by Jan Nieuwenhuijs, Money Metals:

Countries that participate in the novel cross-border payments system mBridge are each hoarding gold and are largely responsible for the bull market of the past two years.

How and when the global dollar standard will disintegrate is hard to predict, but setting up a non-dollar payments system (mBridge) and aggressively accumulating gold to replace U.S. Treasuries as the prime international reserve asset is a potent strategy to de-dollarize.

TRUTH LIVES on at https://sgtreport.tv/

mBridge: An Instant Cross-Border Payment System

MBridge is an international payments project that was launched in 2021 by the Bank for International Settlements’ (BIS) Innovation Hub in Hong Kong. Currently, there are five full members—Thailand, China, Hong Kong, Saudi Arabia, and the U.A.E.—and over 30 observing members.

The project aims to create a multi-central bank digital currency platform for participating central banks and commercial banks, built on distributed ledger technology (DLT) to enable instant cross-border payments and settlement. MBridge uses an Ethereum-compatible DLT network, the mBridge Ledger, developed by China’s Digital Currency Research Institute. Because China oversees the backbone of the technology, it’s immune to Western sanctions.

A common technical infrastructure has the potential to improve the current system and allow cross-border payments to be more efficient, immediate, and cheaper. On June 5, 2024, mBridge reached the Minimum Viable Product (MVP) stage.

A Surge in Gold Hoarding by mBridge Members

Readers who are familiar with my writings understand that the gold price is determined by global flows. Based on cross-border trade statistics, it’s clear that the East assumed dominance in the gold market starting in 2022, overtaking the West.

As stated in a previous article, formal gold import and export statistics represent private flows, but they can also reflect central bank activity. Aside from elevated peaks in private demand from China and Thailand, the Chinese and Saudi central banks (PBoC and SAMA) are largely responsible for the rally that commenced in 2022, both having vigorously stepped up gold purchases after the West froze part of Russia’s foreign exchange reserves.

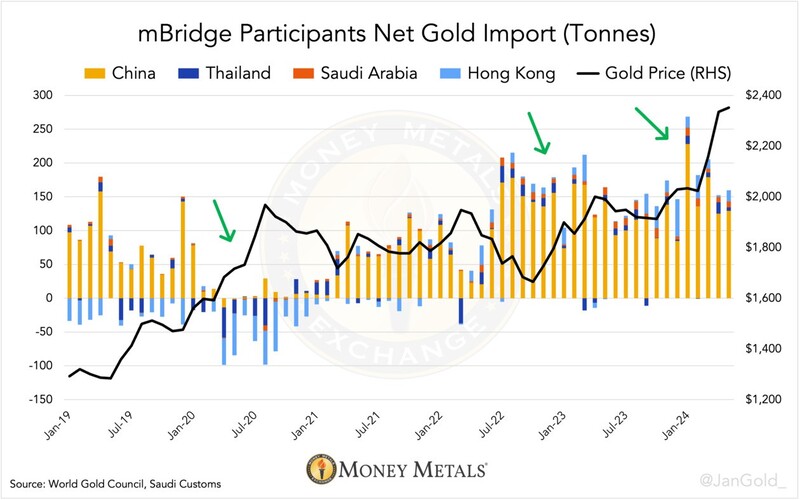

Strikingly, according to available trade data, the countries in the driver’s seat of the gold market are all full members of mBridge: China, Saudi Arabia, Thailand, and Hong Kong (see chart below). Statistics by the U.A.E. lag several years and are misleading due to smuggling to India.

Chart 1. Net gold import data through May 2024 reveals gold stockpiling amid higher prices.

