by Alex Deluce, Gold Telegraph:

The global financial system is not just shifting, it is starting to breakdown.

On April 1st, I wrote: “The erosion of trust: the times are changing.”

That warning has since become a headline.

What was once dismissed as contrarian commentary by many is now being echoed by mainstream media across the world: the dollar’s role as the global reserve currency is no longer unquestioned.

TRUTH LIVES on at https://sgtreport.tv/

For years, I’ve documented the growing dangers of the West’s overreliance on financial warfare:

- Sanctions

- Reserve freezes

- The weaponization of SWIFT

These weren’t strategic tools of diplomacy. They were early signs of something deeper: desperation, fragility, and a crumbling world order.

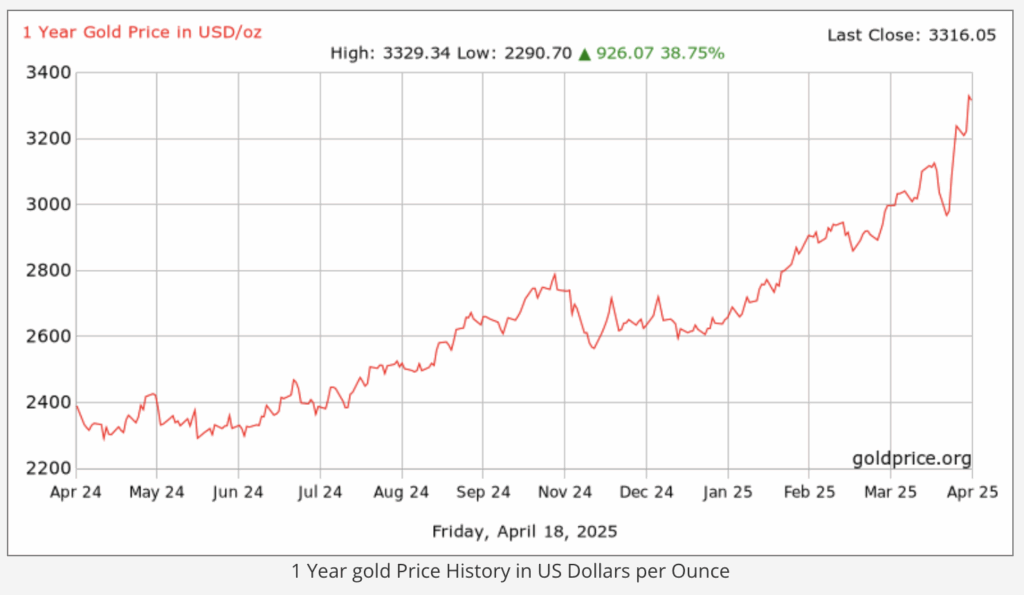

In just the past year, the U.S. dollar has lost over 35% of its purchasing power against gold, driven by record central bank gold buying. This isn’t a trend, it’s a signal.

Meanwhile, the BRICS nations are growing more coordinated, even as fractures widen among traditional Western allies.

Across Europe and Asia, leaders are reassessing their exposure to a system that no longer feels stable.

Increasingly, nations are recognizing that true sovereignty begins with one principle: zero counterparty risk. That path leads directly to gold.

These developments aren’t isolated, they are symptoms of a deeper monetary fracture.

With trust evaporating, gold is no longer just a hedge. It’s becoming the foundation of a new system.

That’s why my recent conversation with Matthew Piepenburg, Partner at VON GREYERZ, couldn’t have come at a more important time.

His perspective on gold, debt, the BRICS realignment, and the unravelling confidence in U.S. Treasuries offered rare clarity in a world clouded by confusion and revealed what many are only just beginning to understand.

Let’s break it down.

The Treasury Market’s Safe Haven Status is Eroding and Gold is the Refuge

For decades, U.S. Treasuries have functioned as the cornerstone of global finance, seen by investors and institutions as the ultimate safe haven. That narrative is now fraying.

“There is a liquidity crisis,” Piepenburg told me. “There’s simply not enough grease to keep this system going.”

