by Egon Von Greyerz, Gold Switzerland:

With stocks, bonds and property in major bear markets, investors are desperately hoping (and praying) that the Fed and other Central banks will come to their rescue. But this time it is different. (You have heard that before). Central banks are determined to kill off inflation and with that the economy. They will of course panic at regular intervals, just like the Bank of England recently did with their £65 billion emergency injection to save the pension funds and the gilt market.

TRUTH LIVES on at https://sgtreport.tv/

But just like the bull market in stocks is turning into a long term bear market, the 40 year down trend in rates finished in 2021. As inflation rages around the world, the coming rapid rise in interest rates will not just shock investors. It will turn the global $300 trillion debt and the $2 quadrillion derivatives (mainly interest derivatives) into a lethal weapon of mass destruction.

Yes, Central banks will panic occasionally and lower rates. But the heavy weight of the debt will lead to both private and sovereign defaults and sell offs which will put continuous upward pressure on rates.

As the world enters the biggest economic and (geo)-political storm in history, few investors are prepared for the total annihilation of their wealth.

DOW UP 55X

In December 1974, the Dow bottomed at 677 and 47 years later the Dow peaked at 37,000 – an increase of 55X. With a compound annual growth of 9%, the Dow doubled every 8 years during this period.

WILL ALFRED LOSE ALL HIS MONEY

Let’s return to Alfred a US citizen who was born at the end of WWII, I wrote an article about him in February 2019 called “Stock Investors like Alfred to Lose 98% of their Investment”

Well, Alfred was very lucky throughout his investment life. By putting all his savings and excess earnings into the Dow Jones he managed to amass a fortune of $14 million until the end of February 2019. He was even more fortunate to see the US market gain another 45% (including dividends) until the end of 2021. So his wealth had by that time grown another $6 million to $20.3 million.

As I wrote in the 2019 article, Alfred never sold and sat through every vicious correction for 77 years. So until January 2022, buy and hold had worked like a dream.

By the end of the first week of October 2022 Alfred’s portfolio is down from $20.3 in January to $16.2 million which is a loss of $4.1 million in 2022.

Currently Alfred is not the slightest bit worried as he has seen many corrections of 20% to 60% in the last 77 years.

Based on his experience, Alfred is not concerned although $4 million is a big paper loss.

But what if the dream is over for Alfred and turns into a nightmare with all his gains evaporating in a market collapse of 90% or more like in 1929-32?

Well, in my view the odds are very high that we will see a fall of that magnitude.

A DEBT INFESTED WORLD

A debt infested world has lived on borrowed time since the debt feast started in 1971 when Nixon took the dollar, and therefore most currencies, off the gold standard.

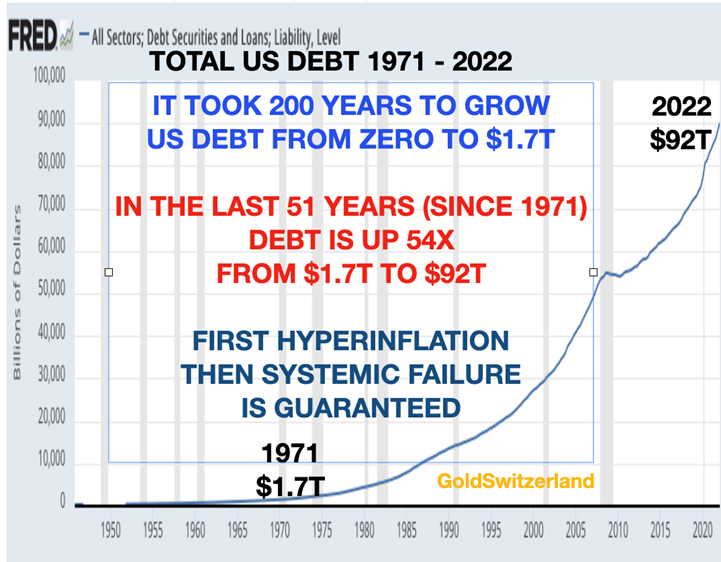

And what a feast it has been with total US debt going from $1.7 trillion in 1971 to $92 trillion today.

That is a staggering 54X increase in US debt in 52 years!

Just look at the Dow Jones chart at the beginning of the article which shows a 55X increase in the index during the same time period.

It is clearly no coincidence that stocks are up 54X and debt 55X since the early 1970s

Stocks have not risen due to a sound and well managed economy. No, stocks only went up because printed money was handed to investors to inflate the economy and asset prices.

We must remember that during the same period since 1971 when the gold window was closed that the US dollar has lost 98% of its value in real terms.

Thus the debt explosion has created inflated values which will deflate much faster when the debt implodes in the next few years.

So it took 200 years to go from zero debt to $1.7t. But when you remove the shackles of the monetary discipline that the gold standard enforces, irresponsible and incompetent governments and central bankers only have one objective. Their principal policy is to hang on to power for as long as possible.

When money runs out, like it did in 1971, there is only one way to stay in power and that is to buy votes. Thus the creation of $90 trillion debt since 1971 has been the most expensive bribery in history.

We must also remember that US Federal debt has increased every year since 1930 (with only a handful of years with surpluses).

The dilemma of creating money out of thin air of such a magnitude is that it leads to debts that can never be repaid, fake asset values which will implode and false human values resulting in misery and decadence. The inevitable consequences are economic and financial collapse. And that sadly is what the US and the world is facing next.

So what will be the market consequences of the coming (hyper)-inflationary depression followed by a deflationary implosion?

Let’s look at some enlightening charts:

1. THE BUFFETT INDICATOR – VALUE OF STOCK MARKET TO GDP

The total value of US stocks (Wilshire 5000) to GDP is one of Warren Buffett’s favourite indicators. It reached almost 200% in November 2021. The previous record valuations were 140% in 2000 (Dot Com Bubble) and 106% in 2007 (Sub Prime Crisis). A strong support area is the lows in the1970s at around 33%.

I doubt however that the 1970s support will hold after the Epic mega bubble we have just seen totally fuelled by tens of trillions of exploding dollar debt.

Read More @ GoldSwitzerland.com