by Pam Martens and Russ Martens, Wall St On Parade:

Last year, the staff of a federally-insured bank in Kansas, Heartland Tri-State Bank, wired out more than one-third of the amount the bank held in deposits to a crypto scam. Why did they do that? Because the CEO of the bank, Shan Hanes, told them to do it. Hanes had become one more crypto sucker seduced by the allure of a get-rich-quick scheme.

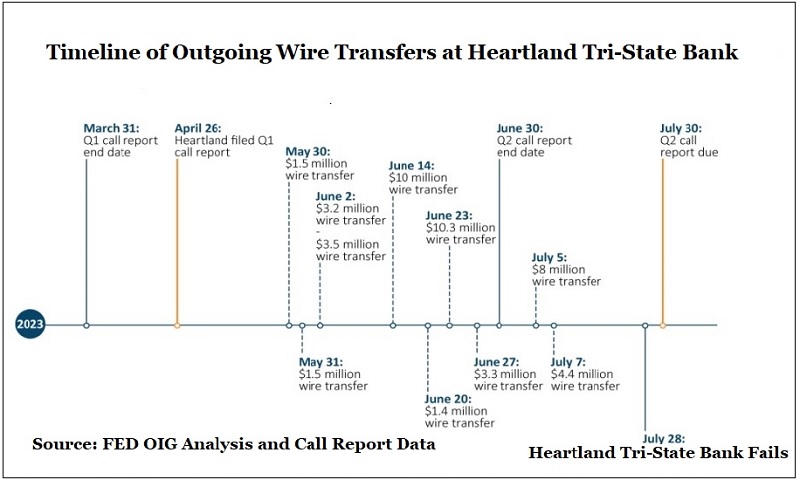

On Monday, Hanes was sentenced in a case brought by the U.S. Department of Justice to 24 years in prison for embezzling $47.1 million (via the wire transfers shown in the graph above) from the bank he was in charge of protecting. The bank failed last July with the Federal Deposit Insurance Corporation (FDIC) stepping in to make depositors whole while the investors in the bank (shareholders) were wiped out.

TRUTH LIVES on at https://sgtreport.tv/

There’s an old saying on Wall Street: “Bulls make money, bears make money, pigs get slaughtered.” The premise is that if a person becomes too greedy (a “pig”), he or she loses the ability to make prudent judgment calls and gets slaughtered.

Exactly one year before Heartland Tri-State Bank failed, Wall Street On Parade wrote about getting “pig butchered” – slang for getting scammed out of your money by crypto con artists. Unfortunately for the shareholders of Heartland Tri-State Bank, its prison-bound former CEO didn’t read our article. Prosecutors say he became the target of a pig-butchering crypto scam which led him into the embezzlement scheme at his bank.

In addition to the federal charges on which Hanes was just sentenced, he also faces 29 state criminal charges, some of which relate to his looting the accounts of the local church and an investment club as part of his wiring binge to the crypto scam artists. A trial in that case is scheduled for October.

What is most noteworthy about this small bank going bust is that the way it was brought down could be happening, at this very moment, at much larger banks anywhere in this country.

The Office of Inspector General of the Federal Reserve released a 27-page investigative report, detailing how the scam was facilitated inside the bank. The investigators wrote:

“The CEO’s wire requests were inconsistent with both Heartland’s prior and recently implemented wire transfer limits and appeared to be unusual given the bank’s agricultural lending business. The wire requests included the name and account numbers of a cryptocurrency platform. Three of the seven wire transfer requests processed before June 24 exceeded the applicable $5 million limit. These requests exceeded the $5 million applicable limit by $1.7 million to $5.3 million per sender. All three of the wires processed after the implementation of the wire policy on June 24 exceeded the new $3 million limit. Those wires exceeded the limit by $300,000 to $5 million per sender. Despite the atypical recipient and the dollar amounts of each transfer significantly departing from prior wire activity and established limits, Heartland’s chief financial officer (CFO) and other bank employees approved the wire transfers. We believe that had Heartland employees followed the bank’s policies, they would have not processed the wires that led to the bank’s failure.”

Federal banking regulators and Congress are just as responsible as the acquiescing employees inside the bank for yet another bank failure related to crypto. The voluntary liquidation of Silvergate Bank last year and the failure of Signature Bank during last year’s spring bank runs were both tied to the banks’ involvement with the crypto industry.

Read More @ WallStOnParade.com