from ZeroHedge:

Elon Musk has responded to a bombshell report by journalists Paul Thacker and Matt Taibbi which reveals that a the UK’s Center for Countering Digital Hate – which is advising the Kamala Harris campaign, aims to “kill Musk’s Twitter”.

Read the report below:

Authored by Paul D. Thacker and Matt Taibbi via The Disinformation Chronicle and Racket News (emphasis ours),

TRUTH LIVES on at https://sgtreport.tv/

This is war https://t.co/tesncwEoXE

— Elon Musk (@elonmusk) October 22, 2024

The British are coming, to meddle in our elections!

In an explosive leak with ramifications for the upcoming U.S. presidential election, internal documents from the Center for Countering Digital Hate—whose founder is British political operative Morgan McSweeney, now advising the Kamala Harris campaign—show the group plans in writing to “kill Musk’s Twitter” while strengthening ties with the Biden/Harris administration and Democrats like Senator Amy Klobuchar, who has introduced multiple bills to regulate online “misinformation.”

Senator Klobuchar’s office did not respond to request for comment.

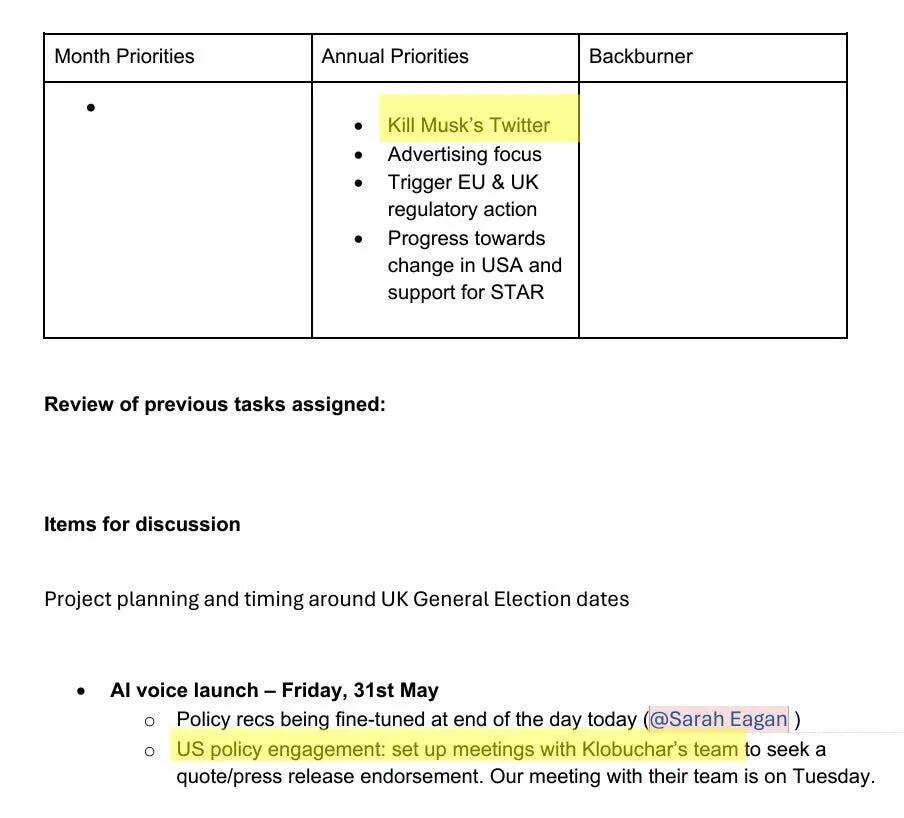

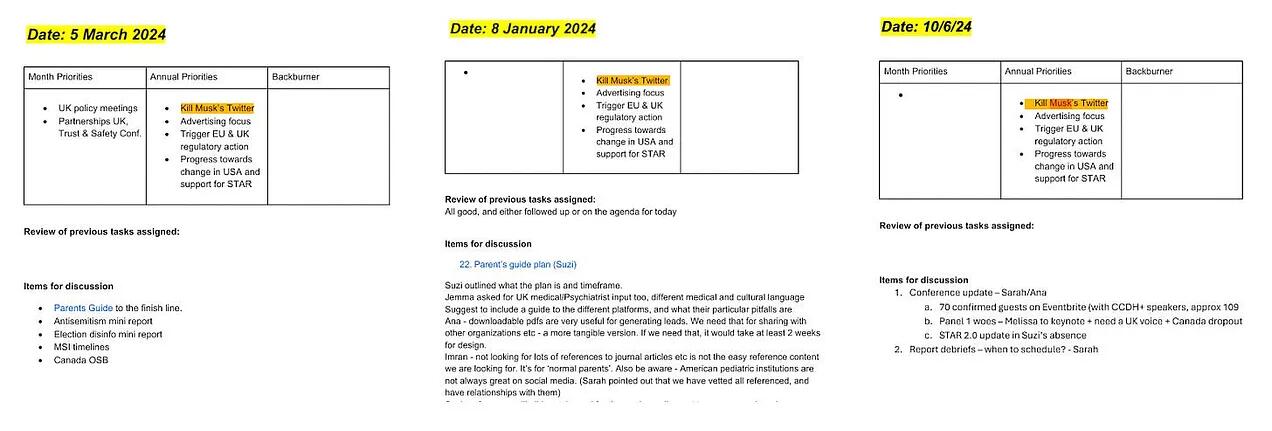

The documents obtained by The DisInformation Chronicle and Racket show CCDH’s hyperfocus on Musk — “Kill Musk’s Twitter” is the first item in the template of its monthly agenda notes dating back to the early months of this year.

The Center for Countering Digital Hate is the anti-disinformation activist ally of Prime Minister Keir Starmer’s Labour Party, and a messaging vehicle for Labour’s neoliberal think tank, Labour Together. Both the CCDH and Labour Together were founded by Morgan McSweeney, a Svengali credited with piloting Starmer’s rise to Downing Street, much as Karl Rove is credited with guiding George W. Bush to the White House.

The CCDH documents carry particular importance because McSweeney’s Labour Together political operatives have been teaching election strategy to Kamala Harris and Tim Walz, leading Politico to call Labour and the Democrats “sister parties.” CCDH’s focus on “Kill Musk’s Twitter” also adds to legal questions about the nonprofit’s tax-exempt status as a 501(c)(3) organization.