by Ronan Manly, BullionStar:

This week, the World Gold Council (WGC), which is a gold market development organization representing 32 of the world’s gold mining companies, published the latest quarterly edition of it’s well-known “Gold Demand Trends” research publication.

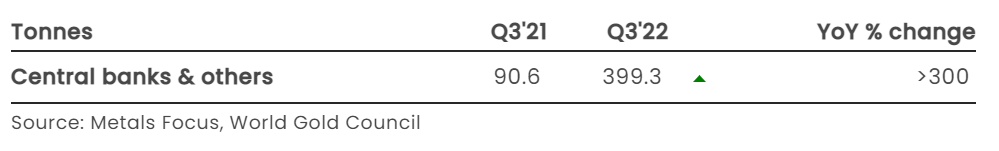

In the latest edition, which is titled “Gold Demand Trends Q3 2022”, the World Gold Council claims that during Q3 2022, “central banks continued to accumulate gold, with purchases estimated at a quarterly record of nearly 400 tonnes.”

TRUTH LIVES on at https://sgtreport.tv/

And for my Next Trick

According to the WGC:

“Global central bank purchases leapt to almost 400 tonnes in Q3 (+115% q-o-q). This is the largest single quarter of demand from this sector in our records back to 2000 and almost double the previous record of 241t in Q3 2018.

It also marks the eighth consecutive quarter of net purchases and lifts the y-t-d total to 673 tonnes, higher than any other full year total since 1967.”

Specifically, the World Gold Council claims that Q3 2022 central bank gold demand was 399.3 tonnes, which is a massive 340% higher than Q3 2021.

Sounding impressive enough, the world’s financial media not surprisingly ran with the soundbite, publishing articles with headlines such as “Record central bank buying lifts global gold demand, WGC says” and “Central bank gold purchases set an all-time high” and “Central banks are buying gold at the fastest pace in 55 years”.

Until that is, you read a bit further and see that the World Gold Council added a caveat for Q 3 2022 central bank gold demand, saying that for “Q3 net demand includes a substantial estimate for unreported purchases”.

Wait, what was that? The Q3 gold buying from central banks includes “a substantial estimate for unreported purchases”? At first glance, and at subsequent glances, this sentence doesn’t add up. Some purchases went unreported, but were somehow estimated? By who? If unreported, how were they estimated? If the estimate was a substantial estimate, does this mean that there were substantial unreported purchases?

The World Gold Council report continues:

“The level of official sector demand in Q3 is the combination of steady reported purchases by central banks and a substantial estimate for unreported buying.”

It was only a Suggestion

So the 399.3 tonnes number in the WGC report is made up of some purchases which were reported by central banks, and also someone estimated a large quantity of buying which was not reported anywhere. What kind of scientific methodology is this, you may ask? Confused? You will be.

The WGC report tries to explain it’s numbers, but arguably digs itself deeper into a hole:

“This is not uncommon as not all official institutions publicly report their gold holdings or may do so with a lag.

It’s also worth noting that while Metals Focus suggests purchases occurred during Q3, it’s possible they may have started earlier in the year. In turn, this may result in future revisions as more information becomes available.”

Wait a minute! Metals Focus ‘suggests’ that unreported purchases occurred in Q3, but possibly these weren’t from Q3. And who is “Metals Focus” anyway? And why is the WGC replying on a methodology based on mere suggestions? i.e. ‘suggesting purchases occurred in Q3’?

Before looking at who Metals Focus is, and why they are involved in the World Gold Council reports, let’s see what else the World Gold Council said about Q3 2022 central bank gold buying.

Reported gold buying – Emerging Market central banks

Given that the elephant in the room is “a substantial estimate for unreported buying”, the World Gold Council report plays it safe and does not address this point further, and limits itself to only addressing central bank gold transactions that were reported at a country level, stating that these were “confined to a relatively small number of emerging market banks.”

These emerging market central bank gold purchases included the Turkish central bank, which accumulated another 31 tonnes of gold during the third quarter, the Central Bank of Uzbekistan which bought 26 tonnes of gold in Q3, the Reserve Bank of India which bought 17 tonnes of gold in Q3, and the central banks of Mozambique (2 tonnes), the Philippines (2 tonnes) and Mongolia (1 tonne).

On the sell side, during Q3 Kazakhstan sold a net 2 tonnes, while the UAE sold a net 1 tonne.

A summary of most of the main country level central bank gold purchases and sales during Q3 can be seen on this WGC website page here.

Qatar – An Inconvenient Fact

Importantly, the WGC report also refers to the Qatar Central Bank, saying that the Qataris bought 15 tonnes of gold in July, but then at the same time the WGC refuses to recognise that the Qatar Central Bank bought an additional 15.75 tonnes of gold between August and September, saying that the Qatar Central Bank “seemingly added more in both August and September, but we are awaiting IMF data to confirm the exact level of buying”, because “early data from the IMF is patchy”.

As readers of BullionStar will know, after buying 15 tonnes of gold during July, the Qatar Central Bank then bought another 4.73 tonnes of gold in August (see here), and then purchased an additional 11 tonnes of gold during September.