by Avi Gilburt, Gold Seek:

Here’s the latest in our “Is Your Bank Safe?” series at SaferBankingResearch.com — this one on Wells Fargo.

Over the last few months, we have written several articles outlining our views of banks in general. We explained the relationship that you, as a depositor, have with your bank is in line with a debtor/creditor relationship. This places you in a precarious position should the bank encounter financial or liquidity issues. Moreover, we also outlined why reliance on the FDIC may not be wholly advisable. And, finally, we explained that the next time there’s a financial meltdown, your deposits may be turned into equity to assist the bank in reorganizing.

TRUTH LIVES on at https://sgtreport.tv/

So, at the end of the day, it behooves you, as a depositor, to seek out the strongest banks you can find, and to avoid banks which have questionable stability.

While we outlined in our last articles the potential pitfalls we foresee with regard to various banks in the foreseeable future, we have not provided you with a deeper understanding as to why we see the larger banks as having questionable stability. Over the coming months, we intend to publish articles outlining our views on this matter.

First, we want to explain the process with which we review the stability of a bank.

We focus on four main categories which are crucial to any bank’s operating performance. These are: 1) Balance Sheet Strength; 2) Margins & Cost Efficiency; 3) Asset Quality; 4) Capital & Profitability. Each of these four categories is divided into five subcategories, and then a score ranging from 1-5 is assigned for each of these 20 sub-categories:

If a bank looks much better than the peer group in the sub-category, it receives a score of 5.

If a bank looks better than the peer group in the sub-category, it receives a score of 4.

If a bank looks in line with the peer group in the sub-category, it receives a score of 3.

If a bank looks worse than the peer group in the sub-category, it receives a score of 2.

If a bank looks much worse than the peer group in the sub-category, it receives a score of 1.

Afterwards, we add up all the scores to get our total rating score. To make our analysis objective and straightforward, all the scores are equally weighted. As a result, an ideal bank gets 100 points, an average one 60 points, and a bad one of 20 points.

If you would like to read more detail on our process for evaluating a bank, feel free to read it here.

But, there are also certain “gate-keeping” issues which a bank must overcome before we even score that particular bank. And many banks present “red flags” which cause us to shy away from even considering them in our ranking system.

As mentioned before, it’s difficult to overestimate the importance of a deeper analysis when it comes to choosing a really strong and safe bank. There are quite a lot of red flags to which many retail depositors may not pay attention, especially in a stable market environment. However, those red flags are likely to lead to major issues in a volatile environment. Below, we highlight some of the key issues that we’re currently seeing when we take a closer look at Wells Fargo (WFC).

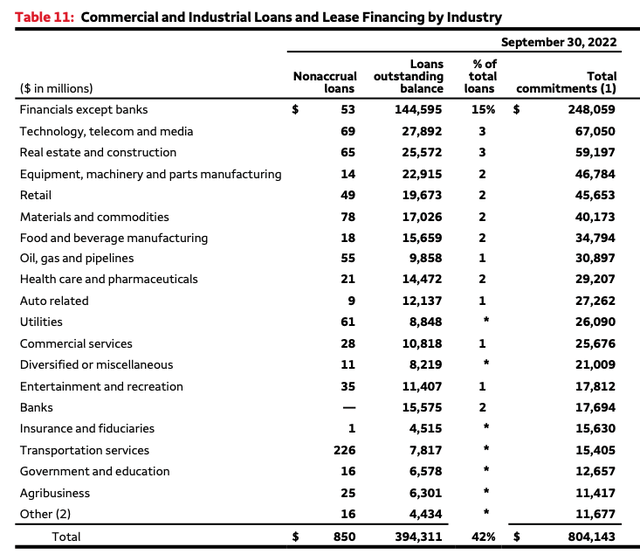

Commercial loan book is skewed toward financial companies

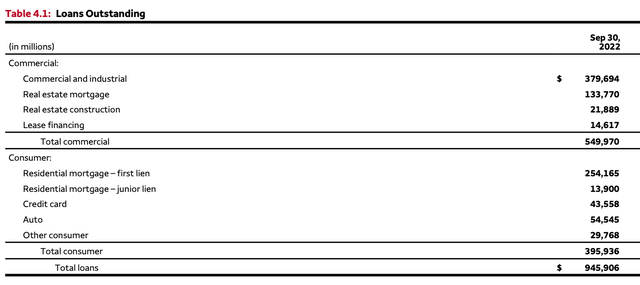

Wells Fargo has been historically viewed by many as a mortgage-focused lender. However, despite this common perception, commercial loans represented 58% of the bank’s total outstanding loans as of the end of the third quarter.

