by Ronan Manly, BullionStar:

“LBMA ensures the highest levels of leadership, integrity and transparency for the global precious metals industry by advancing standards and developing market solutions.”

– LBMA Mission Statement

When BullionStar repeatedly called on the LBMA to uphold its own mission – reforming for integrity and tranparency in the precious metals market – how do you think LBMA responded?

Did LBMA commit to clearer reporting of unencumbered gold? Did LBMA commit to end the price manipulation?

No, instead LBMA sent an operative and his secretary to BullionStar’s Bullion Retail Center in Singapore to inform us that there are inaccuracies in our coverage. The secretary’s assigned task, we were told, was to read our blog posts as soon as published!

TRUTH LIVES on at https://sgtreport.tv/

However, they kindly suggested a solution – if we sent our blog posts to the LBMA for review before publishing, they could ‘correct’ any inaccuracies for us!

We rejected LBMA’s offer to censor us.

BullionStar’s Critique of the LBMA

At BullionStar, we take pride in our independence and have been exposing the LBMA’s practices for years. My colleague Ronan Manly has written extensively on their opaque operations, conflicts of interest, and market manipulation. The more we examine the structure of the gold market, the more evident it becomes that the LBMA is an obstacle to free and fair trading.

The LBMA positions itself as the global authority on gold and silver trading but overwhelmingly favors bullion banks and paper-based trading over physical metals.

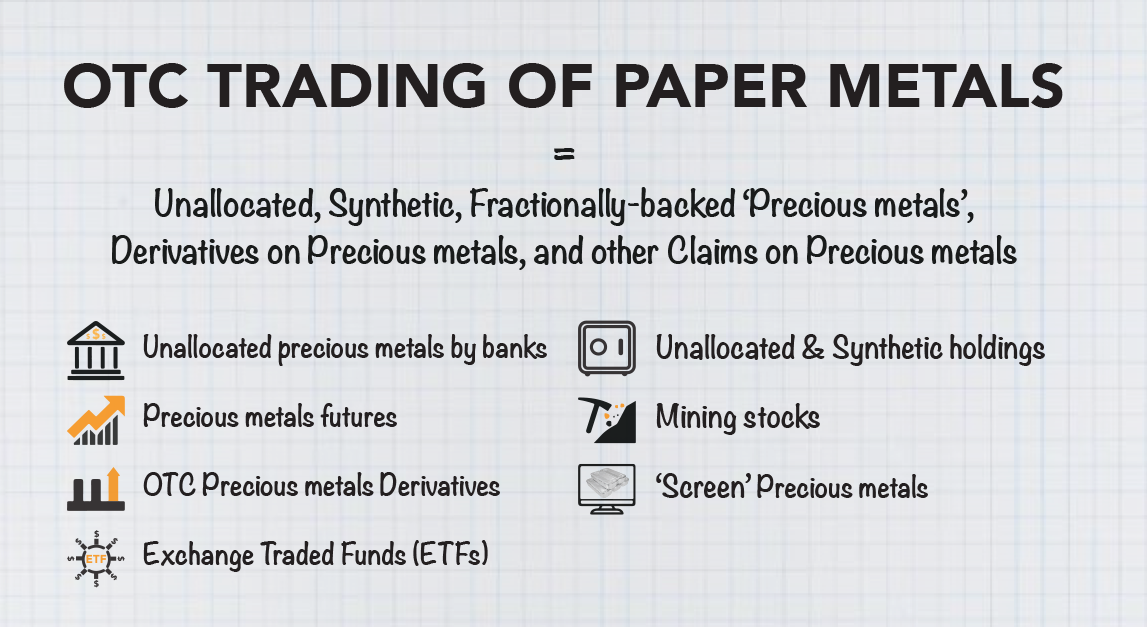

At the heart of the issue is price discovery. Rather than being driven by supply and demand for actual physical gold and silver, prices are influenced by opaque OTC trading of paper metals. This distorts physical market realities and creates opportunities for financial institutions to manipulate prices, sidelining physical investors and businesses.

Tied closely to bullion banks and the Bank of England, the LBMA maintains an opaque system that benefits large players while physical investors face limited transparency and fairness.

Since physical metals inherit prices from the OTC market, real gold and silver holders lose by having the price of their metals suppressed.

The Paper Gold Shell Game

LBMA oversees the paper gold and silver market – an elaborate system of unallocated accounts and derivatives that give the illusion of liquidity while masking the fact that there is far less physical gold than their contracts represent.

This system enables the banks to expand the supply of “gold” far beyond the available physical supply, suppressing prices and protecting their fiat interests.

The entire system is built on the assumption that most traders will never take delivery, allowing the bullion banks to engage in fractional reserve gold trading with impunity.

Convicted Gold Manipulators Run the LBMA

In 2020, JP Morgan admitted wrongdoing and agreed to pay over $920 million to settle U.S. probes into its manipulation of precious metals. The scheme involved thousands of deceptive trades over an 8-year period. Several traders, including Gregg Smith and Michael Nowak (a former LBMA board member), were later convicted of fraud, price manipulation, and spoofing and sent to prison.

In 2020, JP Morgan admitted wrongdoing and agreed to pay over $920 million to settle U.S. probes into its manipulation of precious metals. The scheme involved thousands of deceptive trades over an 8-year period. Several traders, including Gregg Smith and Michael Nowak (a former LBMA board member), were later convicted of fraud, price manipulation, and spoofing and sent to prison.

Despite this, JP Morgan remains a key player in the LBMA, retaining its status as a market-making member and participant in the daily gold and silver price auctions.

How can an organisation claim to ensure the highest levels of integrity, transparency, and governance while having JP Morgan as one of its most influential members?