by Egon von Greyerz, Von Greyerz:

For at least 35 years, the monetary system has been telling us that the current era is coming to an end.

That means a debt collapse, a currency collapse and a collapse of most bubble assets like stocks and property. THUS THE BIG SHORT!

As I am writing this on Easter Monday, the Dow is down 1,100 points (2.9%) and the Nasdaq is down 3.3%.

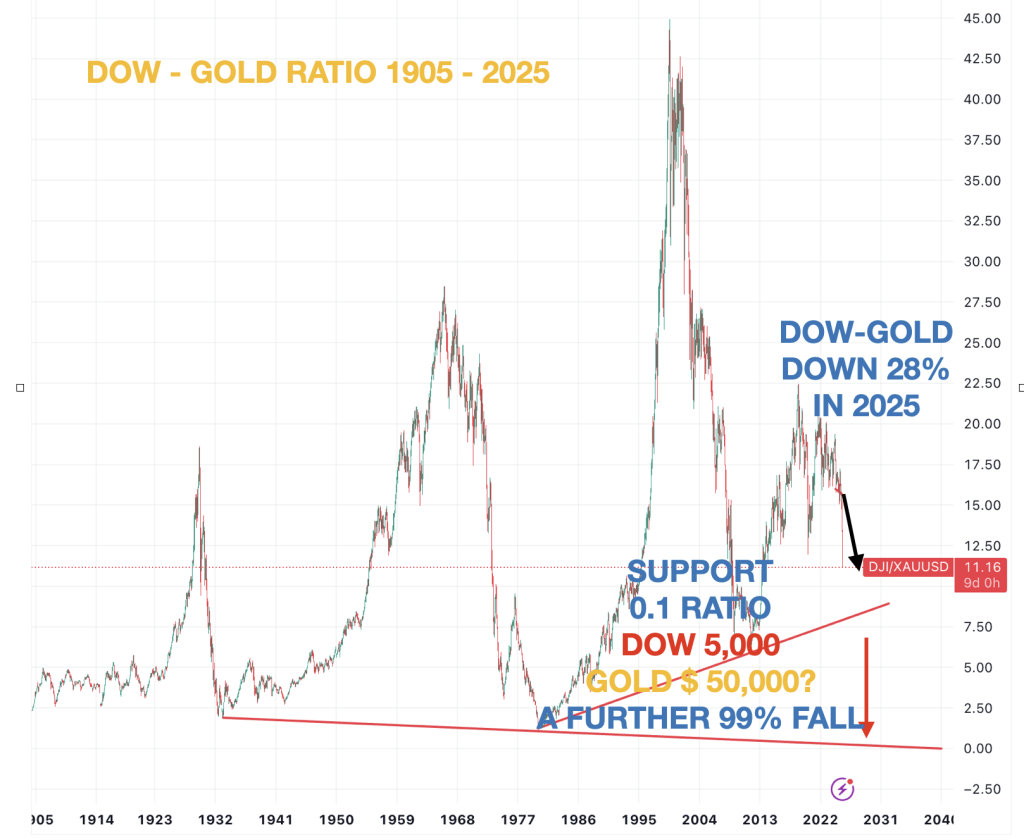

Anyone who buys the dips will be slaughtered. As I have said for a very long time, before this is over, stocks will be down 90-99% in real terms, which is gold.

TRUTH LIVES on at https://sgtreport.tv/

More importantly, this total collapse has very little to do with TRUMP. More later.

And don’t for a moment believe that gold is overvalued. As many have used conventional technical tools to predict a gold correction, I have been saying for a long time that gold is in an acceleration phase and will reach multiples of the current price. (Yes, of course, there will be corrections on the way up, but most probably not yet.) THUS THE BIG LONG!

END OF A MONETARY ERA

The end of a monetary era is always the same, with bubble assets going up in smoke.

The majority of investors haven’t got a clue what is happening. They are hanging on to their stocks, hoping that Trump will save them by firing Powell and telling the next Chairman of the Fed to lower interest rates.

But the time of manipulating rates is over. The market will now determine rates, which it should always do. And with uncontrollable debt escalation in the US and many other countries, the cost of debt can only go one way – UP!

Remember, there is only one buyer of US debt, which is the Fed. But the Fed can only buy debt if the US government issues more debt.

And therein lies the crux. More debt must be created in a futile attempt to save the ever-growing and out-of-control finances of the US.

This is without doubt the biggest Ponzi scheme in history. Madoff would certainly have enjoyed it.

And still, it would have been so easy, as all of this has been totally predictable.

To paraphrase Churchill, the more you study history, the more self-evident the future becomes.

Still no government, no central banker, no journalist and virtually no market student spends any time on learning from the past.

Why, why, why, you ask yourself. Well, it is clearly sheer arrogance in believing that we know better today and that we have better tools. And of course, “The times are different today”. Hmmm!

But they are not and have never been.

Every monetary system has collapsed in history, and every currency has gone to ZERO, without fail.

As I witnessed Greenspan’s expansionary policy after the property market collapse in the 1990s and how debt and derivatives quickly continued to grow, I was certain that we were seeing the end of a major monetary system.

I had, since the late 1980s, been convinced that gold was the best insurance against yet another coming failure of the monetary system.

As major central banks like the UK and Switzerland were selling their gold in the mid to late 1990s, it was clear that we were near the bottom. So we waited until the 1999 gold bottom at $250 and confirmation of the gold price recovery in the early 2000s before buying physical gold.

HISTORY OF VON GREYERZ

I founded Matterhorn Asset Management (brand name GoldSwitzerland) in 2000.

We changed the name to VON GREYERZ in January 2024 to indicate our long-term commitment to a generational family business built on wealth preservation principles.

Finally, in early 2002, we decided to commit the major part of our liquid assets, and that of the investors we advised, to physical gold, stored outside the banking system. So we then bought important amounts of gold at $300 per ounce.

We haven’t looked back since. Although we never intended to open up the business for outside clients, demand from close contacts led to our business expanding.

Today, we are a global business with clients in 90 countries, and vaults in Singapore and Zurich with a $/CHF 400,000 starting level and also the biggest and safest private vault in the world in the Swiss Alps, starting at $/CHF 5 million.