from ZeroHedge:

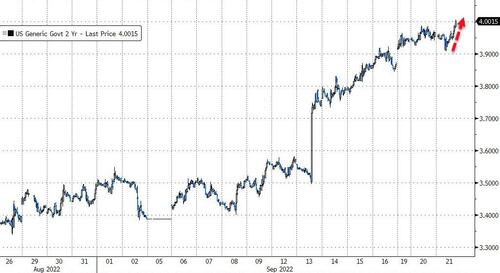

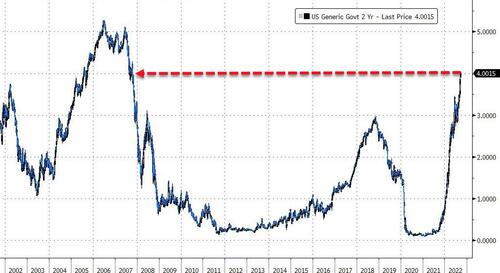

For the first time since October 2007, the yield on 2Y US Treasury bonds has topped 4.00%…

For the first time since October 2007, the yield on 2Y US Treasury bonds has topped 4.00%…

…having soared over 60bps since Fed Chair Powell gave his hyper-hawkish speech at Jackson Hole…

Meanwhile, the terminal rate for Fed rate-hikes has risen to 4.52% this morning, expected in March 2023…

TRUTH LIVES on at https://sgtreport.tv/

…having soared over 60bps since Fed Chair Powell gave his hyper-hawkish speech at Jackson Hole…

Meanwhile, the terminal rate for Fed rate-hikes has risen to 4.52% this morning, expected in March 2023…

Do we really think The Fed can get there without folding to political pressure or flip-flopping to abate risk-asset carnage?

As we noted earlier, how do we think Elizabeth Warren is going to react to this?

When the Fed hikes to 3.25% from 2.50%, it will be paying banks $460MM in daily interest on IOER/Reverse Repo.

When the Fed hikes to 4.25% by year end, it will be paying $600 million in daily interest to BANKS.

Think that won’t be a political issue? Think again

— zerohedge (@zerohedge) September 20, 2022