by Peter Schiff, Schiff Gold:

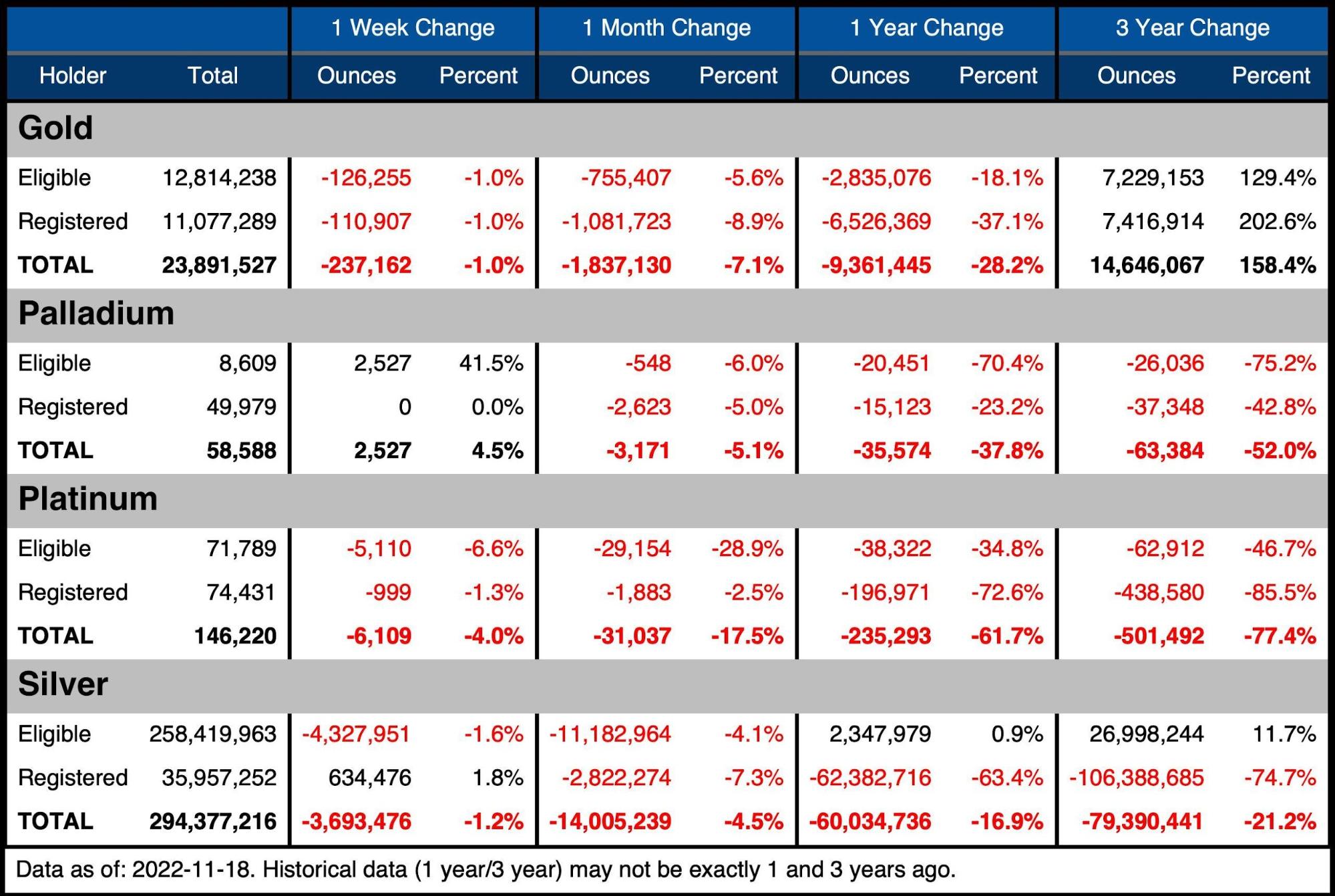

This analysis focuses on gold and silver within the Comex/CME futures exchange. See the article What is the Comex? for more detail. The charts and tables below specifically analyze the physical stock/inventory data at the Comex to show the physical movement of metal into and out of Comex vaults.

