by Jan Nieuwenhuijs, Gold Seek:

In the past two years, the East has been responsible for a momentous move upward in the gold price, decoupling it from the West’s pricing model. But Western investors have taken back the baton and have been driving gold higher since June 2024.

Tellingly, Western investors are abandoning their old pricing model, too. Instead of participating in the gold market for speculative reasons, they are now buying gold as a safe haven. This is highly bullish because Wall Street has little exposure to gold.

Meanwhile, on a net basis, the East is not selling. In this tight market, the gold price is sharply rising: year-to-date, it’s up more than 30%.

TRUTH LIVES on at https://sgtreport.tv/

Gold Prices Are Driven by the Marginal Buyer

What sets the price of gold is usually determined by global flows of gold from West to East or vice versa. It’s important to understand who the marginal buyer (price setter) actually is for several reasons.

Identifying the marginal buyer provides context to why the gold price goes up or down. Historically (for the past 100 years), Western institutional supply and demand have set the price, while the East lowered volatility by selling into bull markets or buying in bear markets.

As the East has recently shown, it can be a driving force in the gold market as well, and the reasons for doing so haven’t faded1. Were we to see continuous buying in two hemispheres at the same time, it would create a perfect storm in gold.

The Awakening of the East

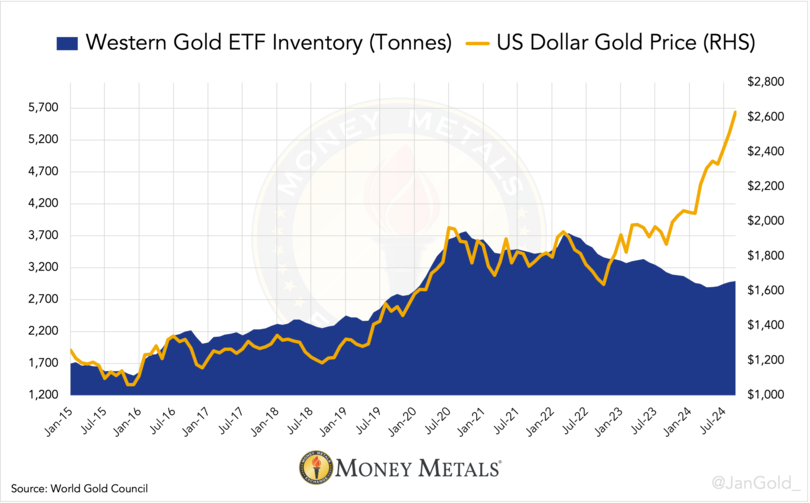

During the upward move in gold from late 2022 until May 2024, it was clear to market observers this wasn’t driven by Exchange Traded Fund (ETF) buying, as ETF holdings declined over this period.

Neither was it caused by OTC buying in London or Switzerland, as both trading centers were net exporters. Before 2022, ETF inventories would swell, and the U.K. and Switzerland would be net importing when the gold price increased.