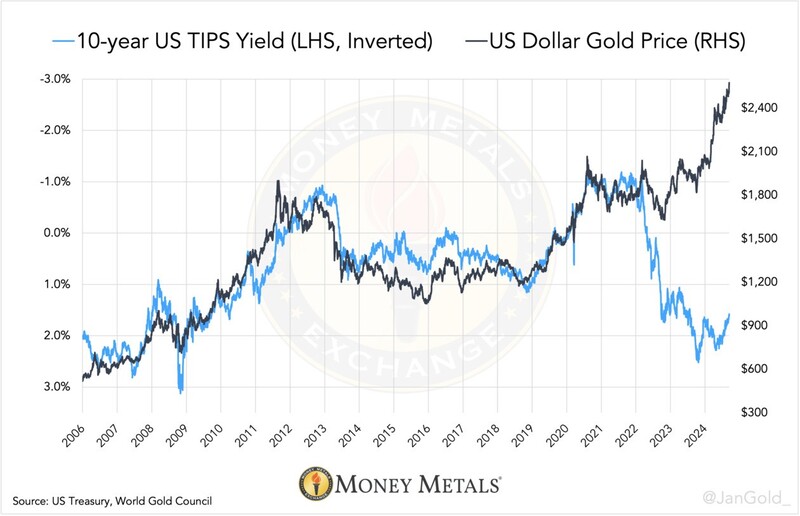

Chart 2. The Treasury Inflation Protected Security (TIPS) yield is the expected real interest rate on U.S. government bonds. Strong gold buying by the East has broken the correlation and rendered TIPS impotent.

Between China, Thailand, Saudi Arabia, and Hong Kong, it’s clear their gold stance has changed since early 2022: they’ve jettisoned their sensitivity to the price. Instead of selling into rallies, they are themselves causing those rallies as a result of strong demand.

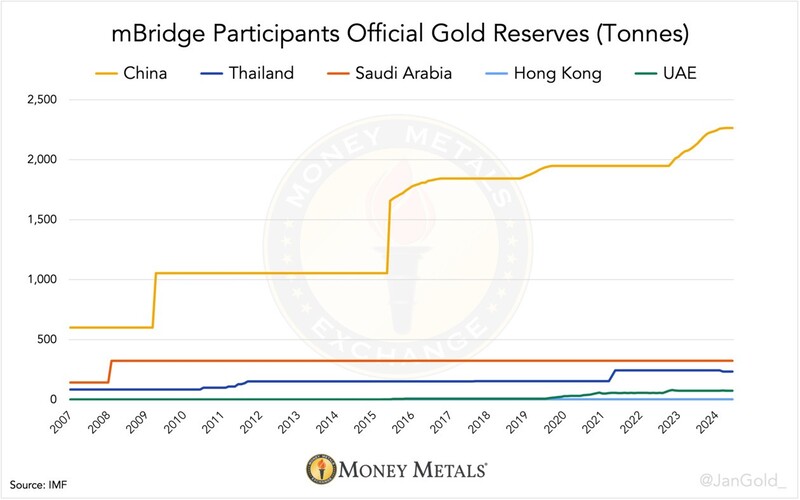

Aside from visible global gold flows, we know the official gold reserves of Thailand, the U.A.E., China, and Saudia Arabia are rising in recent years—even when excluding covert purchases by the latter two. Only Hong Kong’s monetary gold has been flat; however, it can be lumped in with Beijing since it’s a special province of China.

Chart 3. The Central Bank of Thailand has increased its reserves to 235 tonnes from 84 tonnes in 2008. In the U.A.E., official gold assets went up from zero to 75 tonnes over this time span. PBoC and SAMA gold reserves are much higher than disclosed.

mBridge Helps Facilitate a Ditching of the Dollar

The dollar is said to be the world reserve currency, which means it’s the most used currency in global trade. The lion’s share of global international reserves (owned by central banks) are held in dollar-denominated assets such as U.S. government bonds (USTs). Nations wanting to break free from the dollar need an alternative for trade and reserves.

As described above, the members of the mBridge fellowship—all running a current account surplus—have been increasing their gold reserves in recent years. This is referred to as Gold Recycling: storing trade surpluses in gold rather than USTs.