Registered = Warrant assigned and can be used for Comex delivery, Eligible = No warrant attached – owner has not made it available for delivery.

TRUTH LIVES on at https://sgtreport.tv/

Current Trends

Gold

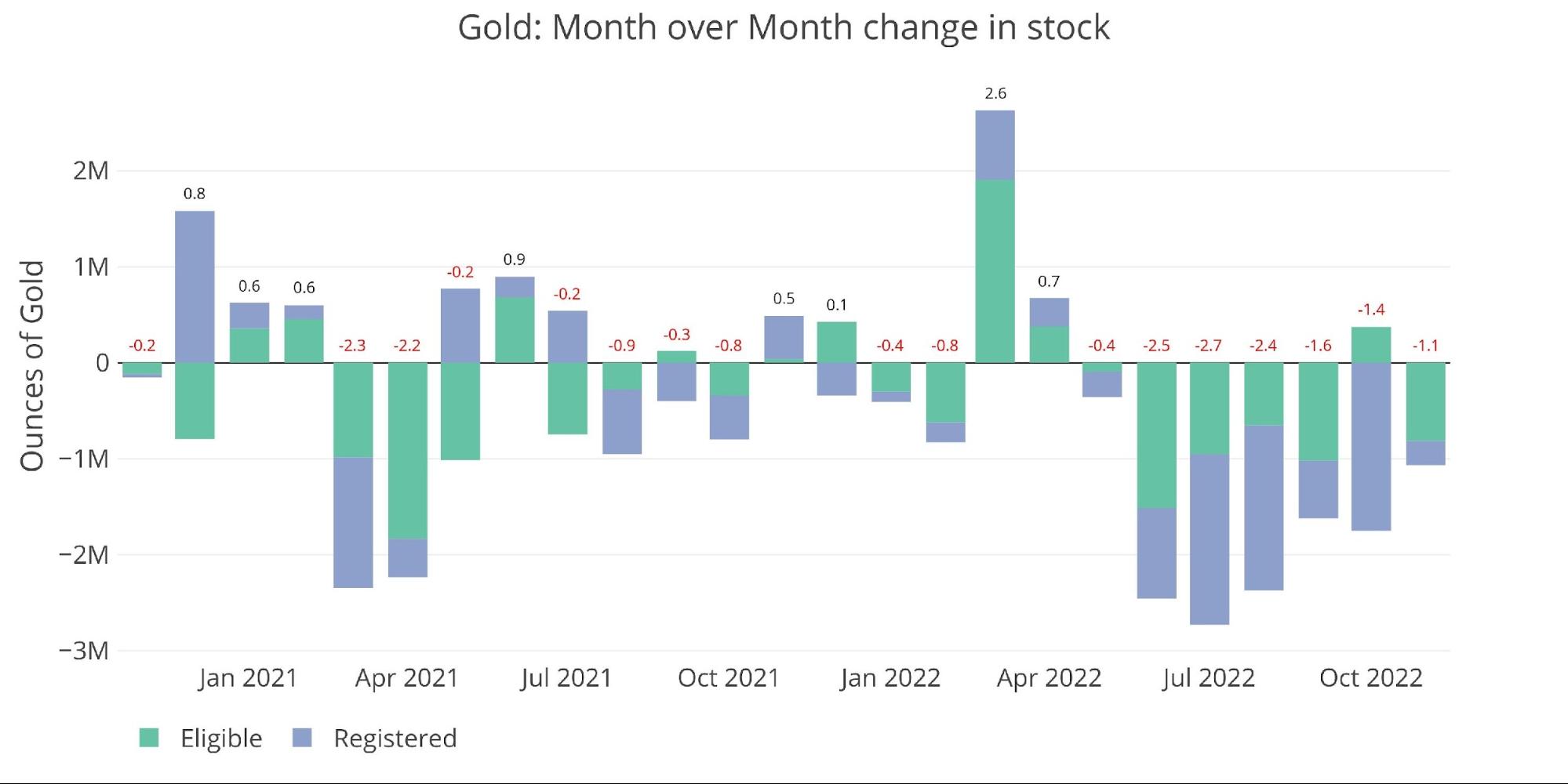

Gold continues to get drained from Comex vaults, seeing its seventh straight month of outflows. Just over halfway through November, the month has seen 1.1M ounces out of the vault indicating the pace of outflows has not yet slowed.

