by Wolf Richter, Wolf Street:

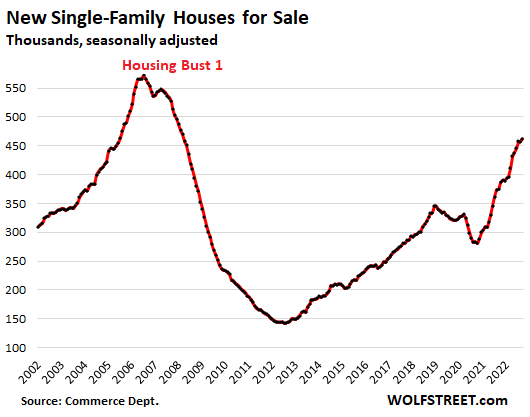

Construction starts of single-family houses have been dropping all year as homebuilders are trying to unload a huge pile of inventory while sales have plunged and foot traffic to view new properties has collapsed. In October, single-family construction starts dropped further.

Construction starts of multifamily projects – condo and apartment buildings – continue at the highest levels since the multifamily boom in the 1980s.

TRUTH LIVES on at https://sgtreport.tv/

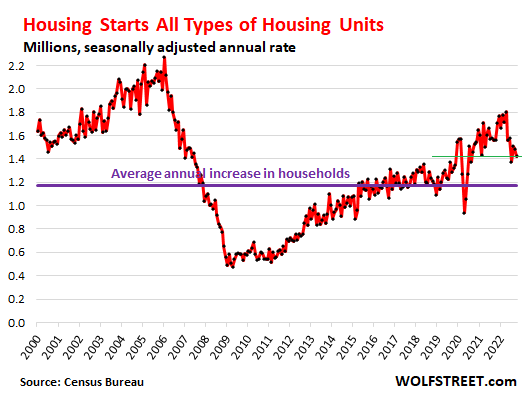

Combined, construction starts of all types of privately owned housing units fell by 4.2% in October from September, and by 8.8% year-over-year, to a seasonally adjusted annual rate (SAAR) of 1.42 million housing units, according to the Census Bureau today.

During the period from 2000 through 2020, the number of households increased by 1.17 million per year on average, topped off by a decline in 2020 (purple line). It sheds some light on the so-called “housing shortage” and “underbuilding.” But this equation doesn’t take into account housing units that are being used for non-housing purposes, such as vacant properties that are held off the market by their owners to ride up the price-spike all the way; and such as housing units being used as short-term vacation rentals.

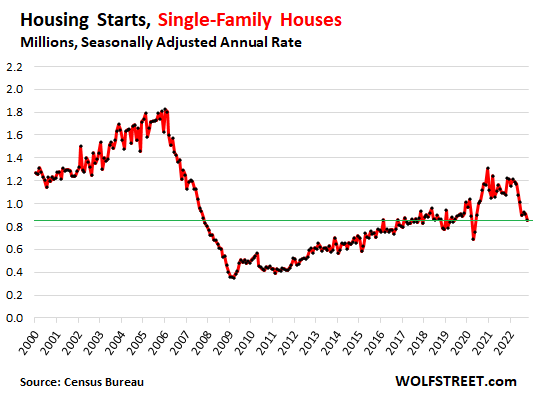

The plunge in single-family construction:

Construction starts of single-family houses plunged by 6.1% in October from September, and by 21% from a year ago, to a seasonally adjusted annual rate of 855,000 houses. Since the free-money-fueled peak in December 2020, construction starts of single-family houses have plunged by 35%.

But even the peak remains far below the Housing Bubble 1 peak in 2005, infamous for rampant overbuilding and the subsequent collapse of the industry.

Inventories of houses in various stages of construction have been piling up in massive numbers and in September, at 462,000 properties, reached the highest level since early 2008, according to separate data from the Census Bureau released last month. Mortgage rates have returned to the normal-ish levels before QE, but house prices have not, and that’s a toxic mix, and it killed demand.

The boom in multifamily construction.

Construction starts of multifamily buildings of five or more units, such as condo and apartment buildings, dipped just a tad in October from September, but surged by 17.3% from a year ago, to a seasonally adjusted annual rate of 556,000 units.

In many densely populated cities and urban cores, multifamily is just about the only type of housing that is getting built, such as in San Francisco, Boston, Manhattan, etc., while single-family construction takes place further away from urban cores.

These initial estimates of multifamily construction starts are volatile from month to month. To show the long-term trends, I converted the monthly data into three-month moving averages (3MMA), which rose to the highest level since 1986.

The current rate of construction starts is up by over 50% from the middle of the range in 2000-2008; and it’s up around 40% from the middle of the range in 2015 through 2019: