

We are also on the brink of a recession, which is bad news for stock prices, but good news for precious metals. Silver and gold bulls like nothing more than an economic crisis, or geopolitical turmoil, to watch the value of their bullion grow. And while stocks enjoyed a November lift, technical analysis shows it was probably a dead-cat bounce.

The mother of all economic crises

In a recent letter to investors, Mark Spiegel of Stanphyl Capital said he believes the major indexes, though not all individual stocks, have considerably more downside — “the inevitable hangover from the biggest asset bubble in US history.”

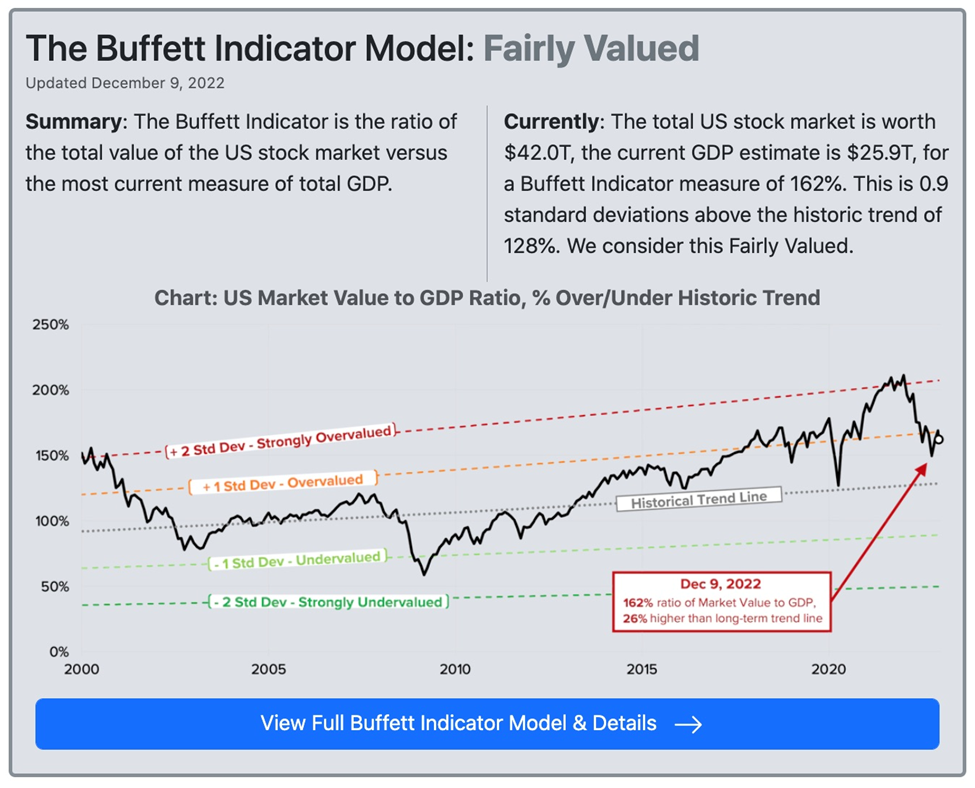

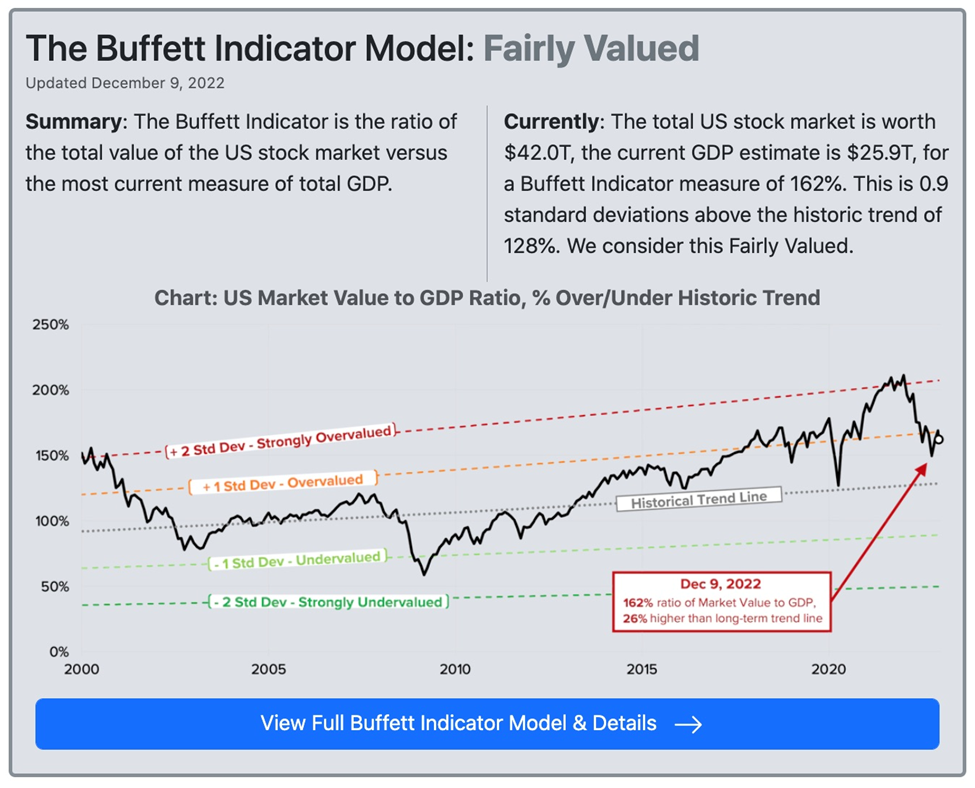

Spiegel via Quoth the Raven (Zero Hedge) also observes that the US stock market’s valuation as a percentage of GDP (the “Buffett Indicator”) is very high, and thus valuations have a long way to go before reaching “normalcy”. The indicator is currently sitting at 162%, 26% higher than the historical trend of 128%.

Source: currentmarketvaluation.com

Source: currentmarketvaluation.com

As for the Federal Reserve’s interest rate increases, and their effect on silver, the Fed will be guided by November’s inflation numbers which are due out Tuesday, right before the next FOMC meeting, on Dec. 14.

The pervasiveness of price pressures is problematic, and it will likely take two or more months of decreases for the Fed to consider pivoting from hawkish to dovish, meaning lowering interest rates and returning to its program of sovereign bond buying known as quantitative easing, or QE — that would be great for gold and silver.

The November CPI forecast, according to consensus estimates from FactSet, is for a slight lessening of the benchmark inflation indicator:

- CPI, year over year, to rise 7.3% versus 7.7% in October.

- CPI to rise 0.35% for the month versus 0.4% in October.

- Core CPI (excluding food and energy) to rise 0.3% for the month versus 0.3% in October.

- Core CPI, year over year, to rise 6.1% versus 6.3% in October.

Another key inflation measure, the Producer Price Index, rose 7.4% in November compared to 8.1% in October, the Bureau of Labor Statistics reported last Friday, via CNN. The PPI measures prices paid for goods and services by businesses before they reach consumers.

However, “Any meaningful relief for household budgets is still somewhere over the horizon,” Greg McBride, chief financial analyst at Bankrate, was quoted by CNBC following the release of the October inflation figures.