Company Data

Moreover, 15% of all WFC’s commercial loans were granted to financial companies. By comparison, the second-largest industry, technology, telecom and media, has a share of just 3%.

Company Data

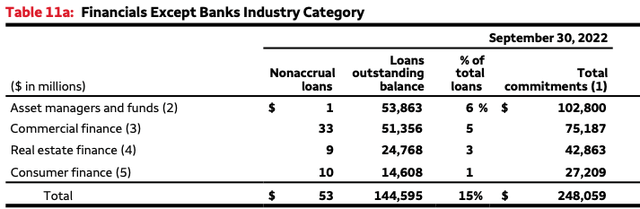

Below is a breakdown of the bank’s loans to financial companies. As you can see, there are loans to such high-risk borrowers as asset managers and funds, commercial finance, real estate finance, and consumer finance. Obviously, as the history tells us, these industries would be under significant pressure in a crisis environment.

Company Data

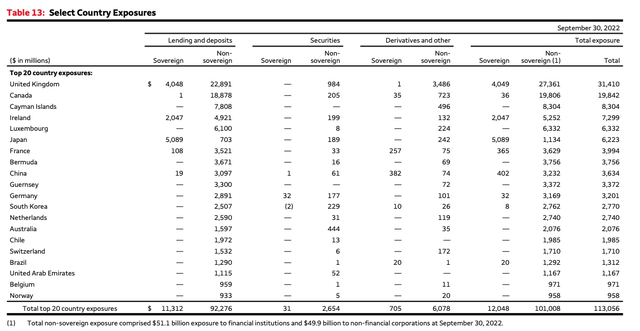

Exposure to non-U.S. lending, including loans to offshore-based companies

According to the bank’s latest 10-Q, its commercial lending book includes $79.6B of non-U.S. loans, which is almost 15% of the bank’s total commercial credit portfolio. These non-U.S. book includes the following loans:

- $44.6B to the financial companies expect banks industry;

- $15.9B to the banks industry;

- $1.7B to the oil, gas, and pipelines industry.

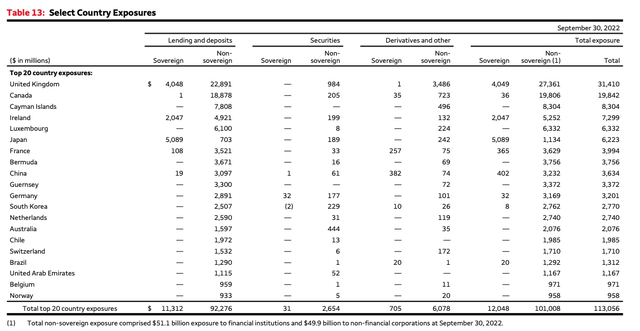

The table below provides a breakdown of the bank’s non-U.S. exposure by country. It’s important to note that, as the table shows, WFC granted loans to corporates based in such off-shore tax-heaven countries as Cayman Islands, Bermuda, and Guernsey, as well as such small countries as Luxembourg.

Company Data

In comparison, we also analyzed Bank of America’s (BAC) non-U.S. exposure in our recent article. While BAC does have quite a few red flags as well, it’s well worth noting that its non-U.S. lending book does not have exposure to offshore-based countries, which suggests that WFC is in even a much more risky posture.

Credit cards represent just 11% of consumer loans, however, this segment generates almost a half of earnings

Residential loans (first lien) are still the largest part of WFC’s retail lending portfolio. The rest of the book is represented by higher-risk products, such as junior lien mortgages, credit cards, and auto loans. The share of credit cards looks quite low, at 11% of the bank’s total consumer loans.