from ZeroHedge:

There is some good news and some bad news for China bulls this morning (local time).

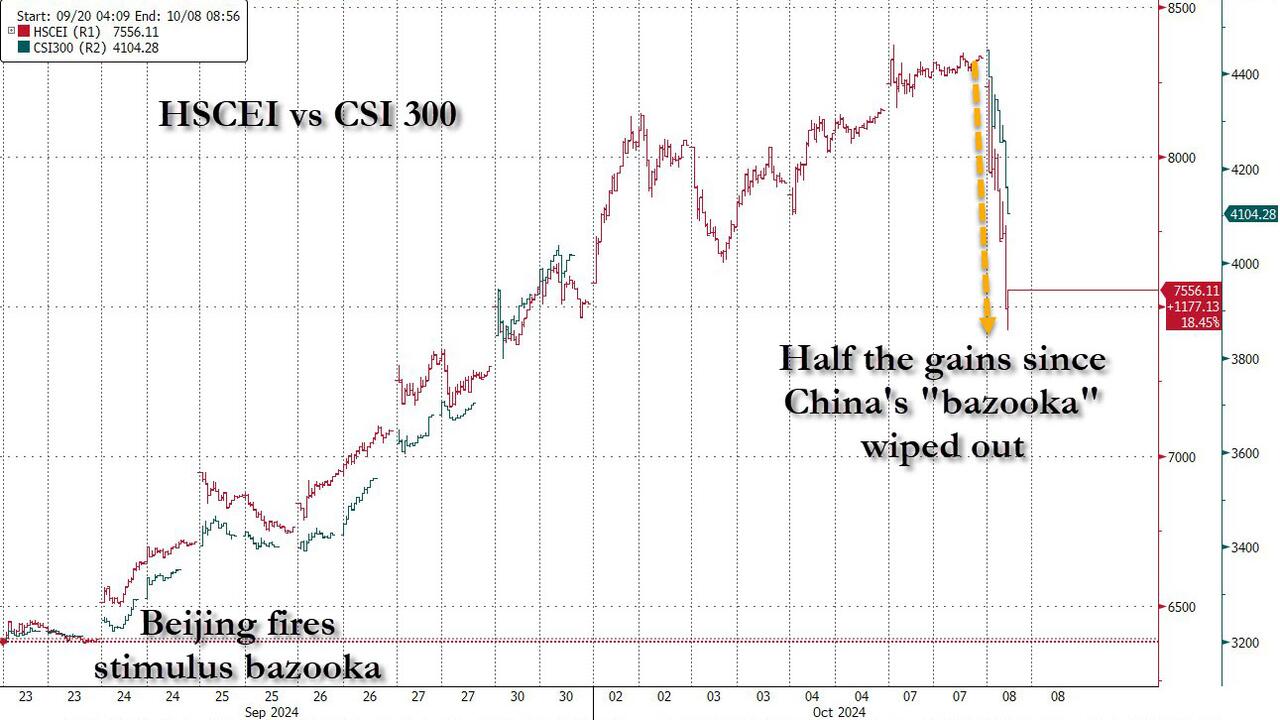

First the good news: since mainland China (aka A-shares) were closed for the past week, mainland Indexes such as the Shanghai Shenzhen CSI 300 are up – just barely – because after opening up almost 11% to catch up with the frenzied rally in offshore markets and ETFs, the index has erased almost all gains since it closed for trading on Sept 30.

TRUTH LIVES on at https://sgtreport.tv/

For the real action, one has to go to neighboring Hong Kong, which was open while China was closed, and which proceeded to soar as much as 30% since the China stimulus bazooka was fired on Sept 23 (just two days after we said it would be). It’s also were the bad news is because one look at what the local Hang Seng China Enterprises Index is doing, and HK longs will want to throw up: as shown below, not only are HK stocks down as much as 11% after the open, but they have somehow managed to wipe out almost half the gains since the bazooka was launched in less than two hours!

Alas it was not meant to be, and the press conference led by Zheng Shanjie, chairman of China’s top economic planner, the National Development and Reform Commission was an epic dud: in it, Shanjie said that while external risks and downward economic pressures were increasing, they remained confident of achieving the full-year GDP growth target. He said new policy measures will focus on expanding domestic demand, increasing support and the property and capital markets.

In short, nothing new, and certainly nothing even remotely close to the Rmb 10 trillion in fiscal stimmies that many were expecting. As UBS writes, “the NDRC press conference has released no details on fiscal stimulus so far, with the Q&A session ongoing. Zheng Shanjie along with deputy heads Liu Sushe, Zhao Chenxin, Li Chunlin and Zheng Bei, were widely expected to announce an action plan at the press conference. As a result, USDCNH is coming up, while iron ore and copper are declining. Shenzhen’s ChiNext has narrowed gains to 13% from more than 18% earlier as China returned from the Golden Week holiday.”

What is the take home message here? First, that Jim Cramer was – as usual – a fade.