from BullionStar:

Unprecedented Spreads Between Spot and Futures Prices in Gold and Silver

Over the past few weeks, financial markets have experienced an unprecedented widening of spreads between spot and futures prices for both gold and silver.

Traditionally narrow, these spreads have expanded to as much as USD $60 for gold and over USD $1 for silver. This significant discrepancy has created unique arbitrage opportunities, prompting substantial flows of physical metals from London to New York, as traders capitalize on lower spot prices in London and higher futures prices in New York.

TRUTH LIVES on at https://sgtreport.tv/

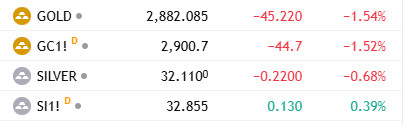

As of the time of writing, the spread has narrowed slightly, with a USD 18.615 difference (0.65%) between spot gold (“GOLD”) and gold futures (“GC1!”). For silver, the spread stands at USD 0.745, equivalent to 2.27%.

Despite clear arbitrage potential, these spreads have not normalized as quickly as would be anticipated by an efficient market, suggesting underlying market failures beyond simple arbitrage opportunities.

LBMA Bullion Bank Cartel

The LBMA cartel of bullion banks has historically controlled the London OTC spot price for gold, operating within a system that prioritizes the interests of bullion banks over the actual physical gold and silver market. Opacity is the name of the game here.

The LBMA lacks transparency, providing no public access to order book volumes or trading data. As a result, trading practices remain hidden from scrutiny. In essence, so-called spot gold is treated more like a currency, with little to no physical metal backing. Notably, the LBMA itself holds no gold reserves, instead relying on its member banks to maintain stockpiles.

BullionStar has been a long time critic of the LBMA where we repeatedly have been highlighting the lack of transparency, misleading data, and prioritization of paper trading over physical bullion. The LBMA has for a long time misrepresented vault stock levels creating a false sense of security about available metals.

Furthermore, LBMA enables the proliferation of unallocated synthetic paper gold, allowing bullion banks to trade so-called gold and silver without actual physical backing, which distorts true price discovery.

Controlled by bullion banks, the LBMA prioritizes their interests over individual savers and physical metal investors, favoring financial institutions while undermining the integrity of the bullion market.