from Birch Gold Group:

Your News to Know rounds up the most important stories about precious metals and the overall economy. This week, we’ll cover:

- $4,000 gold hints from big institutions are here

- Why faith in the U.S. dollar is going on all sides

- Gold vs the greenback: who will win?

- Bosnia’s central bank now owns the most gold it has since year of establishment

TRUTH LIVES on at https://sgtreport.tv/

Gold’s unpredictable trend toward $4,000

Axel Merk, CEO of Merk Investments, said a lot in a recent (brief) segment on the relationship between the price of gold and the U.S. dollar.

Merk says we are now seeing perhaps the biggest shift since the end of World War II, one where the U.S. will no longer be the world’s police force. (The turning point was the invasion of Ukraine, when the greatest weapon in our economic arsenal, weaponizing the dollar against Russia, failed spectacularly.)

That was the final sanction that broke the proverbial camel’s back. This isn’t a fringe opinion – pretty much every analyst has made the same point repeatedly.

Russia decided it could thrive without access to SWIFT and the Western financial system generally. Ever since, they’ve been freely trading both gold and oil – and even struggled with an overheating economy, although the specific causes of the boom are more complex.

From the perspective of the rest of the world, though? The U.S. did its worst to sabotage the Russian economy, weaponizing the dollar to a truly unprecedented degree. Crossing a line which had never been crossed before… Russia not only survived but thrived in the aftermath.

Not only does that make a mockery of Western economic dominance, it forcibly reminded the rest of the world of two things:

- The U.S. dollar is nothing but an IOU. A promise to pay. Perhaps a less-than-ideal basis for a global financial system…

- Gold offers independence from both the global financial system, but also from Western political pressure.

So, the dollar now faces an unprecedented loss of faith.

On one hand, we have what Alasdair Macleod has been saying: gold is going up because people don’t trust in the dollar from a purchasing power standpoint.

But on the other, sovereign nations have not only lost faith in the U.S. dollar’s safety, but in its purchasing power as well.

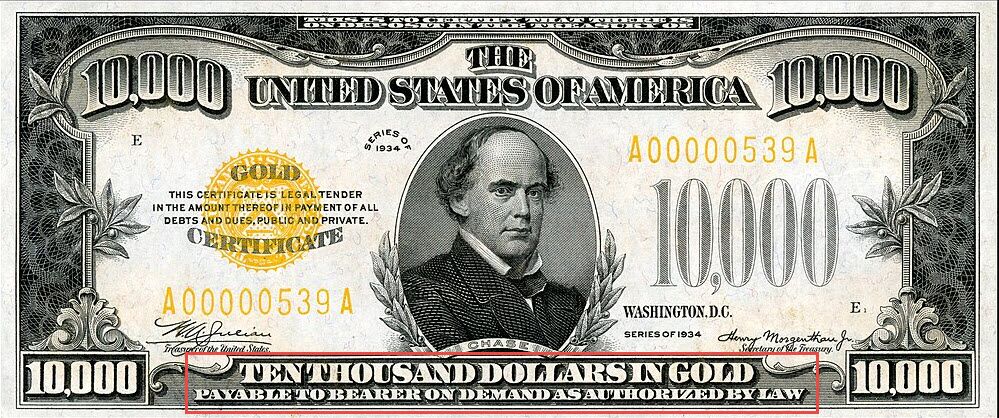

By this point, even a gold standard might not restore faith fully. Consider, for a moment, that paper gold certificates (like this one) only work if the Treasury Department really has the gold, and really will honor the agreement to trade the piece of paper for the gold:

In order to create a form of money that doesn’t require trust, we’d need to return to gold and silver coinage.

Exciting things to ponder! Even if our $36 trillion indebted government is likely too far gone to really consider a return to real money…

We’re still seeing some talk about gold’s price rising, despite after-inflation interest rates holding steady. Last week, I said that’s because keeping interest rates higher than inflation, in the long term, simply isn’t sustainable. Nobody is buying it. Furthermore, we’ve already begun a rate cutting cycle – rates are almost certainly going down rather than up.

Merk, Bridgewater and Goldman Sachs each have a slightly different take. Though they agree on one thing: Weaponizing the dollar – breaking the world’s trust in the dollar itself – broke gold’s correlation with interest rates.

Merk says it broke the correlation with basically everything, and that now, all bets are off regarding gold’s correlation with other financial assets. (Might I suggest gold is correlated with nothing anymore, and is finally returning to its historic role as money? Too early, sure, but it’s worth a think.)

Meanwhile, JPMorgan analysts wondered out loud just how close $4,000 gold is:

“With each $1,000 phase taking about two-thirds less time than the previous one, and considering the law of diminishing returns alongside investors’ attraction for round numbers, could the $4,000 mark be just around the corner?”

Remember, folks, gold was $1,650 less than two years ago. This repricing looks more like that of 2000-2011, less like the 2008-2011 period…

Regardless of where gold’s price lands in the months and years ahead, I believe gold owners will be delighted. And that those who preferred to pretend that cash isn’t trash?

Well, I strongly suspect they’ll regret that decision.