by Corey Lynn, Corey’s Digs:

Is BlackRock really buying up all of the single-family homes in America? How involved is Blackstone? Are private equity firms and big investors taking over the housing market? Are “build-to-rent” communities becoming a trend? Are foreigners buying up U.S. residential properties? Who owns all of the vacation rentals, manufactured home communities, and student housing? Are we really going to own nothing and be happy?

TRUTH LIVES on at https://sgtreport.tv/

Whether you are looking to buy, sell, rent, invest, relocate, or just want to keep your eye on the ball, this report will act as a roadmap, showing where individuals, mom-and-pop investors and large investors monopolize different sectors of the housing industry and where the hot locations are. It is packed with hundreds of statistics and charts to provide both context and visual aids for a comprehensive view of how the landscape of America is shifting. There have been some big misconceptions and many of these statistics will surprise people.

The Complete Roadmap:

• Single-Family Homes and The Rental Market: Homeowners Versus Investors

• The Top 6 Companies That Own Single-Family Home Rentals

• Build-To-Rent Single-Family Home Communities

• Foreign-Owned U.S. Residential Property

• Manufactured Housing Communities

• Vacation Rental Homes Market

• Student Housing Market

• The Affordable Housing Scheme

• Private Equity and Large Investors

• The Biggest Takeaways

Download this full report in The Bookshop >

Increased mortgage rates that have reached as high as 7.79%, coupled with increased homeowners insurance, property taxes, utility bills, and the darn silverware in the kitchen drawers, has made it extremely difficult for people to afford homes. One of the bigger trends is build-to-rent communities. In fact, many private equity firms, real estate management companies and developers have been selling off inventory of single-family homes while the market has been hot and using the capital to expand on these communities. But make no mistake, there is also a growing trend of buying homes for cash and converting them to rentals. Is it the mega investors, the mom-and-pops or the small-to medium-sized management companies, and where do the shareholders fit into this action?

It’s important to cut through the fog and get down to specifics while comparing homeowners versus small investors, flippers, and mega investors to see where this housing market sits and where it’s headed. The reality is that individual homeowners own the majority of the single-family market and there are a lot of data points that will surprise people. There is also opportunity for individuals and mom-and-pop investors. However, private equity firms pretty much have their claws dug in to every sector of the housing industry from single-family homes to manufactured housing communities and student housing.

There are numbers flying all over the place and it’s not an apples-to-apples comparison by any means because numerous sources use mixed terms without specifying precisely the type of dwelling the numbers represent. Oftentimes, the percentages for investors’ stakes are reduced by lumping data on specific dwellings into the overall housing units market. In addition to this, certain data is only available up to 2022, where other data is current through first quarter 2024. Another big hiccup is that there is no universal definition of “institutional investor,” so multiple data sources will state numbers and percentages based on what they deem to be an institutional investor. For example, some break it up based on 1-10 homes being a small investor and mega investors own more than 1,000, while others will report numbers based on large investors owning more than 100 homes. And, there are also short-term and long-term investors, which obviously makes a huge difference in the grand scheme of things. Furthermore, most don’t dig deep enough to get a realistic picture of who the actual owners are. The data is inconsistent across the board, so comparisons and scrutiny are necessary when pulling data points.

After doing an immense amount of cross referencing, digging into dozens of data points, and running the math to get to the bottom of the actual numbers, this report reveals where homeowners, small investors and mega investors stand in the entire U.S. housing market.

Definitions for clarity:

• Single-Family Homes: include fully detached homes and semi-detached which are side-by-side dwellings making up row houses, duplexes, quadruplexes, and townhouses. If there are units above or below, they are not separate by a ground-to-roof wall, or they have shared meters for utilities they are considered multifamily.

• Multifamily Units: residential buildings containing units built one on top of another and those built side-by-side which do not have a ground-to-roof wall and/or have common facilities such as attic, basement, plumbing, etc. Townhouses and condominiums that do not meet the definition of single-family homes fall under multifamily. Typically, multifamily buildings consist of 5 units or more, but a single structure with 2-4 units can also be considered multifamily if it meets the criteria. Example: of the 450,000 completed multifamily units in 2023, only 12,000 were 2-4 units, 206,000 made up 5-49 units and 233,000 were buildings with over 50 units, with the largest volume built in the South.