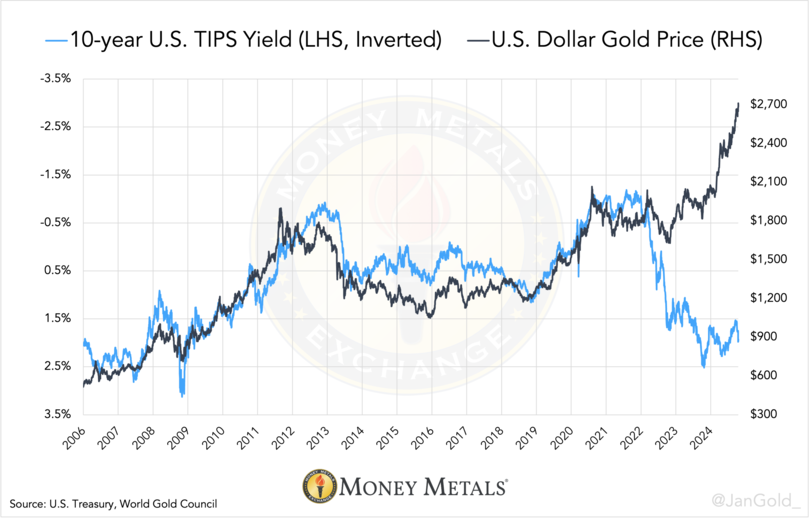

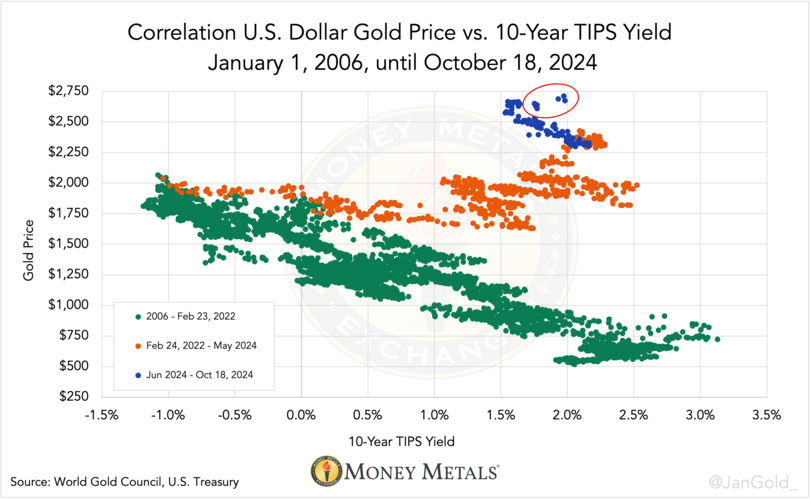

Something new was occurring as gold decoupled from the 10-year Treasury Inflation Protected Securities (TIPS) yield in 2022. Although this made little sense in the long run2, Western traders preferred the TIPS yield for pricing gold from 2006 through early 2022.

To a large extent, the Chinese and Saudi central banks—and to a lesser extent, the private sector in, for example, China, Thailand, and Turkey—were driving gold higher due to geopolitical tensions and deteriorating financial conditions.

From early 2022 until Q2 2024, central banks, in aggregate, bought 2,500 tonnes, of which, according to my research, the People’s Bank of China bought 1,600 tonnes, and its Saudi peer bought 160 tonnes (as explained here and here).

The East was in charge of the gold market during this period.

Western Investors Are Back Buying Gold

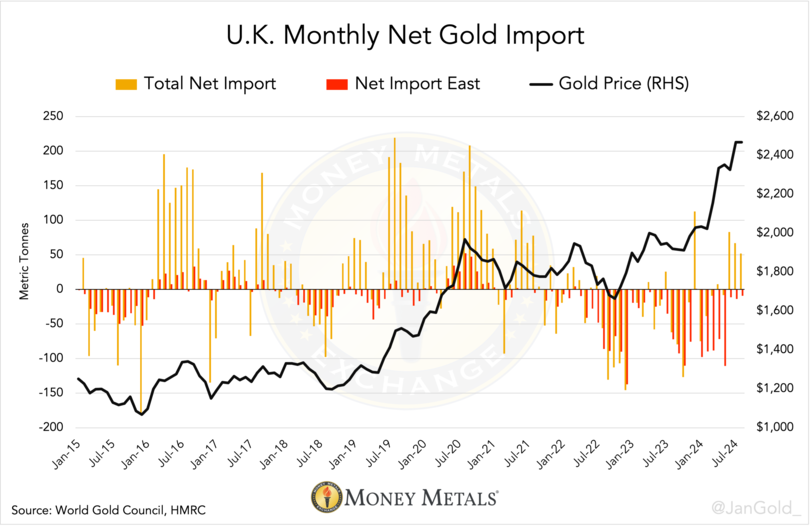

What happened since last June is that the gold price has been rising, gold ETF inventory has gone up, and the U.K.—home of the London Bullion Market—has turned into a net importer.

Chart 1. Monthly Western gold ETF holdings. ETF holdings by the rest of the world are only 6% of total gold ETF holdings.

In addition, the gold price was correlated to the TIPS yield again for more than four months. But starting this month, this correlation is now breaking down while the West continues to be the driving force for higher prices.

Chart 2. TIPS yield versus gold price up until October 18, 2024.

Chart 3. Since June, the blue dots have been forming a new diagonal cloud, reaffirming the old TIPS model at a higher price, though in October, the model was aborted (red oval).

Meanwhile, gold demand in the East has moderated. The premium at the Shanghai Gold Exchange went negative starting in July (and still is), Chinese imports have declined in recent months, and the same goes for India.

Global indicators signal the West is back in charge of the market.

A Tight Gold Market

The gold market hasn’t entirely gone back to how it was before 2022. Dishoarding by the East to the world’s largest refining hub, Switzerland (as we saw before 2022 during rising gold prices) has not reoccurred since. My take is that the East is catching some breath in the most recent run-up, but it’s not done buying.