from BullionStar:

As banking systems falter, currencies devalue, and global conflicts escalate, millions of Americans hold savings and portfolios that are dangerously exposed to systemic risks—all because financial advisors intentionally exclude one critical asset class: physical gold bullion.

This omission leaves hardworking savers just one market crash away from devastating losses while denying them the wealth preservation power that has safeguarded families through wars, depressions, and currency collapses for over 5,000 years.

TRUTH LIVES on at https://sgtreport.tv/

Despite gold’s 5,000-year history as a monetary metal and store of value, less than 2% of Americans own physical gold as an investment, and even fewer have been advised to do so by their financial professionals.

This widespread omission isn’t merely coincidental. There are specific, structural reasons why the financial advisory industry largely steers clients away from physical precious metals.

Today, we’ll explore what many financial advisors aren’t telling you about gold bullion – and why this information gap could leave your savings and portfolio vulnerable.

The Commission Conflict: How Advisor Compensation Discourages Gold Recommendations

The modern financial advisory business operates primarily on either fee-based or commission-based models. Neither structure incentivizes the recommendation of physical gold bullion.

Fee-based advisors typically charge a percentage of assets under management (AUM), commonly 1-1.5% annually. Physical gold stored outside the financial system—whether in a private vault or personal safe—generates no ongoing fees for the advisor. Allocating $100,000 to physical gold instead of managed funds represents $1,000-1,500 in lost annual revenue per client.

Commission-based advisors face similar disincentives. While selling mutual funds, annuities, and insurance products can generate up to 6% commissions, the margins on physical precious metals typically range from 1-3%, often as one-time transactions rather than recurring revenue streams.

This compensation structure creates an inherent conflict of interest. Even well-intentioned advisors operating under fiduciary standards face economic pressure to recommend paper assets over physical bullion.

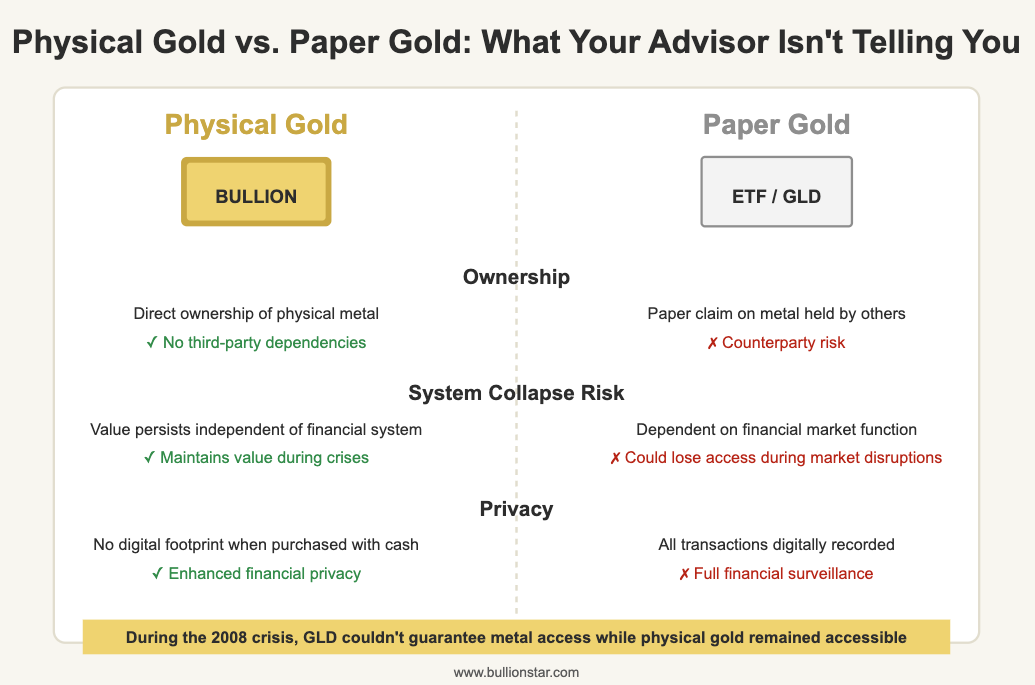

Physical Gold vs. Paper Gold: A Critical Distinction Your Advisor May Blur

When gold does enter the conversation with financial advisors, the recommendation typically leans toward “paper gold” – financial products that track the gold price rather than provide actual ownership of the metal itself.

These include:

-

- Gold ETFs like GLD or IAU

- Gold mining stocks

- Gold futures contracts

- Gold certificates

While these instruments offer convenience and liquidity, they fundamentally differ from physical gold bullion in one crucial respect: counterparty risk. Each paper gold vehicle depends on the ongoing solvency and honesty of one or more financial intermediaries.

The popular SPDR Gold Trust (GLD) prospectus spans 40 pages of legal disclaimers and risk factors. Few advisors direct clients to read this document, which explicitly states: “The Trust may not have adequate sources of recovery if its gold is lost, damaged, stolen or destroyed.”

During the 2008 financial crisis, many gold ETF holders were surprised to learn their “gold investment” didn’t guarantee access to actual metal during a liquidity crunch. Similar concerns emerged in 2020 when the spread between paper and physical gold prices temporarily widened to unprecedented levels as demand for real metal surged.

Physical gold bullion, by contrast, carries no counterparty risk when directly owned and adequately stored. This fundamental advantage rarely features in typical financial advisory conversations.

Savings & Portfolio Protection: From Market Crashes to Regime Changes

Savings & Portfolio Protection Beyond Correlation Statistics

When gold is discussed in mainstream financial planning, it’s typically framed in terms of its correlation (or lack thereof) with other asset classes. While this statistical approach has merit, it drastically undersells gold’s primary function: monetary insurance against both immediate market risks and long-term systemic challenges.

Historical data demonstrates gold’s exceptional performance during periods of financial stress:

-

- During the 2008 financial crisis, gold rose 25% while the S&P 500 fell 38%

- In 2020’s pandemic market shock, gold dropped just 3% during the initial selloff compared to the S&P 500’s 34% plunge

- During the regional banking crisis of March 2023, gold surged while bank stocks collapsed

- Today, as we confront unprecedented trade wars, gold has achieved new heights.

This performance pattern isn’t coincidental. Gold serves as a hedge against the financial system’s foundations: currency debasement, banking system fragility, and counterparty risk.