• Housing Units: include all single-family detached and semi-detached homes, all multifamily such as apartments, a group of rooms, condos, prefabricated and modular units, mobile homes, and units in assisted living facilities. Excluded from statistics are: dormitories and rooming housing, barracks, transient hotels unless permanent resident, and nursing homes.

Single-Family Homes and The Rental Market: Homeowners Versus Investors

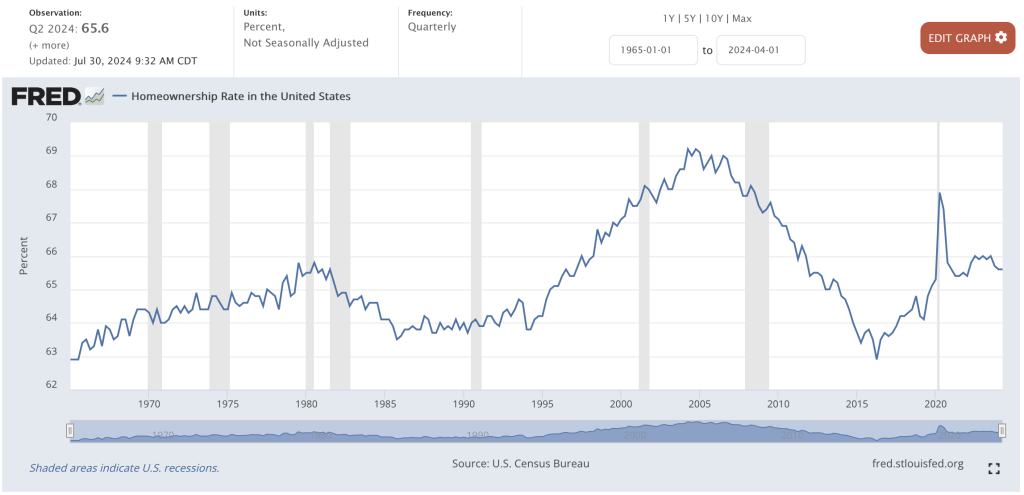

Homeownership rate has toggled between 62.9% and 69.2% from 1965 to April 30, 2024 where it sits at 65.6%.

As of 2022, 39.28% of homeowners own their homes outright and do not carry a mortgage, which is a 6.5% increase since 2010. Again, nearly 40% of homeowners own their homes outright and are mortgage-free! 38% of all homeowners are baby boomers so many have probably lived in their homes for a long time and paid off their mortgage, and some “homeowners” are investors who often don’t carry a mortgage. Nonetheless, it’s an impressive percentage.

For those who don’t own their homes outright, the largest mortgage originators by number of loans as of 2023 are United Wholesale Mortgage, Rocket Mortgage, Bank of America, Fairway Independent, CrossCountry, U.S. Bank, Navy Federal, Citizens Bank, PNC Bank, and LoanDepot.

Who are the top shareholders of the top three largest mortgage lenders in the U.S.?

The top shareholders of United Wholesale Mortgage (UWM Holdings Corp) are Vanguard, Fidelity, Platinum Equity Advisors, BlackRock, and Northern Trust Corp.

The top shareholders of Rocket Mortgage (Rocket Companies, Inc.) are Vanguard, Fidelity, Boston Partners, JP Morgan Chase & Co, and BlackRock.

The top shareholders of Bank of America are Berkshire Hathaway, Vanguard, BlackRock, State Street Corp, and Fidelity.

