by David Haggith, Gold Seek:

One of my recent warnings was that the US is sliding toward more credit downgrades because the Trump Tariffs are stripping away the one thing essential to the dollar surviving as the global trade currency—TRADE. The big thing that makes the present situation far more precarious for the dollar than any previous situation is that the trade that makes dollars desirable and even needed around the world is being seriously sucked down a vortex. That greatly reduces the need for dollars in trade, which makes this the easiest time ever for any nation wanting to ditch the dollar to do so as a way to finally end US hegemony.

TRUTH LIVES on at https://sgtreport.tv/

That doesn’t mean the dollar will go down without a hard fight, and it doesn’t mean the dollar cannot still be saved, but its rapid decline has begun, and suddenly, few seem to be arguing with that. In fact, many are openly saying it. Probably no one can say, based on any actual experience, how far a currency as broad and stable for such a long time as the dollar can slide before momentum continues the flush, no matter what anyone does to intervene.

Right now, what we see is a spike in government and investor, and banker conversations about the need for a rushed intervention to save the dollar from its rapid decline.

US credit ratings on the verge of collapse

The dollar’s sudden journey down came recently with its first major credit agency warning this year, along with serious warnings from others:

European credit ratings agency Scope has warned that the United States could be downgraded if a lengthy trade war erodes long-term trust in the dollar, or if President Donald Trump implements even more extreme measures such as capital controls.

The fallout from Trump’s trade tariffs has included the dollar’s sharpest year-to-date fall against other major currencies in more than 50 years, while credit default swap (CDS) markets, which investors use to hedge risk, are pricing in as many as five U.S. rating downgrades.

What hits the US currency harder than all its competitors is that the US is the hub causing the global trade war, making it, as Scopes pointed out, far more heavily impacted by trade strangulation than any other nation in the world. The US is, as I have argued recently, impacted by all nations acting against it as well as by it acting against all nations (reducing trade between the US and the world in both directions—import and export) while other nations are only impacted in their trade relations with the US, but not with each other. This asymmetry is already leading to other major currencies rising in preferred status over the damaged dollar.

“If doubts about the exceptional status of the dollar were to increase, this would be very credit negative for the U.S.,” Scope’s head of sovereign ratings, Alvise Lennkh-Yunus, said in a report published on Tuesday.

Well, those doubts have arrived, and they are increasing in droves.

Dollar doubted bigly

Let’s start with an impartial metric of the dollar, rather than the politicized warnings of global leaders who are caught in the war.

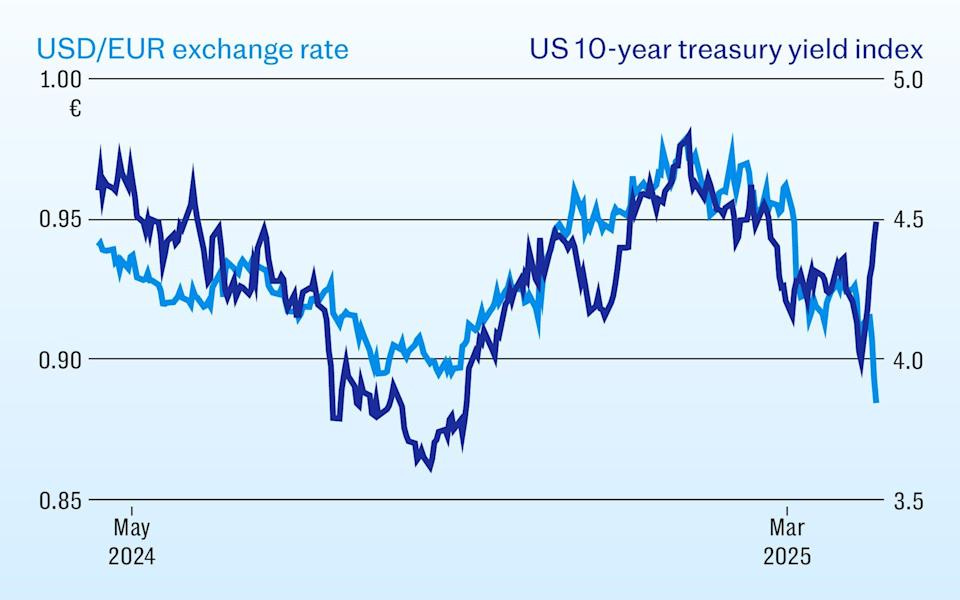

Just look at the cross-directions that have come into play between the yields now needed to attract buyers into US dollars (US Treasuries) and the exchange rate between dollars and euros.