from ZeroHedge:

Ocean freight transit times from Shanghai to Los Angeles typically range from 14 to 40 days, with faster services—such as CMA CGM’s expedited routes—delivering containers in as little as three weeks. With 145% tariffs now applied to most Chinese imports, the full economic impact will likely emerge with a lag of about a month or more as reduced import volumes and supply chain disruptions begin to take effect. Early high-frequency indicators already suggest those disruptions are imminent.

TRUTH LIVES on at https://sgtreport.tv/

Let’s review the key trade war developments since President Trump, following “Liberation Day” on April 2, announced a tsunami of tariff hikes on Chinese imports to 145% on April 11.

- Amazon Cancels Orders, Walmart Pulls Forecast As Tariffs Take Hold

- Are China Road Traffic Indicators Set To Collapse As Tariff War Cancels Factory Orders

- Chinese Sellers On Amazon Panic After Trump’s Tariff Bazooka

- Liberation Day Fallout: China’s Port Volumes Sink After Trump’s Tariff Blitz

- Chinese Plastics Factories Face Mass Closure As U.S. Ethane Supply Evaporates

On Wednesday, new data from Port Optimizer, a tracking system for vessel operators, showed that scheduled import volumes into the Port of Los Angeles are set to decline sharply beginning on Sunday.

Adding to the conversation, FreightWaves CEO Craig Fuller posted on X that trucking activity at the LA Port, the largest container port in the Western Hemisphere, has just plunged …

“Year-over-year trucking activity out of Los Angeles down 23%. It will likely drop to 50% in the coming weeks if there isn’t trade war resolution,” Fuller said.

Year-over-year trucking activity out of Los Angeles down 23%.

It will likely drop to 50% in the coming weeks if there isn’t trade war resolution.

Massive layoffs coming to the West Coast trucking sector pic.twitter.com/rLiow0xmoV

— Craig Fuller

(@FreightAlley) April 24, 2025

He warned: “Massive layoffs coming to the West Coast trucking sector.”

The incoming disruption at Port LA will soon result in sliding containerized flows from China, which will ripple through the Southern California economy.

Here’s how the disruption could unfold:

Plunging Container Volumes

- Volume Drop: A decline in imports would slash throughput at the port, disrupting operations that rely on consistent traffic for profitability.

- Revenue Hit: The Port of LA, which generates revenue through container handling fees, leases, and other port services, would face a significant decline in income.

Job Losses

- Dockworkers & Terminal Staff: ILWU labor hours would be cut; possible layoffs or furloughs.

- Truckers & Warehouse Workers: Major layoffs in the Inland Empire’s massive logistics hub (Ontario, Riverside, etc.)—home to over 200 million square feet of warehousing.

Broader Economic Fallout (Southern California)

- The logistics sector is the largest private employer in the Inland Empire. A large drop in volume could collapse parts of the warehouse economy.

Retail & Consumer Ripple Effects

- Higher costs and shortages for imported goods would pressure retailers and consumers alike.

Port Diversions

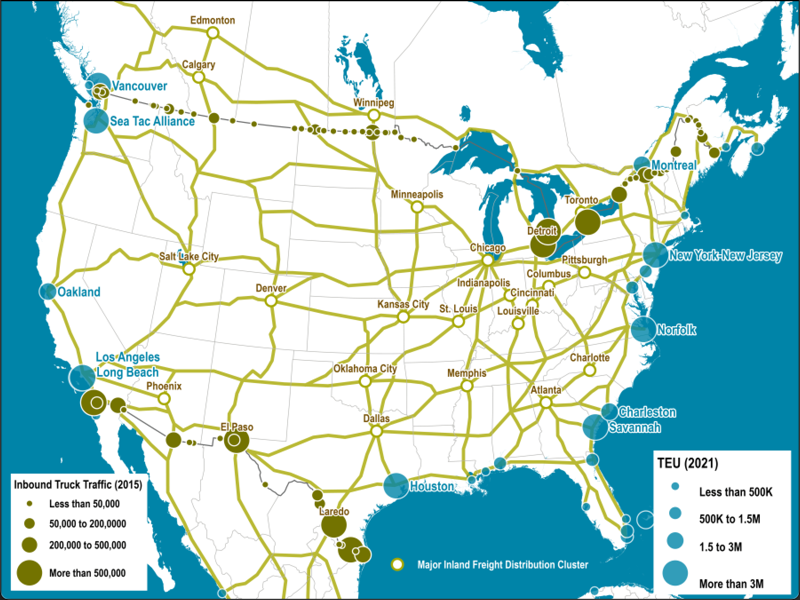

- Shippers would increasingly reroute to Mexican and Canadian ports, bypassing LA entirely.

- Companies could shift sourcing to Mexico or other non-tariffed nations, reducing LA’s role as a China-facing import hub.

While the first wave of disruptions is materializing at Port LA and could soon ripple across the Inland Empire and then the Heartland, across the Pacific, high tariffs on Chinese goods have already sent factories in the world’s second-largest economy into a tailspin, as per a new Financial Times report: