from ZeroHedge:

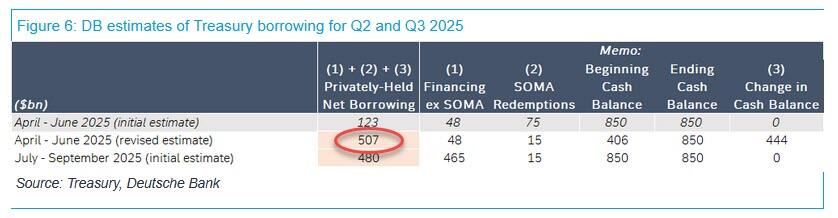

In our preview of today’s Treasury borrowing estimate release, we said that we expect the Treasury to announce $507bn in Q2 borrowing, a “figure much higher than Treasury’s estimate of $123bn in February” and entirely due to a lower starting cash balance, which as regular readers know, has collapsed due to the debt ceiling impasse that has forced the Treasury to draw down on its TGA (cash) balance as well as use various extraordinary measures.

TRUTH LIVES on at https://sgtreport.tv/

We were off by a tiny $7 billion, $507BN vs $514BN as per the table below:

At 3pm ET, ahead of Wednesday’s Refunding statement, the Treasury published its debt borrowing estimates for calendar Q2 and Q3 and it was just as expected:

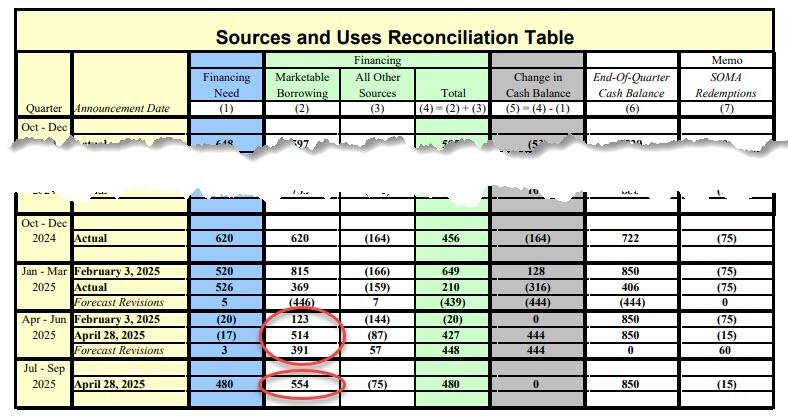

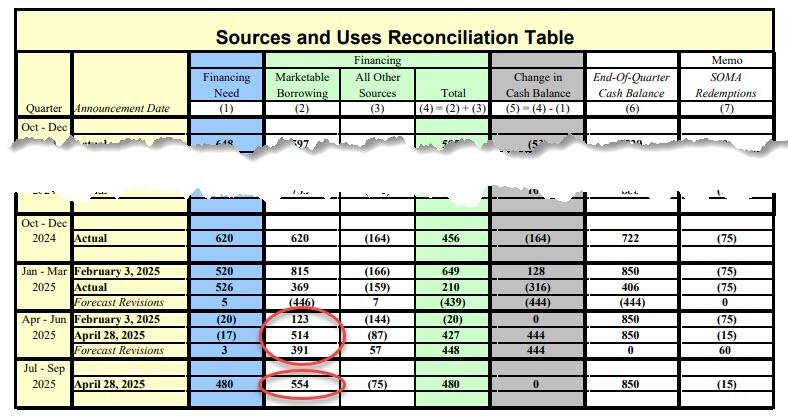

- During the April – June 2025 quarter, Treasury expects to borrow $514 billion in privately-held net marketable debt, assuming an end-of-June cash balance of $850 billion. The borrowing estimate is $391 billion higher than announced in February 2025, primarily due to the lower beginning-of-quarter cash balance and projected lower net cash flows, partially offset by lower QT (i.e. debt redemptions) to the tune of $60 billion.

The above was completely expected, which means it is completely distorted due to the ongoing debt ceiling standoff. This is what we said earlier:

Treasury issuance in Q2 will most likely end up short of the estimate if the debt ceiling remains unresolved this quarter. Similarly, Q3 estimate will assume a normal beginning-of-quarter cash balance, but actual issuance could end up materially higher once the debt ceiling constraint is lifted during the quarter and Treasury begins to rebuild its cash balance (and if it isn’t, and the US begins to default, there will be much bigger problems at hand than termed-out debt issuance).

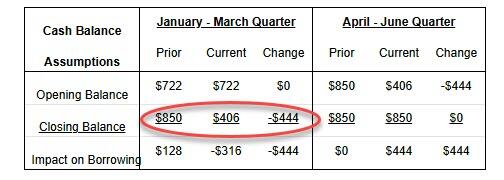

Translation: the Treasury drew down its cash by $444BN from $850BN to $406BN, also as we said in our preview.

What we didn’t say, because we didn’t know it (and neither did anyone else), is what the Treasury reported as an endnote to its borrowing needs paragraph, namely that “the current quarter borrowing estimate is $53 billion lower than announced in February” which indicates that DOGE is indeed working and the US funding needs are actually declining.

To be sure, this also should not be a huge surprise, because as we also reported just before the Treasury press release, “fiscal flows year-to-date are coming in better than expected (thank you DOGE). Gross receipts are tracking slightly above prior-year levels (adjusted for CBO forecasts for 2025), while outlays are closer to the bottom of the historical range, although sadly nowhere near enough to make a notable impression over the long-term.”