by Ronan Manly, BullionStar:

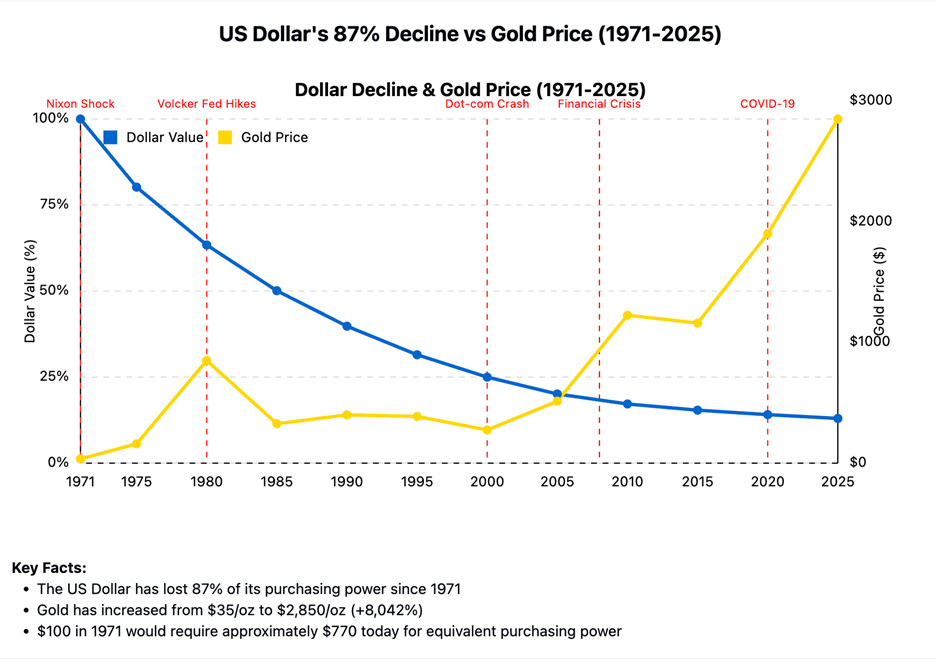

Since the United States abandoned the gold standard in 1971, the U.S. dollar has lost 87% of its purchasing power. The US dollar’s decline highlights the fundamental value proposition of physical precious metals as a store of value and hedge against currency debasement.

Since the United States abandoned the gold standard in 1971, the U.S. dollar has lost 87% of its purchasing power. The US dollar’s decline highlights the fundamental value proposition of physical precious metals as a store of value and hedge against currency debasement.

TRUTH LIVES on at https://sgtreport.tv/

The Nixon Shock and Its Lasting Impact

On August 15, 1971, President Richard Nixon announced that the United States would no longer convert dollars to gold at a fixed value, effectively ending the Bretton Woods system.

This momentous decision, the “Nixon Shock,” fundamentally transformed the global monetary system.

Before this decision, the U.S. dollar, backed by gold, had maintained relatively stable purchasing power for decades. The gold standard disciplined monetary policy by requiring that currency be backed by physical gold reserves.

Without this anchor, central banks gained unprecedented ability to expand the money supply.

The Consequences of Untethered Currency

The results of this policy shift have been dramatic:

- In 1971, the average price of a new home in the United States was approximately $25,200. As of March 2025, that figure had surpassed $500,000.

- In 1971, a gallon of gasoline cost around 36 cents. Today, Americans pay over $3.80 per gallon on average.

- The average family car that cost $3,000 in 1971 would now cost well over $55,000.

These price increases are not merely the result of natural economic growth or improved quality—they fundamentally reflect the erosion of the dollar’s purchasing power through persistent inflation.

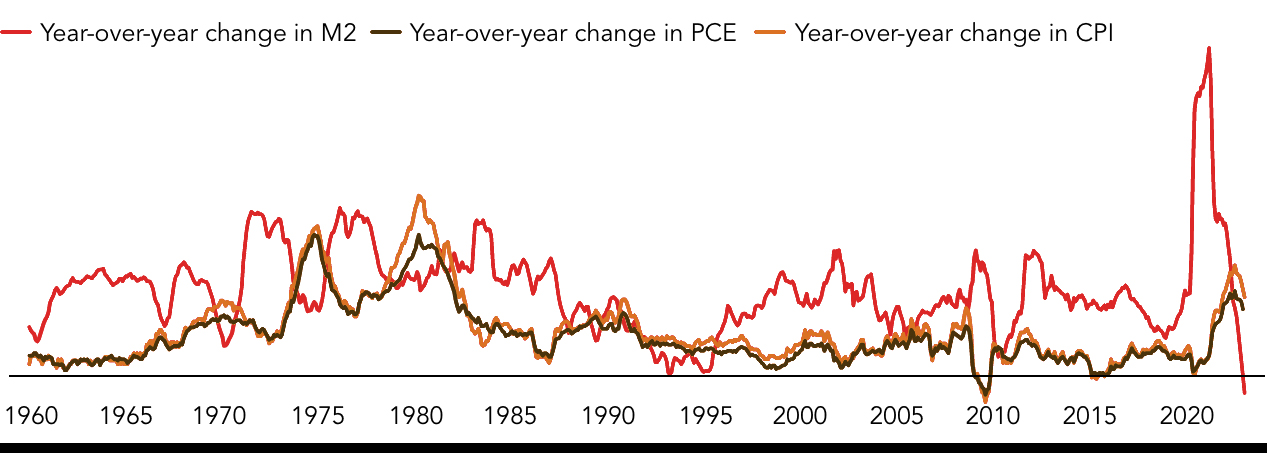

The Money Supply Explosion

The federal government and Federal Reserve have dramatically expanded the money supply, particularly during economic stress. Money printing reached unprecedented levels during the COVID-19 pandemic, with the M2 money supply growing by nearly 40% in just two years.

Even more concerning, the Federal Reserve’s balance sheet has expanded beyond $8 trillion as of early 2025, maintaining historically high levels despite attempts at quantitative tightening.

Each newly created dollar dilutes the value of every dollar already in circulation, functioning as a hidden tax on savers and those on fixed incomes.

Gold and Silver: Preserving Purchasing Power

While fiat currencies like the U.S. dollar have consistently lost value, physical precious metals have maintained their purchasing power over millennia:

- An ounce of gold that bought a fine men’s suit in Ancient Rome would still buy one today.

- Silver has similarly preserved wealth throughout human history, maintaining its value while countless paper currencies have failed.

The performance of gold since 1971 has been particularly telling. When Nixon closed the gold window, gold traded at $35 per ounce.

Today, as of March 2025, it trades above $2,850 per ounce, reaching multiple all-time highs in recent months—a clear reflection of the dollar’s declining value rather than gold “going up” in any absolute sense.

Gold Bullion: The Ultimate Inflation Shield Amid Rising Tariffs and Global Economic Uncertainty

Today’s macroeconomic landscape is increasingly dominated by rising protectionist policies, notably propelled by the second Trump administration’s substantial new tariffs on Chinese imports and potential trade barriers with other economic partners. While these tariffs aim to shield domestic industries, they simultaneously generate inflationary pressures within supply chains and escalate input costs for manufacturers.

In a climate of increased economic uncertainty and potential currency fluctuations, investing in gold bullion stands out as a highly prudent choice. Physical gold acts as a traditional safeguard against inflation and currency depreciation, offering essential protection, especially when global trade tensions threaten economic stability.

As central banks continuously expand their balance sheets and sovereign debt reaches unprecedented levels, gold’s inherent value and its distinctive position outside the financial system make it a crucial element in any investment portfolio aimed at preserving wealth.