by Craig Hemke, Sprott Money:

Whether it’s due to central bank demand, delivery delays, tariffs, a lower dollar, or a combination of all these factors, there’s no denying that the price of gold is off to a strong start in 2025.

Gold Price Performance in 2025

It has been a great beginning to the new year for gold and silver. After very strong gains in 2024, many analysts were expecting a pullback in prices in 2025 after a peak with all-time highs for gold in late October of last year. Not this “analyst,” however. Instead, as we wrote in our annual macrocast back in early January, more gains in 2025 should follow as the world, led by the U.S., slips into economic recession.

TRUTH LIVES on at https://sgtreport.tv/

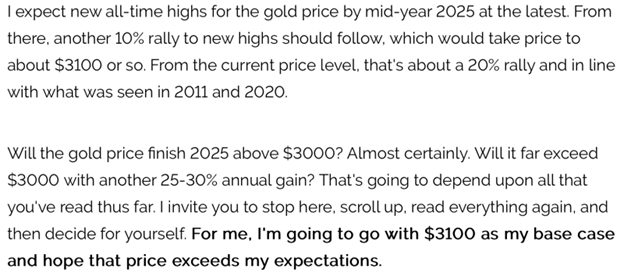

Gains in 2025 should be consistent with how gold has performed since the turn of the century…which is now already 25 years ago! (Oh my, where has the time gone?) The table below from Ronnie Stoeferle and his team at Incrementum shows annual gains for gold in every major fiat currency. In dollar terms, gold is already up about 9% year-to-date and approaching its long-term average annual gain of about 10%.

Will Gold Prices Continue to Rise?

So is that all for this year? Has gold already seen its best gains for 2025, leaving us with just sideways action for the remainder of the year? While I suppose that’s possible, I also think that’s unlikely. Instead, as we wrote in the 2025 macrocast, a slowing U.S. economy is likely to result in more fed funds rate cuts than currently forecast. This, in turn, will weaken the U.S. dollar and drive interest rates lower. The result should be a positive environment for gold, and our price target near $3100 remains valid.

Short-Term Gold Price Outlook

What about the short term, though? Again, the gold price has charged out of the starting gate for 2025 and may be due for another pullback and consolidation. We saw several of these “bull flag” consolidations in 2024, and it appears price has entered one at present too.

The chart above reveals that the long-term trend continues undeniably higher, however, and occasional pullbacks are a fixture of bull markets in gold as price moves upward in its typical two-steps-forward-and-one-step-back pattern.

This current consolidation may continue for a while longer and at least until we get more clarity from the Fed regarding their expected monetary policy for 2025. Their “Summary of Economic Projections (SEP)” from December 2024 trimmed their rate cut expectations for 2025 from four to two. When the FOMC meets again next week, look for an updated SEP to add back at least one expected cut. The fed fund futures market is currently indicating as much with the first fed fund rate cut now expected by June at the latest.