by Jon Forrest Little, Silver Seek:

REMEMBER THIS

1. Silver investors outnumber the Silver riggers. Keep this in mind when reading this article.

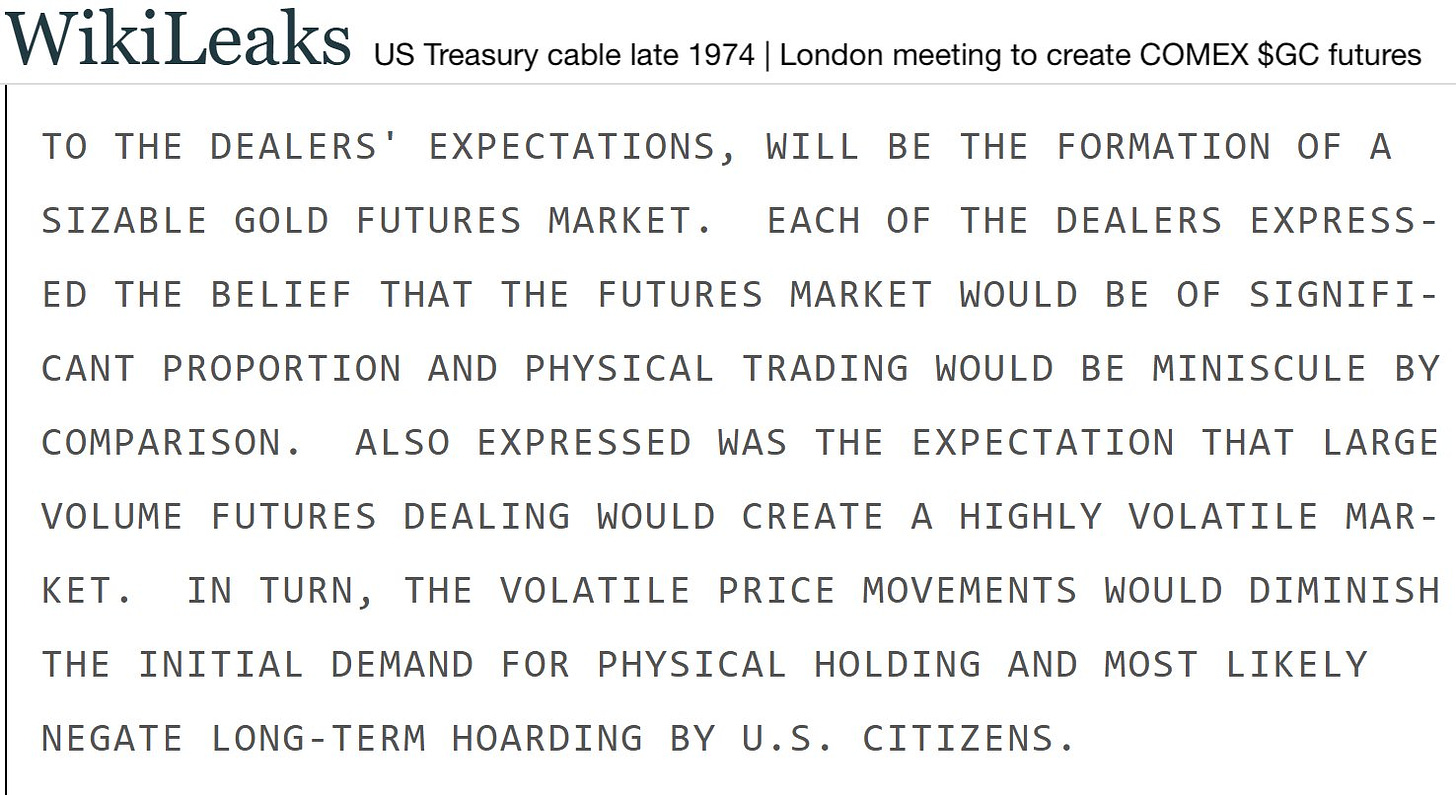

2.Keep in mind that gold futures market (and silver) was invented to demoralize Silver investors.

3. It was an intentional act to trick you into not buying silver.

If you have any competitive spirit or fight in you. This should make you want it more right?

TRUTH LIVES on at https://sgtreport.tv/

Our Main Themes

When Silver goes up, we cheer.

