by Mark Goodwin and Whitney Webb, Unlimited Hangout:

TRUTH LIVES on at https://sgtreport.tv/

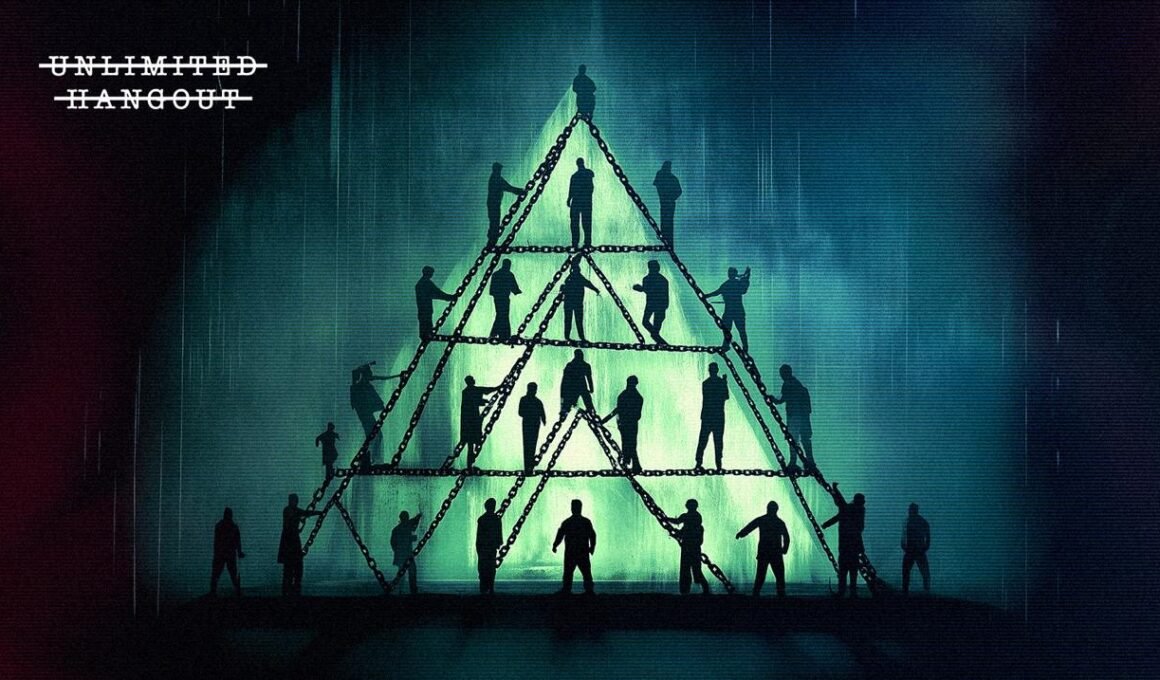

The initial trio of pieces in The Chain series have focused on the three essential pillars for creating a new digital monetary system. The first, The Chain of Custody, examined the construction of novel custodial infrastructure to enable the secure holding of billions of dollars worth of digital assets after the proliferation of Bitcoin as a new financial class. The second, The Chain of Issuance, investigated the primordial roots of digital payments fortifying data brokers and information bankers within the global surveillance network. It also noted how stablecoin issuers are the modern day analogue to the influence that the major infrastructural titans of the Industrial Age had on the formation of The Federal Reserve in the first half of the 20th century. The third, The Chain of Consensus, focused on the currency speculators and intelligence-connected developers behind the monetary policy and consensus infrastructure of privately-issued money and the blockchain revolution during the infancy of the Deflationary Age brought about by Bitcoin and the subsequent, dollarized iterations of its underlying database technology.

In summary, a new financial system cannot be built without the ability to custody assets, issue new assets, and uphold the settlement and monetary policy of said assets via a governing consensus. Yet, even with the successful formation of this necessary trifecta, the construction of a monetary network is simply fruitless without the acquisition of the last remaining pillar: a network of active users. This concept is well understood by both the private sector companies that have been mentioned throughout this series, in addition to the public sector that currently acts as the enabling environment for the rules and regulations of nation-state monetary systems upheld by central banks across the world. None of these public issuers of money, however, have the global impact of the U.S. Federal Reserve and the U.S. Treasury system, which provides immense privileges that come downstream from their issuance of the notes and reserves backing the world reserve currency, the U.S. dollar. With 66 countries worldwide listing the dollar as an official currency, the vast number of users utilizing these instruments makes the dollar system the largest financial network in the world.

Even within this monopoly, there is a fractured set of settlement networks, such as PayPal, and private banks, such as J.P. Morgan, issuing said dollars in users’ checking accounts. This balkanization presents a unique opportunity for further consolidation and, with that consolidation, the ability to acquire even more users. For example, PayPal acquired millions of global users via their purchases of Venmo and Xoom, while J.P. Morgan assumed the deposits of the failed First Republic Bank after the onset of the regional banking crisis in 2023.

Money itself is but a technology that enables agreeable and predictable outcomes between two bartering parties. This axiom requires money that simultaneously acts as a unit of account, a store of value, and a medium of exchange. While all of these properties can be met by a multitude of currently circulating currencies – and even commodities – their usefulness for settlement across both time and space is determined nearly entirely by the number of users within their respective networks. The dollar system is the most liquid monetary network in the world, and has held this position for nearly a century. Historically, the world’s reserve currency has held its dominant status for roughly this same duration of time. With U.S. debt levels now growing at uncontrollable and exponential rates, the formation of proposed alternatives to the dollar’s monopoly are popping up across the globe. The world economy is a finite pie consisting of finite users, and with the dollar network appearing truly weak for the first time in decades, competitors are posturing for a piece. However, with the global broadband internet dissolving some of the control that nation states have over their own citizens’ monetary choices, the world is actually dollarizing faster than ever.

As the internet age enters its third decade, the stakes for creating the internet of money have never been higher. For now, the proliferation of dollarized blockchains seemingly aims to fortify the dollar’s hold over global finance, not dissolve it. Regardless of the dollar’s domination of denomination, the upstart issuers of these tokenized assets have hemorrhaged away enough users that it now threatens many of the privileges the legacy system once enjoyed, mainly the available profits found by selling their data and leveraging their deposits.

Read More @ UnlimitedHangout.com