by Janet Phelan, Activist Post:

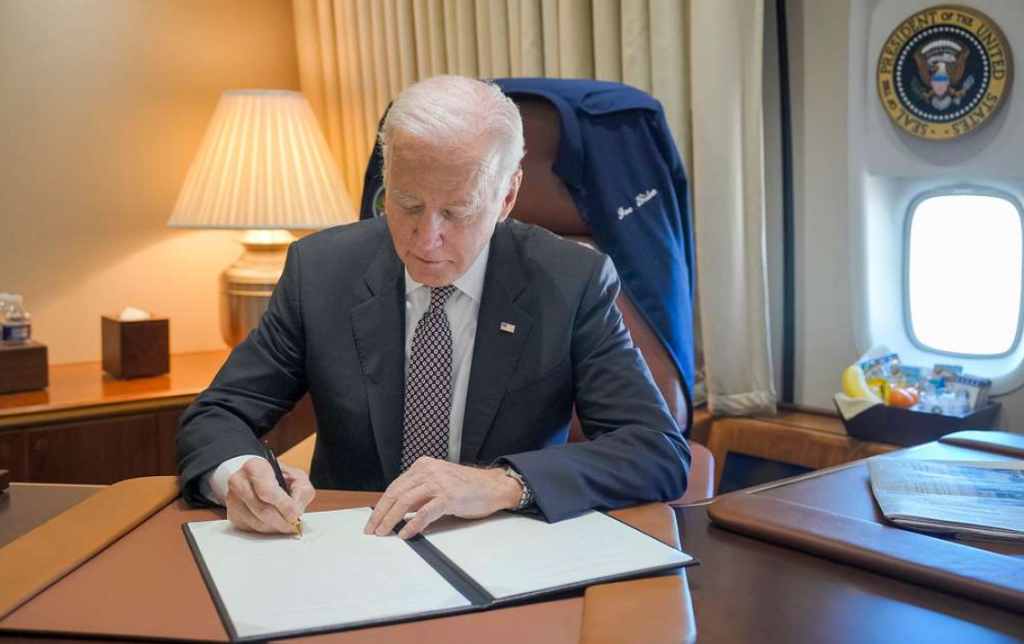

In what is being called the largest single day of clemency, President Biden commuted 1500 sentences, including the lengthy sentence of a Pennsylvania judge. Michael Conahan was convicted of funneling juveniles to for-profit detention facilities in exchange for $2.1 million in kickbacks, in what came to be nationally known as the “Kids for Cash” scandal.

The implications of this need to be further examined. Biden has been quoted as saying “America was built on the promise of possibility and second chances.” He went on to state that “I have the great privilege of extending mercy to people who have demonstrated remorse and rehabilitation, restoring opportunity for Americans to participate in daily life and contribute to their communities.”

TRUTH LIVES on at https://sgtreport.tv/

It appears, however, that there is more to this story than a scummy judge getting caught and rehabilitated and subsequently set free. Research indicates that somewhere in the range of ⅔ of the judges already checked have financial profiles that are redolent of money laundering and bribe taking.

Let that sink in. A full ⅔ of sitting judges, both state and federal, have been confirmed as on the take. And given that the research involves only those partaking of the mortgage scam (more on this in a moment) and excludes other vehicles for bribing a judge, these numbers need to be seen as deeply conservative.

The mortgage scam works in this way—Judge X takes out a loan and Y pays it back. This has the patina of respectability and it is only by doing a deep dive into the judge’s finances, such as was done here and again here that one begins to see the pervasiveness of this vehicle for enriching pivotal members of the legal system. Also, this method runs a detour around the IRS mandate that any deposit of over $10,000 must of necessity be flagged and reported up the line of command.

Multiple individuals have attempted to turn the results of these investigations over to the FBI, which refuses to take this on. Several years ago, a veterans group contacted the US attorney in the state of Washington with the results of a similar investigation and when the US attorney failed to act, the group turned the research process on the US attorney herself, with dramatic results.

Jim Jordan’s subcommittee on the Weaponization of Government was contacted by this reporter with details as to the weaponization of the courts. While those who answered at that subcommittee were exquisitely polite, there was no follow up on the allegations. The subcommittee was also contacted for input on this article. At the time of going to press, there was no response.

There exist other vehicles for funneling money to a complicit judge. When the judges in Nevada got national attention, due to the prosecution of an officer of the court, guardian April Parks, this reporter began to look at the involved judges.

Once again, two out of three involved judges had problematic mortgage histories. However, one of the worst offenders (in terms of his decisions impacting guardianship) looked to be clean, financially. Input from another reporter that this court heavyweight was using casinos to launder his ill-gotten gains was unverifiable.

When Arizona legislator Liz Harris sponsored a talk by researcher Jaqueline Breger, which extensively revealed the use of mortgages to pay off complicit politicos, the retaliation against Harris was swift and severe. Harris was expelled from the Legislature. While this reporter does not endorse some of Breger’s claims, such as her claim that the Mexican cartels are paying these bribes, much of Breger’s research concerning the mortgage scam appears to be valid.