by Jon Forrest Little, Silver Seek:

Presenting Problem: What Silver Price Manipulation Looks Like (30-minute snapshot)

- 23,600,000 oz paper SILVER traded in 15mins did the damage. (see the screenshot where the volume is concentrated in 15 15-minute time window)

- Each contract is 5,000 ounces of Silver

- 4,720 x 5,000 = 23,600,000 ounces

- This gives the illusion that Silver is selling off but no physical silver is exchanged

TRUTH LIVES on at https://sgtreport.tv/

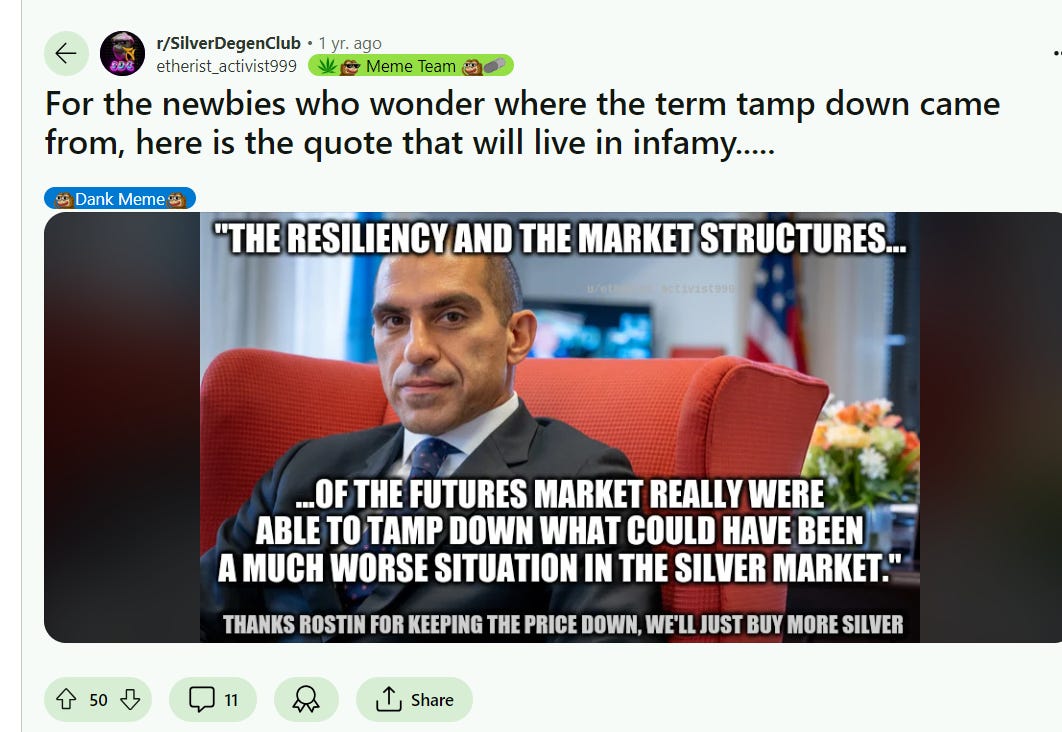

Reddit Apes call this:

- A Tamp Dance or

- Tamppety Tamppety

- Tamp Me Harder Daddy

- Tampy Tamp Tamparoo

- or Mr. Slammy

Silver Stackers believe the following:

When the price goes up (we’re happy)

When the price goes down (we buy more because it’s on sale)

