by Alex Berenson, Unreported Truths:

In 2021, in a huge, onerous expansion of the surveillance state, Congress largely banned anonymous corporate ownership. A federal judge has already ruled the law unconstitutional. It needs to go.

In 2021, in a huge, onerous expansion of the surveillance state, Congress largely banned anonymous corporate ownership. A federal judge has already ruled the law unconstitutional. It needs to go.

“New BOI Reporting Requirement”

Recently, my accountant sent me an email with that mysterious subject line.

Notes that include the word “requirement” are rarely pleasant. I gritted my teeth, opened it, and found this:

TRUTH LIVES on at https://sgtreport.tv/

We wanted to ensure you are aware of the new Beneficial Ownership Information (BOI) reporting requirements under the Corporate Transparency Act (CTA). Based on our records, we believe you may need to submit a BOI report for a company in which you hold a beneficial ownership interest…

Filing deadline: January 1, 2025…

Failure to comply may result in fines of up to $591 a day…

Fines of $591 a day? You have my attention.

I wondered if I’d gotten a weird spoof email, a hacking attempt, USPS has failed to deliver package, sign up checking account to receive important business information or American States attorney will persecute you…

Nope.

The Corporate Transparency Act turns out to be all too real, a federally mandated fishing (or should that be phishing?) expedition that marks yet another massive and apparently unconstitutional expansion of the administrative state.

Passed in 2021 to “curb illicit finance,” the act “requires many companies doing business in the United States to report information about the individuals who ultimately own or control them.” Not my words, the Treasury Department’s.

—

I ran afoul of this law because, like lots of self-employed people, I have my own business. It’s registered in New York state. Corporate registrations, like other ordinary police powers, are supposed to belong to the states in the American system.

But, in a (possibly) well-intentioned effort to curb money laundering, tax fraud, and other financial crimes, Congress and the Biden Administration decided practically every company in the United States should have to disclose its owners and controlling partners to the federal government.

This is not a trivial requirement. As the United States Chamber of Commerce explains:

[B]usiness owners may be surprised by some requirements for updated filings. For instance, if a beneficial owner changes their address, legally changes their name due to marriage or divorce, or obtains a new driver’s license, it may necessitate an update to a company’s BOI report. Operational changes or a new delegation of authority could also qualify.

—

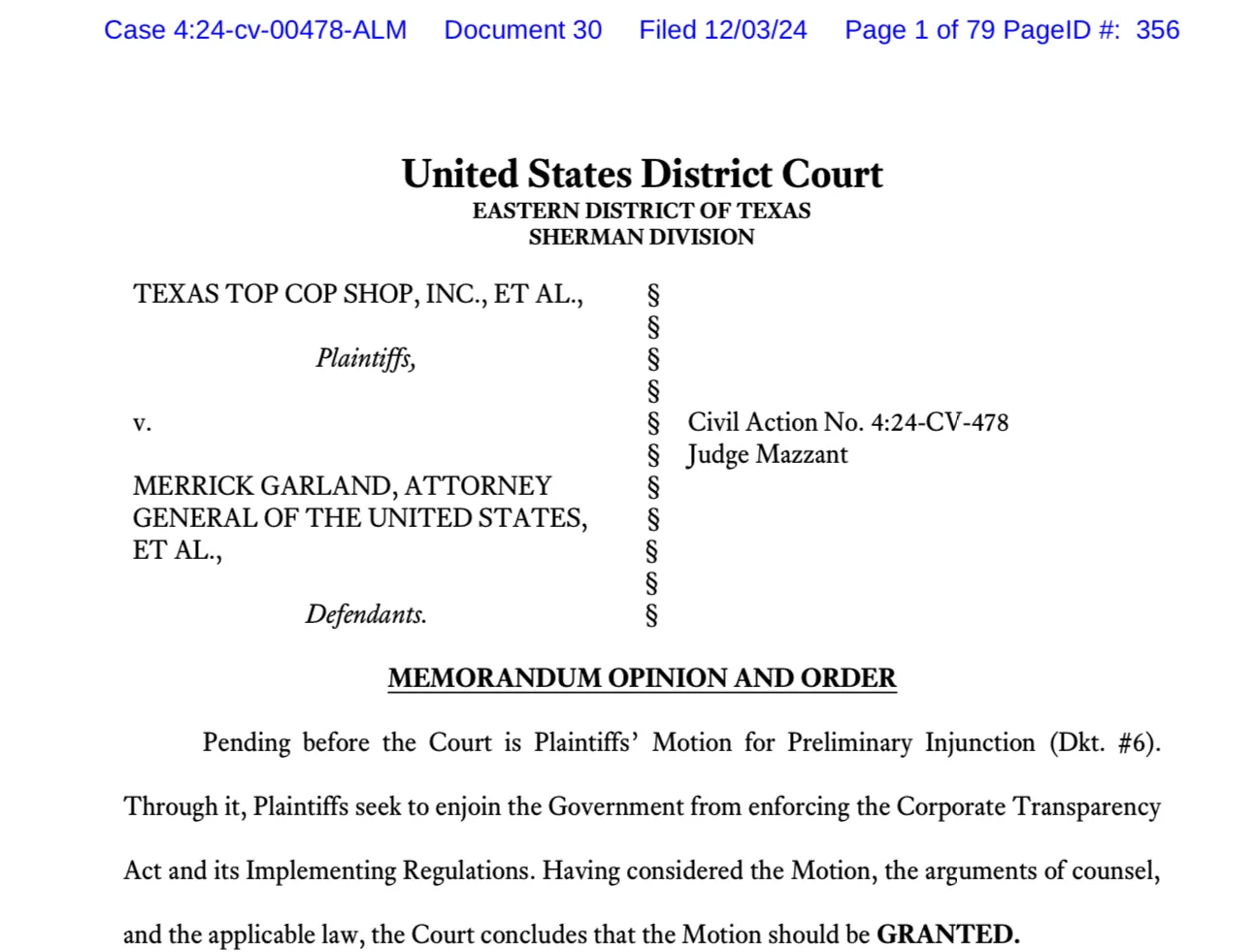

No surprise, numerous lawsuits challenging the constitutionality of the Corporate Transparency Act have been filed. And on Dec. 3, federal Judge Amos L. Mazzant III of the Eastern District of Texas issued a tightly argued 79-page ruling barring its requirements from taking effect anywhere in the United States on Jan. 1.1

Mazzant noted that nationwide preliminary injunctions like the one he issued are rare and face a high bar.

He found that this one was justified because neither the Commerce Clause nor any other part of the Constitution gives the federal government the right to demand the information it seeks. As Mazzant wrote, the law:

[R]epresents a Federal attempt to monitor companies created under state law—a matter our federalist system has left almost exclusively to the several States… [and] ends a feature of corporate formation as designed by various States—anonymity…

Read More @ alexberenson.substack.com