Figure: 1 Recent Monthly Stock Change

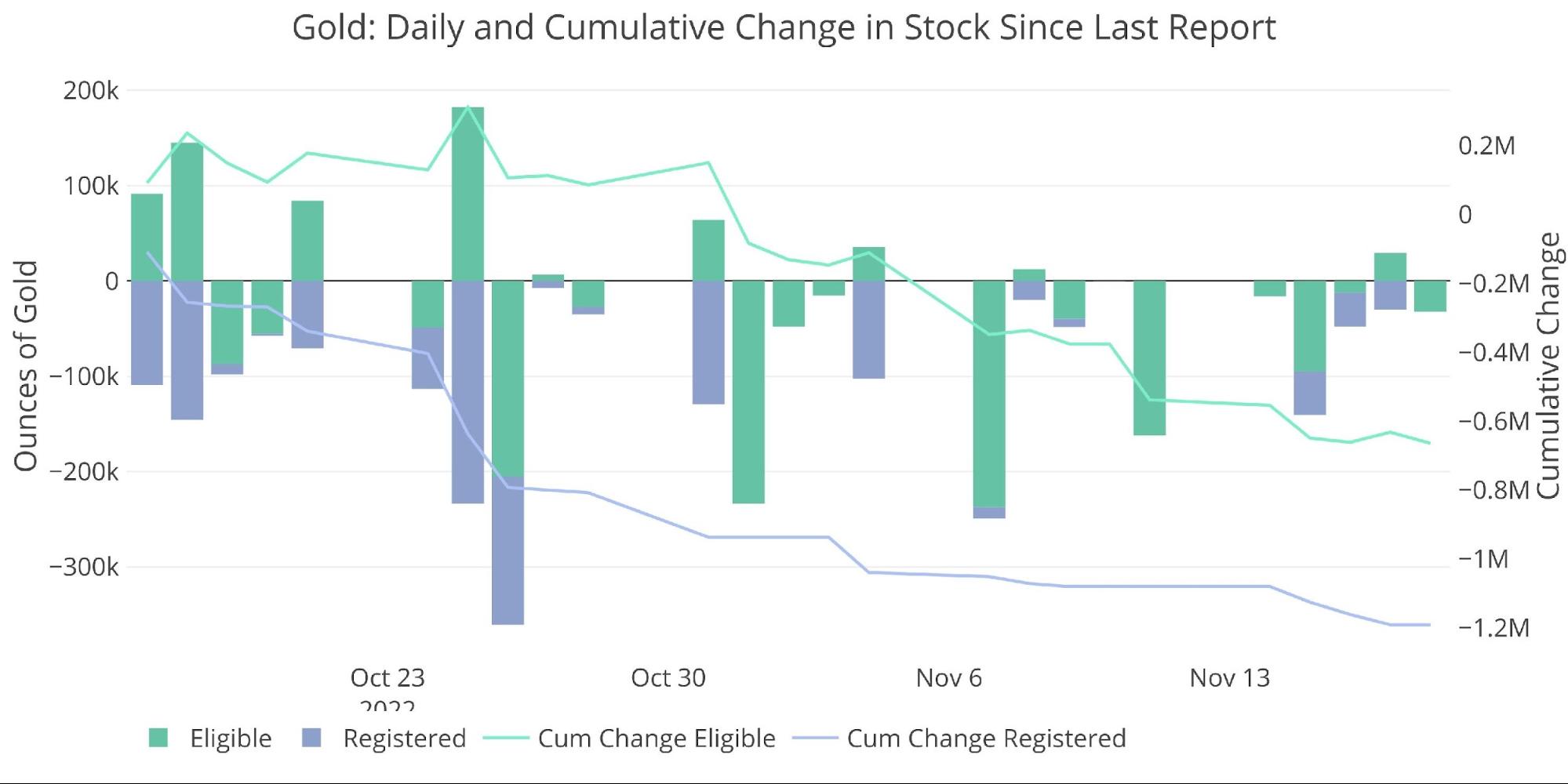

The daily vault moves can be seen below. Registered has not seen a material net inflow in over a month. Additionally, the metal entering Eligible is mainly coming from Registered rather than new sources. The move from Registered to Eligible is metal no longer available to meet delivery requests.

Figure: 2 Recent Monthly Stock Change

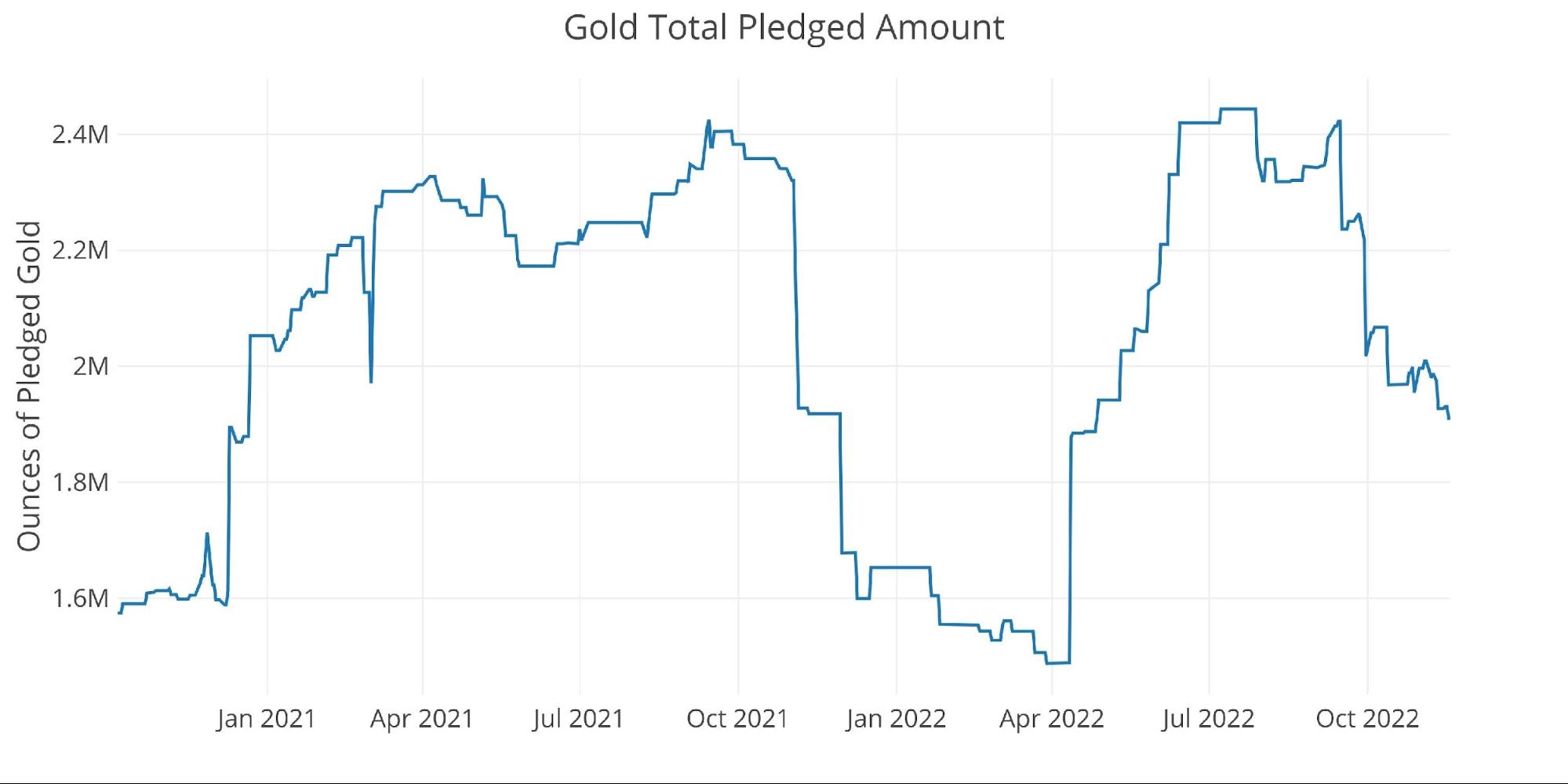

The current fall in Registered is also impacting the Pledged category. Pledged is a subset of Registered but is actually not available for delivery because it has been pledged as collateral. The amount in Pledged is now the lowest amount since April.

