by Wolf Richter, Wolf Street:

But China’s renminbi keeps losing ground.

But China’s renminbi keeps losing ground.

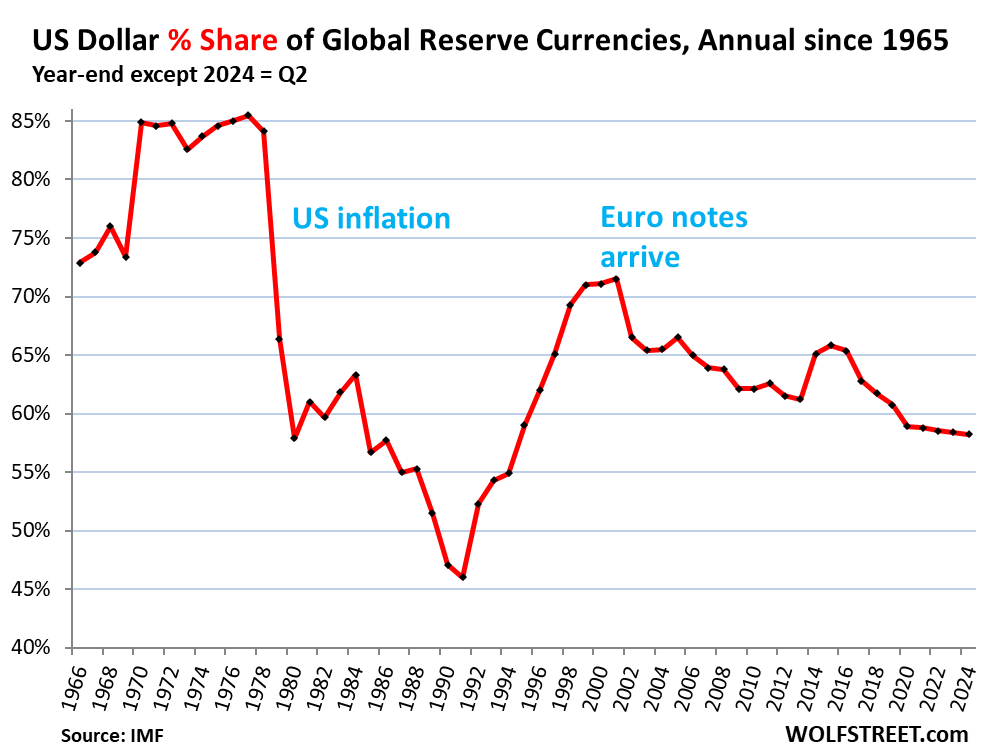

The US dollar, still the #1 reserve currency held by central banks, keeps losing share in bits and pieces ever so slowly against a mix of other reserve currencies as central banks diversify their holdings of dollar-denominated assets to assets denominated in other currencies. And they’re also adding to their holdings of gold.

TRUTH LIVES on at https://sgtreport.tv/

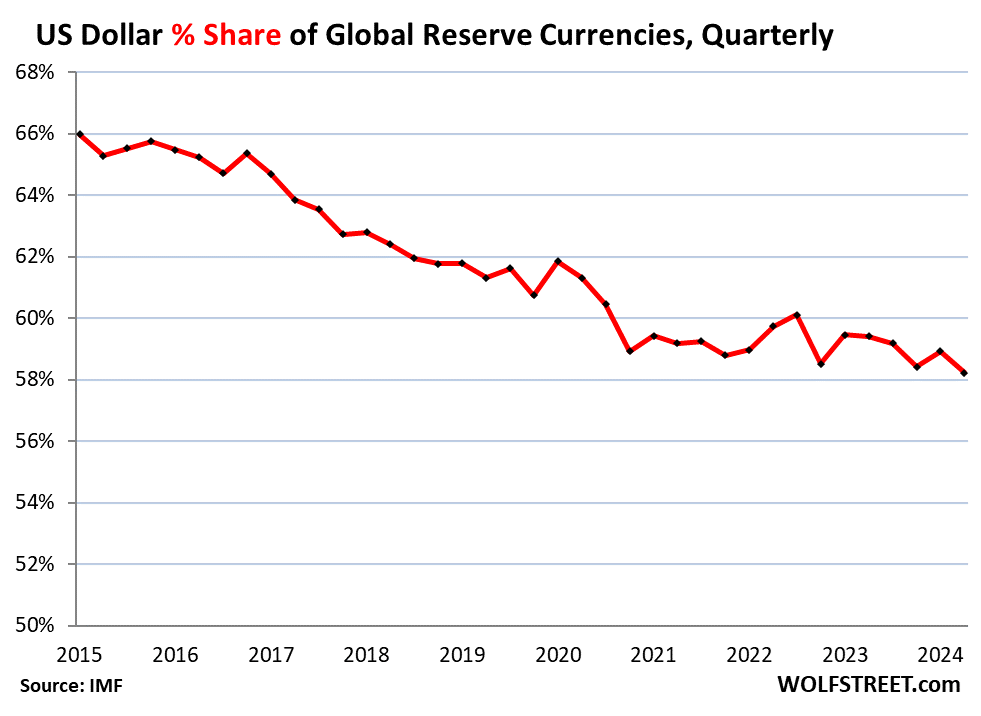

The share of USD-denominated foreign exchange reserves – assets that central banks other than the Fed hold that are denominated in USD – ticked down to 58.2% of total exchange reserves in Q2, the lowest share since 1995, according to the IMF’s new COFER data.

Over the past 10 years, the dollar’s share has dropped by about 8 percentage points, from 66% in 2015 to 58.2% in 2024 so far. If this pace continues, the dollar’s share will kiss 50% in 10 years.

By the 1990s, with inflation on decline for a decade, confidence returned, and central banks loaded up on dollar-denominated assets again, until the euro came along, which combined the major European reserve currencies into one, making it a solid alternative to the dollar.

The chart shows the share of the USD at year end except in 2024, for which we use the Q2 figure.

In dollar terms, central banks held foreign exchange reserves in all currencies of $12.35 trillion in Q2. Of this amount, holdings of USD-denominated assets dipped to $6.68 trillion.

These US-dollar denominated assets include US Treasury securities, US agency securities, US government-backed MBS, US corporate bonds, even US stocks, held by central banks other than the Fed.

Excluded are assets denominated in a central bank’s local currency, such as the Fed’s holdings of Treasury securities, and the ECB’s holdings of euro-denominated assets.

Central banks have not been “dumping” their dollar-assets – in dollar amounts, their dollar-holdings haven’t changed much and are not far off the peak in 2021. But as overall foreign exchange reserves grow, they’re taking on assets denominated in many alternative currencies, and the dollar’s share of the total declines.