from BullionStar:

The first weeks of President Donald Trump’s second administration have produced a remarkable divergence in the performance of two assets often compared by investors seeking alternatives to traditional fiat currencies. While gold has continued its steady ascent to new all-time highs, Bitcoin has experienced a significant correction from its January peak, challenging the narrative that cryptocurrencies would consistently outperform precious metals in times of economic uncertainty.

TRUTH LIVES on at https://sgtreport.tv/

Gold’s Resilient Performance

Gold exhibited remarkable strength in early 2025, appreciating by about 8% since President Trump’s inauguration on January 20th. This upward trend continues with gold achieving multiple new all-time highs throughout March 2025.

This performance reinforces gold’s enduring status as a reliable value store, particularly during geopolitical and economic uncertainty periods. The precious metal’s positive momentum starkly contrasts its digital competitor, which has struggled to maintain its earlier gains.

Bitcoin’s Substantial Correction

While Bitcoin peaked at $109,000 in January 2025, the leading cryptocurrency has since experienced a steep decline. As of February 25th, 2025, Bitcoin was trading below $90,000—representing a substantial 24% decrease from its January high and marking its lowest since November 2024.

This correction raises important questions about Bitcoin’s volatility and suitability as a “digital gold” during market stress.

Understanding the Divergence

Several key factors explain the contrasting performance of these two assets:

Factors Supporting Gold

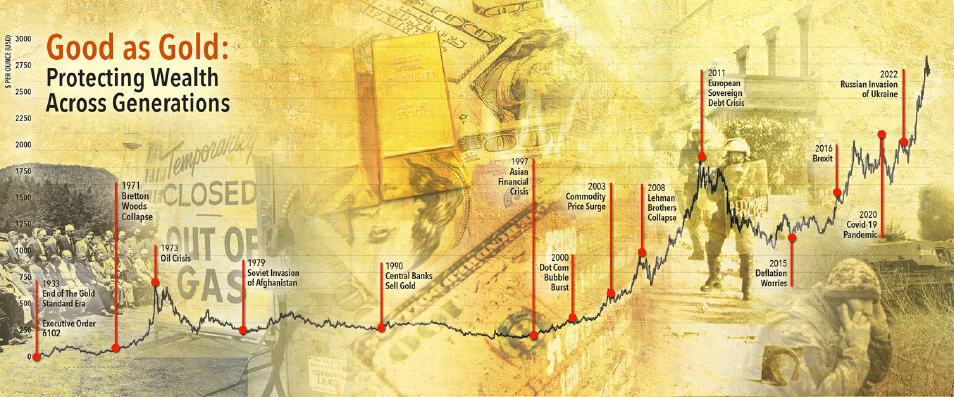

Safe-Haven Demand: In a familiar pattern observed throughout monetary history, investors have again gravitated toward gold amid economic and geopolitical uncertainties. This behavior reaffirms gold’s time-tested role as a stable store of value—a position it has maintained for thousands of years across countless economic cycles and political regimes.

Gold’s physical nature, the impossibility of being “hacked” or digitally compromised, zero counterparty risk, and finite supply continue to make it an attractive option for wealth preservation during uncertain times.

Factors Challenging Bitcoin

Market Volatility: Bitcoin has been disproportionately affected by broader market sell-offs and increased volatility in early 2025. While advocates have long promoted Bitcoin as an “uncorrelated asset,” its price movements continue to show sensitivity to macroeconomic conditions and general market sentiment.

Market Volatility: Bitcoin has been disproportionately affected by broader market sell-offs and increased volatility in early 2025. While advocates have long promoted Bitcoin as an “uncorrelated asset,” its price movements continue to show sensitivity to macroeconomic conditions and general market sentiment.

Security Concerns: A significant theft of $1.5 billion in Ether from the Bybit exchange has reignited concerns about the security vulnerabilities inherent to digital asset platforms. While Bitcoin wasn’t directly compromised, this high-profile security breach has dampened enthusiasm across the cryptocurrency sector and reminded investors of counterparty risks associated with digital asset custody.