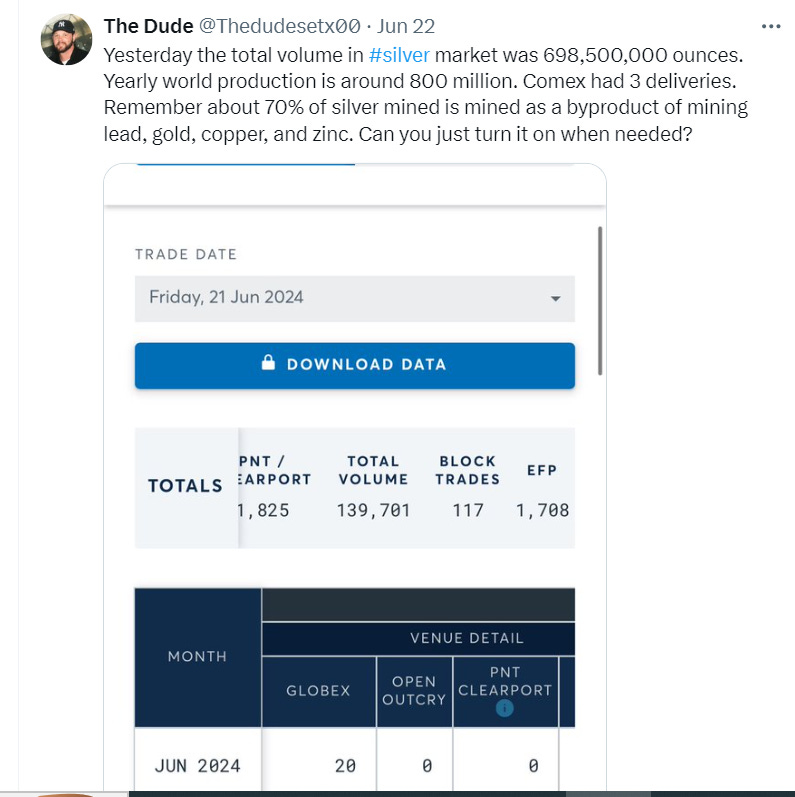

Let’s break this tweet:

- A very typical day in Comex.

- Paper transactions 698.5 Million ounces.

- Remember that annual mining is around 800 million ounces.

- The Dude’s astute observation that 70% of silver mined is a by-product of extracting lead, zinc, copper, and gold. (indicating all the work in exploration, testing, mining, processing, sorting, refining, minting)

- You can’t just flip on a light switch and expect Silver to show up

What does this have to do with Julian Assange?

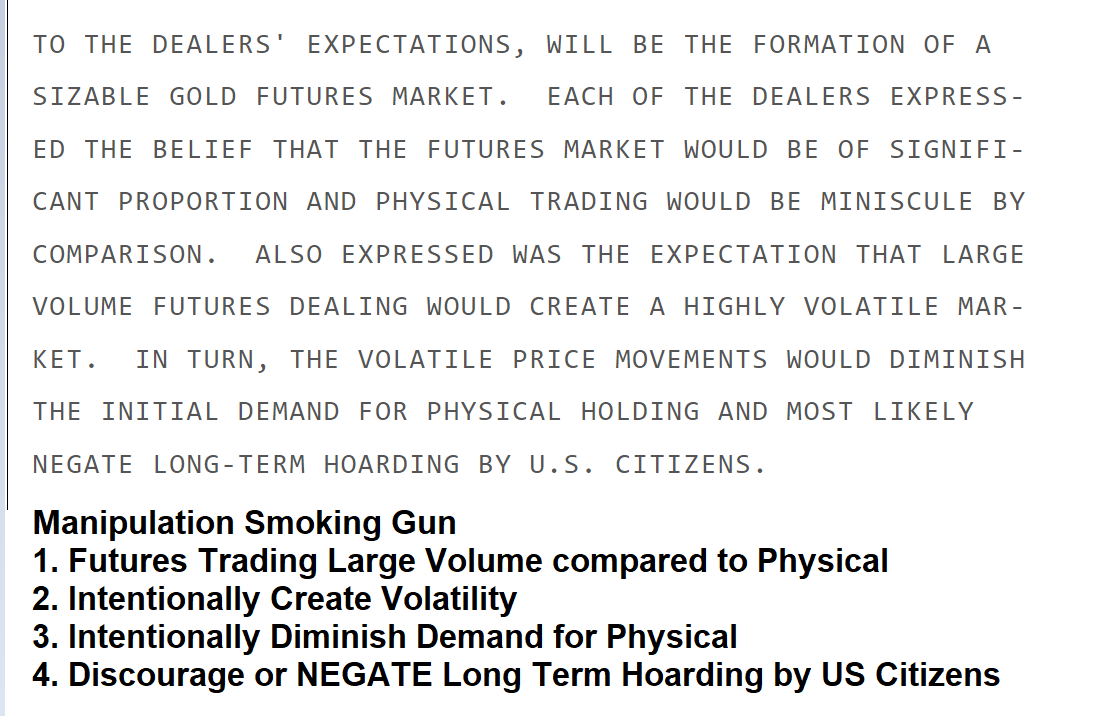

Source: WikiLeaks 1974 Fractional reserve Future’s Exchange

Motive: By Allowing Naked Shorts and Paper Transactions where no delivery takes place this 1.) Deters the public’s physical bullion demand. 2.) Negates long-term enthusiasm or “Hoarding” by US Citizens. 3.) Intentionally creates volatility. 4.) Admission that paper trades would overwhelm less than 1% of physical deliveries

WikiLeaks Source Link: https://wikileaks.org/plusd/cables/1974LONDON16154_b.html (See section 4)

Commodity prices are managed by selling a “virtual” representation of the commodity. Need to drop the price? Then sell more virtual silver (SLV). Need to raise the price? Let the constant natural heavy global hoarding demand take the stock price up.

But if you are in the inside club like Jeff Christian or The Silver Institute and you know tomorrow’s newspaper today then you make money walking it up and down and they’ve been doing this for the past 30 years.