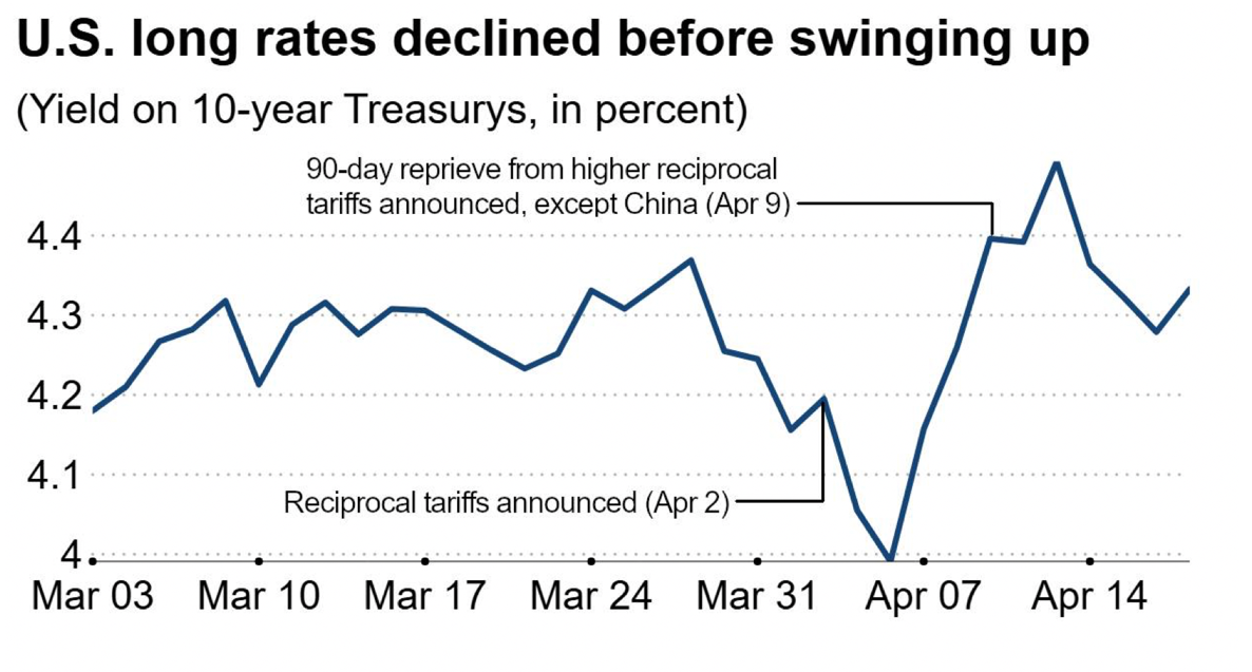

Rather than providing stability during periods of volatility, U.S. government bonds have started to behave more like risk assets. In recent market turmoil, yields rose when they typically would have declined, highlighting the growing fragility of the system.

“Yields have actually been going up, not down, in times of stress,” he explained. “Why isn’t the U.S. Treasury acting like a safe haven anymore?”

The answer, he says, lies in debt, which has buried the American economy.

With over $37 trillion in federal debt and more than $100 trillion when household, corporate, and long-term entitlement obligations are included, the system is buckling under the sheer weight of its own promises.

“Santa Claus can’t solve a liquidity crisis when you’re buried under this much debt,” Piepenburg warned. “There’s not enough grease to keep those debt wheels spinning without bazooka money, without debasing the currency.”

That’s why, he added, gold is being quietly re-monetized by central banks around the world, not as a hedge, but as a foundational reserve asset.

“Gold is now a Tier 1 asset. Central banks are net settling in it. They’re moving away from Treasuries,” he said. “This isn’t about getting rich. It’s about not getting poor.”

The Rise of BRICS and the Global Move Away from the Dollar

The de-dollarization trend, long discussed in policy circles, has become an observable reality in the wake of U.S. sanctions against Russia. What began as an assertion of geopolitical power has accelerated a multipolar financial realignment.

“Since the weaponization of the U.S. dollar in 2022, 45 countries are now trading outside of it,” Piepenburg told me. “Thirty countries have repatriated their physical gold. That’s not a coincidence, it’s a reaction.”

He pointed to the critical shift that occurred when the U.S. froze Russian central bank assets. For many governments, that action shattered the illusion of the dollar as a neutral global reserve. “When you weaponize the world reserve currency,” he said, “you undermine the very trust it depends on.”

Nowhere is this shift more evident than among the BRICS nations, Brazil, Russia, India, China, and South Africa.