When Silver is under pressure, we not only cheer but also seize the opportunity of the discount. This is the silver squeeze, a testament to the working class’s resilience and their ability to challenge market norms. It’s about ordinary people taking control of their financial destiny, saying, “Be Unbanked,” “Become your own bank,” or “Fight the Fed with Silver.”

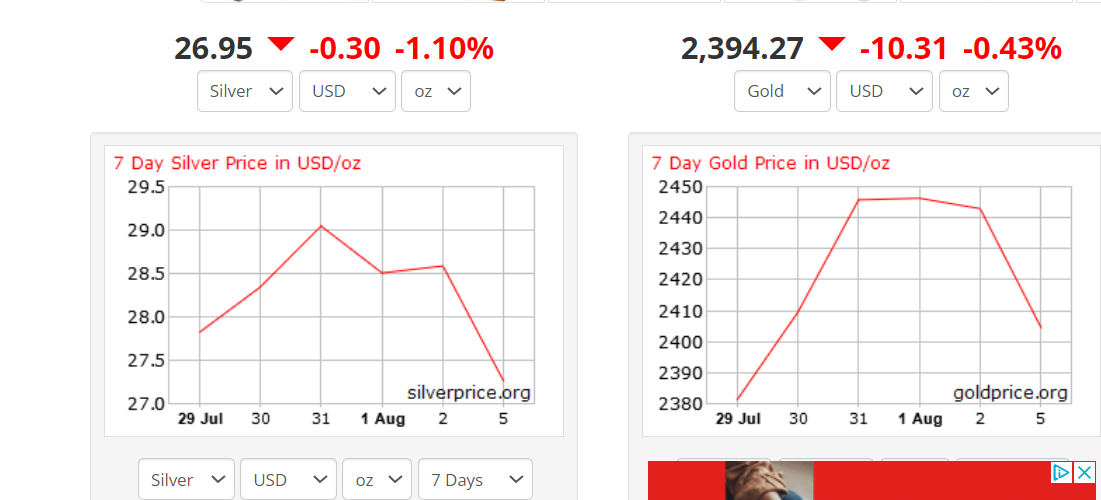

The silver price is rigged by industrialists and bankers who trade on CRIMEX on COMEX, a paper market where one year of global mining volume can be transacted in a day.

We call this the paper-to-physical ratio.

So, for every ounce of physical Silver, there are often 400 paper versions of silver futures (no one has to stand for delivery).

The military-industrial complex devoured most of the World’s Silver, as proven here (this is similar to why we have seen the Biden regime drain the Strategic Petroleum Reserve)

However, what sets Silver apart is its industrial significance. Its unique properties-ductility, malleability, reflectivity, corrosion resistance, thermal and antimicrobial properties-make it indispensable.

Notably, it’s the top-ranked metal for CONDUCTIVITY, making it a crucial component in various industries.

Silver batteries are the preferred choice in space, air, and sea operations. Their ability to hold a potent charge for extended periods, coupled with their corrosion resistance and reliability, make them indispensable. After all, you can’t just swap out a battery when you’re thousands of feet underwater or orbiting in space.

You cannot switch out a battery when a torpedo or submarine is parked thousands of feet underwater or orbiting in space.

You can review our past archives (over 20 articles) to learn why the Department of Defense stopped reporting their silver use, drained the strategic stockpiles, and closed The US Bureau of Mines to cover up the entire scheme. (once is happenstance, twice a coincidence, third instance A PATTERN)

You can also learn about the USGS scam and the worthless template the Silver Institute and Metals Focus use to confuse investors.

It’s also worth your time to research the Wikileaks cable, in which “inventors of the Silver futures trade” intentionally introduced volatility to demoralize investors and discourage silver investors from holding.

Silver was removed from coins because the military needed it, while the US Treasury and Federal Reserve had to debase the currency to fulfill their obligatory and historical role as Fiat overlords (with a monopoly on the money supply), infecting the villagers with inflation.

So it’s like the Military Industrial sword cutting twice, it cuts on one side stealing Silver from the people, then cuts again to infect the villagers with inflation (the paper money paying for 251 wars since 1991)

Many of these events happened decades ago, and since then, the supply-demand dynamics have intensified in favor of silver investors. This intensification underscores the urgent need for immediate action in the silver market.

Witness CONFIRMS families of politicians are financially benefiting from leasing buildings to the Federal Government

Witness CONFIRMS families of politicians are financially benefiting from leasing buildings to the Federal Government