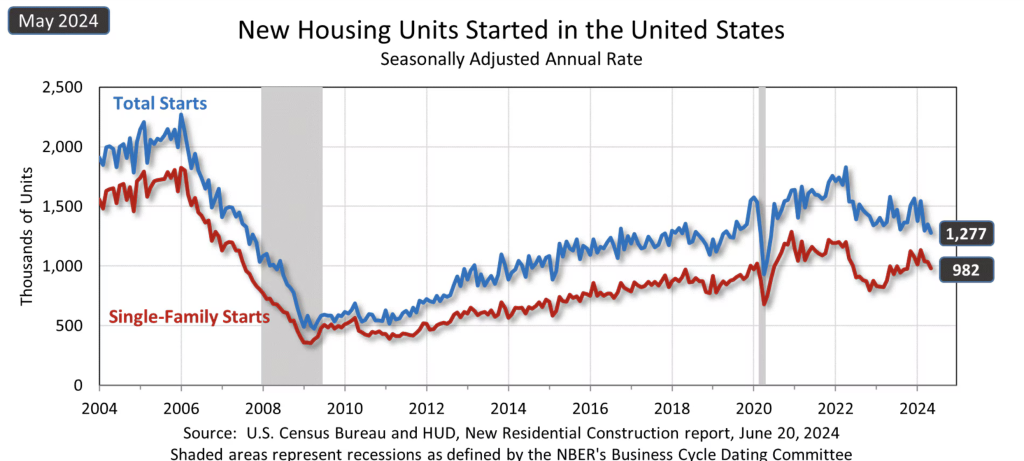

New housing builds have been on a steady increase since 2010, with a slight dip in 2022-2023. On average, there are close to 1.5 million house starts annually, with roughly 65% accounting for single-family homes.

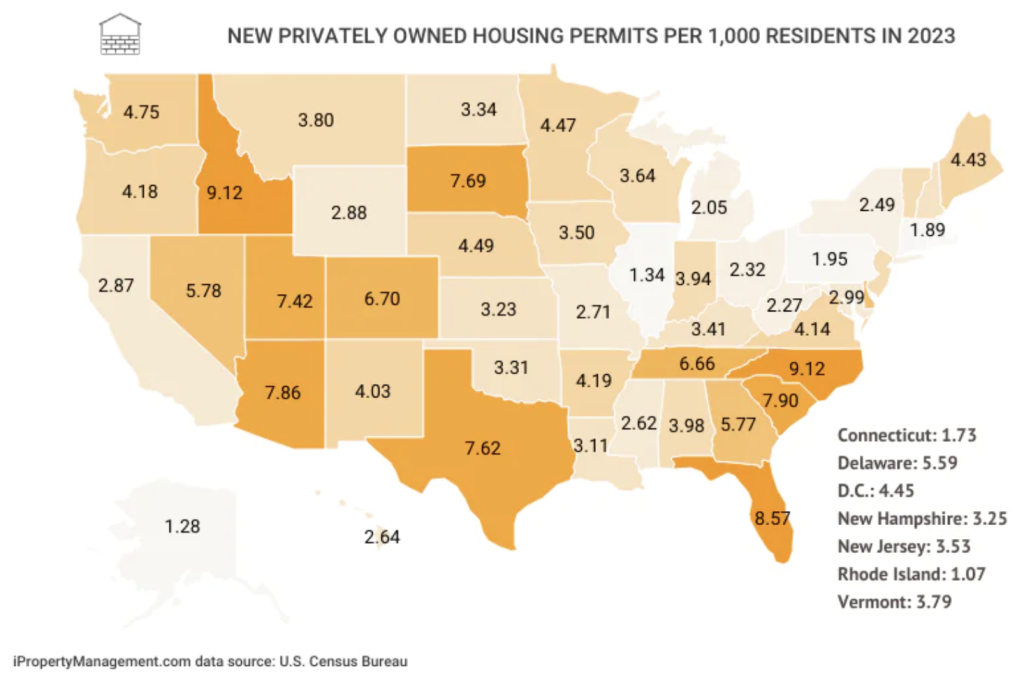

In 2023, North Carolina had the largest number of privately owned housing permits per 1,000 residents, while Idaho, Florida, Arizona, South Dakota, and Texas saw good activity as well.

According to a May, 2024 release by the U.S. Census Bureau, Population Division on annual estimates of housing units for the United States, Regions, States, and the District of Columbia, there were 145.4 million housing units in the U.S., which was updated to 146.6 million in Q2 2024.