by Jesse Colombo, Gold Seek:

For the past several months, I’ve been theorizing and writing about the compelling idea that another major gold surge would be driven by Chinese futures traders coming out of dormancy to propel gold to $3,000 an ounce and beyond. And remarkably, it now appears that this is exactly what’s unfolding. In this piece, I’ll walk you through the background of this fascinating and unfolding theory—along with the evidence that it’s playing out in real time.

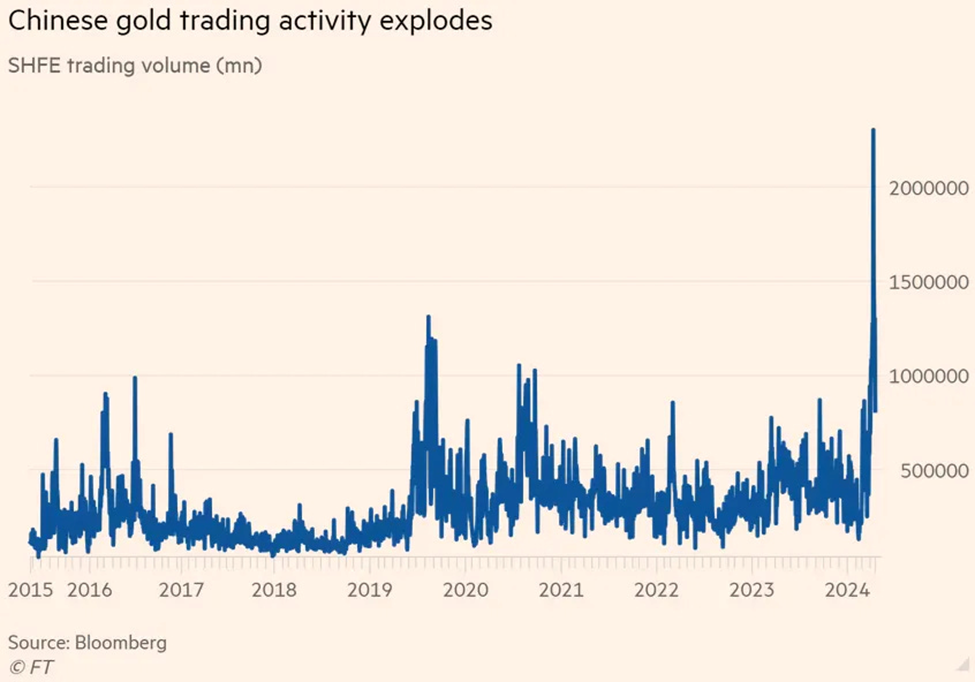

To provide some context, the powerful $1,200 gold bull market of the past year began in the spring of 2024, driven largely by aggressive Chinese futures traders on the Shanghai Futures Exchange (SHFE), while Western investors largely stayed on the sidelines. In just six weeks between March and April, these traders propelled gold prices upward by $400—or 23%—an extraordinary surge. While their activity quieted for a while, I’ve been anticipating their return, expecting them to drive gold to staggering levels—well beyond $3,000 an ounce.

TRUTH LIVES on at https://sgtreport.tv/

As this chart illustrates, the Shanghai Futures Exchange gold futures were the primary vehicle behind the spring 2024 gold frenzy, a surge that subsequently spilled over into international gold prices:

A fascinating Financial Times article from that time titled “Chinese Speculators Super-Charge Gold Rally” highlighted how trading volume in SHFE gold futures had surged by 400%, propelling gold prices to record highs:

The spring Chinese gold trading frenzy can also be seen in the chart of long open interest in SHFE gold futures:

Now let’s take a look at the current chart of SHFE gold futures, which shows that while gold has been steadily climbing, the move had been relatively orderly and accompanied by subdued volume—until recently. Over the past couple of weeks, however, the tone of the market has shifted dramatically: gold is beginning to rise in a more aggressive, parabolic fashion, and trading volume has surged. To me, this marks a clear confirmation that the long-anticipated Chinese gold mania has arrived—and it’s likely to drive gold to levels that will shock most observers.

A look at the spot price of gold per ounce in Chinese yuan confirms the trend seen in SHFE gold futures—showing that the rally has recently entered a sharply accelerating phase, which is typically a sign of rising public awareness and participation: