by Ed Steer, Silver Seek:

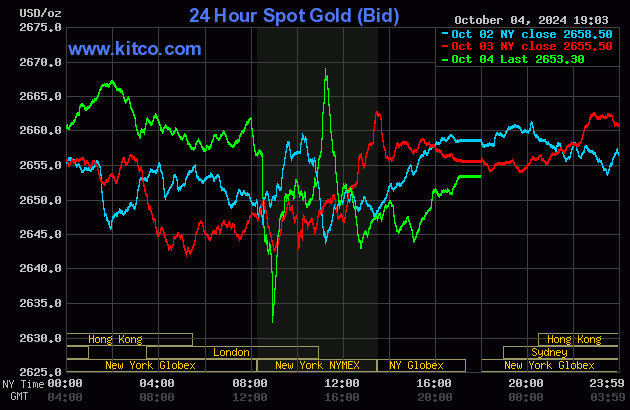

The gold price took two steps higher once Globex trading commenced at 6:00 p.m. EDT on Thursday evening in New York — and that lasted until its price was capped at 2 p.m. China Standard Time on their Friday afternoon. It was sold quietly lower from there until 11 a.m. in London — and then crept a bit higher until it got smacked at exactly 1:00 p.m. BST/8:00 a.m. in New York. Then the collusive commercial traders of whatever stripe showed up in force at the 8:30 a.m. EDT non-farm payroll number in Washington — and its low tick was set about 8:59 a.m. It then rallied two enormous steps higher from there until ‘da boyz’ showed up anew about fifteen minutes after the 11 a.m. EDT London close. Shortly after that its price was engineered lower until 12:45 p.m. — and then had a decent up/down move that ended at 3:01 p.m. in after-hours trading. It rallied rather smartly from there until trading ended at 5:00 p.m. EDT.

TRUTH LIVES on at https://sgtreport.tv/

The low and high ticks in gold, both of which were set by ‘da boyz’ in COMEX trading in New York, were recorded by the CME Group as $2,651.60 and $2,690.60 in the December contract…an intraday move of $39. The October/ December price spread differential in gold at the close in New York yesterday was $22.00…December/February was $22.90…February/April was $19.50 — and April/June25 was $19.60 an ounce.

Gold was closed on Friday afternoon in New York at $2,653.30 spot, down $2.20 on the day…22 dollars off its low tick — and and 17 bucks off its Kitco-recorded high. Net volume was only a bit on the heavier side at a bit under 169,000 contracts — and there were just about 24,000 contracts worth of roll-over/switch volume out of December and into future months on top of that.

I noted that 114 gold, plus 156 silver contracts were traded in October yesterday, so I look forward to what portion of that shows up in tonight’s Daily Delivery and Preliminary Reports.

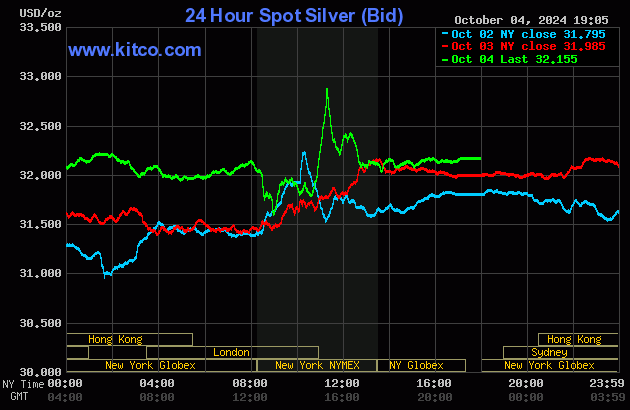

Silver’s price was managed in the same fashion as gold’s…including all the major and minor inflection points — and that lasted until ‘da boyz’ were done with it at 12:45 p.m. in COMEX trading in New York. From that point it wandered quietly higher until around 3:55 p.m. in after-hours trading — and didn’t do much after that.

The low and high ticks in silver were reported as $31.755 and $33.225 in the December contract…and intraday move of $1.47…almost five percent. The December/March price spread differential in silver at the close in New York yesterday was 42.1 cents…March/May was 25.6 cents — and May/July25 was 24.4 cents an ounce.

Silver was closed on Friday afternoon in New York at $32.155 spot…up 17 cents from Thursday — and 70.5 cents off its Kitco-recorded low tick — and 75.5 cents off its high. Net volume was pretty heavy at a bit over 81,500 contracts — and there were a bit over 4,900 contracts worth of roll-over/switch volume out of December and into future months in this precious metal.

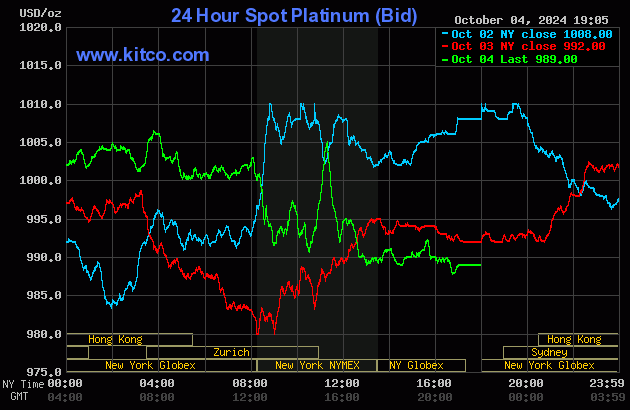

In most respects that mattered, platinum’s price was also managed in a similar fashion as gold and silver…up until a minute or so before 9 a.m. in New York. It’s 10:40 a.m. EDT rally in COMEX trading was all gone — and then some, within the following two hours. It didn’t do a whole heck of a lot after that. Platinum was closed at $989 spot, down 3 dollars on the day.

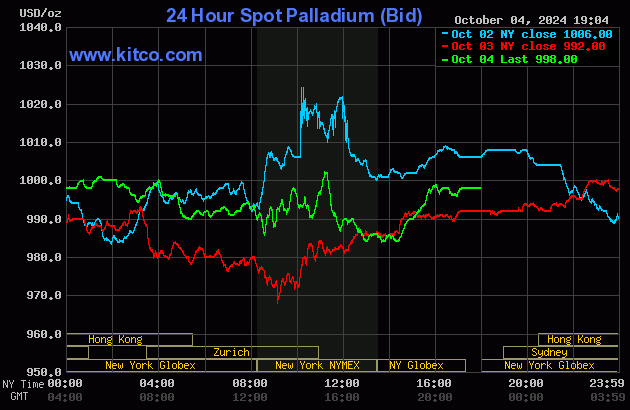

Palladium’s price path was similar to the other three precious metals…but on Valium. It managed to close up 6 bucks at $998 spot.

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 82.5 to 1 on Friday…compared to 83.0 to 1 on Thursday.

Here’s the 1-year Gold/Silver Ratio Chart…courtesy of Nick Laird and, for whatever reason, the Friday data point is not on it. Click to enlarge.

![]()

The dollar index closed very late on Thursday afternoon in New York at 101.99 — and then opened lower by 8 basis points once trading commenced at 7:45 p.m. EDT on Thursday evening, which was 7:45 a.m. China Standard Time on their Friday morning. From that point it wandered very quietly and very broadly sideways to a bit lower until that non-farm payroll number showed up at 8:30 a.m. in New York. It went vertical at that point…lasting until 9 a.m. EDT — and then had a quiet but bit choppy down/up move that ended at 12:30 p.m. From that juncture it was quietly down hill until around 4:05 p.m. EDT — and didn’t do a thing after that until trading ended at 5:00 p.m.