by Craig Hemke, Sprott Money:

The new year began with some trepidation regarding silver after it failed to finish 2024 with a new annual high close. However, the silver price has begun 2025 on solid footing, and now with the U.S. dollar looking like it might turn lower, perhaps we can start looking forward to a new breakout?

Silver Price Performance in 2024

It’s not as if 2024 was a disappointment for silver. Far from it! Price gained about 22% on the year. However, my hope had been that the silver price would finish the year with its highest annual close ever, but after a mid-December swoon, those hopes were dashed.

TRUTH LIVES on at https://sgtreport.tv/

In our 2025 macrocast, I stated my belief that silver would follow up 2024 with an even better year in 2025, and price has begun January with a rally. Spot silver ended 2024 at $28.97/ounce, and as of Monday, January 20, it’s trading at $30.55. That’s a handy gain thus far of $1.68 or about 5.8%. Not too shabby.

Silver Fundamentals and Supply Deficit

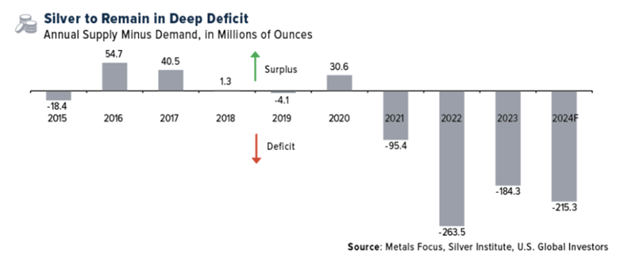

The silver price has some solid fundamentals behind it that should continue to serve it well in 2025 and beyond. For instance, after another supply deficit that is projected to exceed 200,000,000 ounces in 2024, the total supply deficit for the past four calendar years will exceed 700,000,000 ounces. With industrial, solar, and EV demand continuing to grow in the years ahead, the world is poised to continue consuming more silver than it mines and recycles.

In just about any good or commodity, higher demand combined with falling supply signals higher prices. Silver should be no exception.

The U.S. Dollar Index and Its Impact on Silver

There may also be a key short-term driver in play, and that’s a falling U.S. dollar index. Over time, silver prices hold a close, inverse correlation with the U.S. dollar index. It’s not true of every day but, in general, a rising dollar leads to lower silver prices and vice versa. Perhaps a better way to think of it is in nautical terms: A rising dollar provides a headwind for silver prices while a falling dollar provides a tailwind.

I mention this today because finally, after trading consistently higher since late September, it appears that the trend in the dollar index is shifting. Check the chart below: