by Jan Nieuwenhuijs, Gold Seek:

The People’s Bank of China (PBoC) is covertly buying very large amounts of gold, adding upward pressure to a tense gold market.

An explosive cocktail of Western institutional investors and central banks in the East buying gold this year is making the gold price rise sharply. Interest rate cuts and geopolitical strain will sustain this bull market.

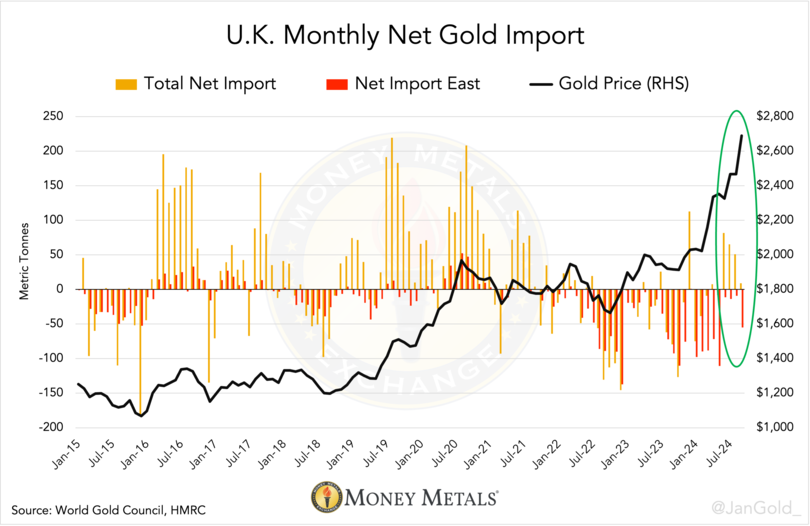

U.K. Gold Exports to China Are a Proxy for PBoC Buying

Last July, I published an analysis proving how the Chinese central bank covertly buys gold in the London Bullion Market through bullion banks.

TRUTH LIVES on at https://sgtreport.tv/

All “non-monetary” gold (privately owned metal) in China is traded over the Shanghai Gold Exchange (SGE)1. However, since the war in Ukraine began, there has been more supply in the Chinese market than sold through the SGE; the “surplus” reflects what the PBoC buys.

Gold exports from the U.K. are virtually all in the form of 400-ounce bars from the London Bullion Market. The retail market in the U.K. pales in comparison to the wholesale market that deals in “large bars” (400-ounce bars).

On the SGE, very few large bars are traded—the Chinese private sector prefers 1 Kg bars. My research shows that direct exports from the U.K. to China are, in fact, purchases by the PBoC. These purchases show up in cross-border trade statistics because the PBoC buys the gold from bullion banks that take care of shipping and insurance and thus have to deal with customs.

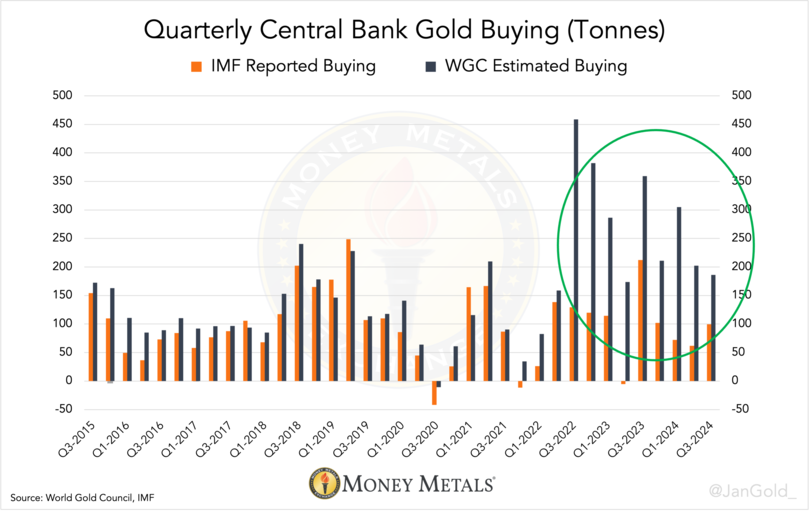

The above matches other evidence of the PBoC acquiring gold surreptitiously. By now, most gold investors are aware that the massive difference between what the World Gold Council (WGC) estimates central banks purchase in aggregate (based on field research) and what central banks in total report to the IMF is mainly attributable to the central bank of China.

Chart 1. Since mid-2022, actual central bank gold purchases have been dramatically higher than the IMF was willing to report.

This secret buying by central banks has exploded since the outbreak of the war in Ukraine early 2022 because, at that point, the West froze Russia’s dollar assets. Next to the PBoC, the Saudi Central Bank (SAMA) is known to be buying gold under the radar, albeit in smaller sizes.

More Proof the PBoC Buys Gold in London

Elaborating on the above, the PBoC has made it overtly clear what they did in September: buy 60 tonnes of gold from bullion banks operating in the London Bullion Market.

As we saw private gold demand move from East to West halfway through 2024, driving the price up, the premium at the SGE took a nose dive into negative territory. But, surprisingly, Chinese customs data from September shows gross gold import accounted for 95 tonnes2.

According to the rules in the Chinese gold market, all bullion imports into the domestic markets must be sold through the SGE first. But if the SGE trades at a discount, why would any bank import gold to sell at a loss? Of course, they do not. When the SGE trades at a steep discount, gold imports into the domestic market are not bought by the private sector.

Chart 2. In green, large imports while private demand on the SGE is weak, indicated by a discount relative to the gold price in London. Imports shown are destined for the PBoC, not the private sector3.

What has happened is that 60 tonnes imported from the U.K. in September2 were swiftly handed over to the PBoC (exempt from rules) when they arrived in Beijing and carried to central bank vaults4.