Figure: 3 Gold Pledged Holdings

Silver

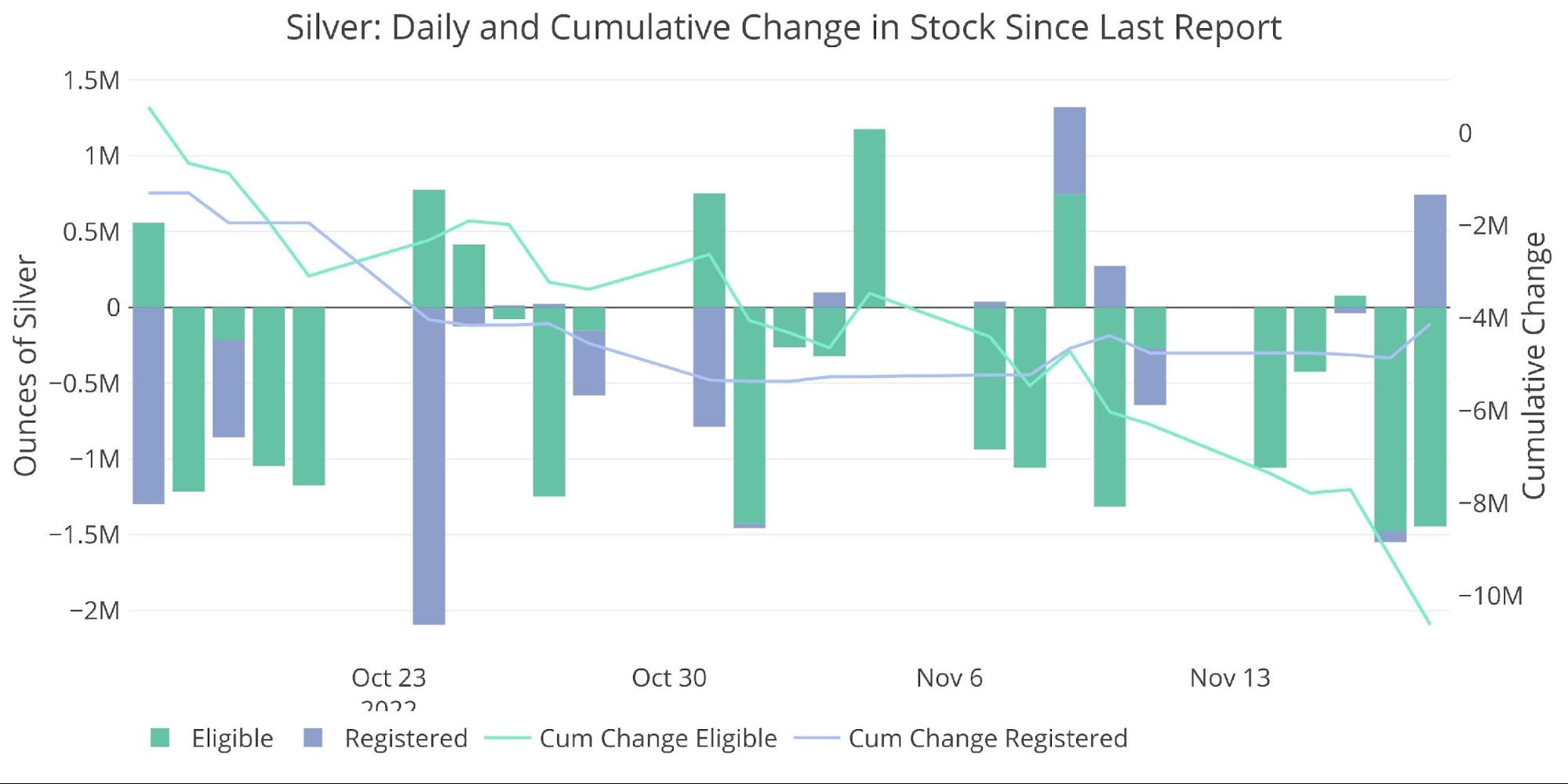

Silver has seen 5 straight months of net outflows. More importantly, though, the fallout of Registered has been relentless. There has been a slight uptick this month, but that is likely to reverse as the December contract starts delivery. Not including the current month, Registered has only seen a net increase in 3 months since January 2021.

In 2022, the fall in Registered has been simply astonishing. It has slowed some in November, but the same thing happened last year, right before nearly 17M ounces were removed in December. A similar event this year would cut the remaining Registered inventory by more than 50% in a single month!

Figure: 4 Recent Monthly Stock Change

The lack of available Registered silver seems to be influencing the bank’s delivery activity. Their house accounts have been very busy ever since December 2020 as shown below. That activity has slowed to a crawl over the last two months. Could this be due to the plummeting supplies or just seasonal activity? A similar event happened last year in October and November which proved to be the calm before the storm. As mentioned above, a similar storm to last year will decimate the remaining inventory.

Figure: 5 House Account Activity

Looking at the daily activity shows that there has been much more activity in the Eligible metal leaving the vault recently. This is a very interesting change. Over the last 6 months, metal has been moving from Registered to Eligible but staying within the Comex system. Now that metal is leaving the Comex system entirely.

While there is a much bigger supply of Eligible, much of that is owned and even backing the silver ETFs. This means the Eligible stack is much smaller than it appears. And that stack is definitely starting to shrink. Are people losing faith in the Comex system or just deciding “if you don’t hold it, you don’t own it”?

Figure: 6 Recent Monthly Stock Change

The table below summarizes the movement activity over several periods to better demonstrate the magnitude of the current move.

Gold

-

- Over the last month, gold has seen Registered fall of almost 9% with a total fall of 7.1%

-

- The fall over the last year has been 37.1%, up from 31.2% last month. This is a major acceleration.

-

- Over the last month, gold has seen Registered fall of almost 9% with a total fall of 7.1%

Silver

-

- Silver Registered is down by 7.3% in the last month even with a weekly increase of 1.8%!

-

- Registered silver is down an incredible 63.4% in the last year and 74.7% over three years

-

- Eligible saw 11M ounces removed over the last month

- Combined, inventory has dropped 4.5% in the last month

- Silver Registered is down by 7.3% in the last month even with a weekly increase of 1.8%!

If Registered silver continues to fall at the current pace, inventory could be wiped out within 5 months!

Palladium/Platinum

Palladium and platinum are much smaller markets but that may be where the market breaks first.

-

- Palladium is down 5% over the last month as it gears up for its major delivery month of December

- Platinum inventory is down 17.5% over the last month and 61.7% over the last year

-

- Platinum’s major delivery month is in January which could get interesting given recent events.

-

Figure: 7 Stock Change Summary

The next table shows the activity by bank/Holder. It details the numbers above to see the movement specific to vaults.

Gold

-

- Every vault has seen inventories fall over the last month with 6 vaults seeing supply fall by more than 5%

-

- Loomis has lost 13.1% of their metal stack in the last week alone

-

- Over the last year, 6 vaults have lost more than 25% of their total inventory!

- Every vault has seen inventories fall over the last month with 6 vaults seeing supply fall by more than 5%

Silver

-

- Silver has seen some big moves over the last month with Brinks losing 15% and Int. Delaware losing 32%

- Over the last year, 3 vaults have lost more than 10M ounces.

-

- Delaware Depository has been a lone standout, increasing its stack by 17M ounces or almost 90%

-