by Peter Schiff, Schiff Gold:

French markets have found some relief after the first round of its latest election, with stocks recovering somewhat and bond yields falling after reaching a 12-year high. But no matter which side wins in France, the market is afraid that an increase in unsustainable spending could be the common denominator.

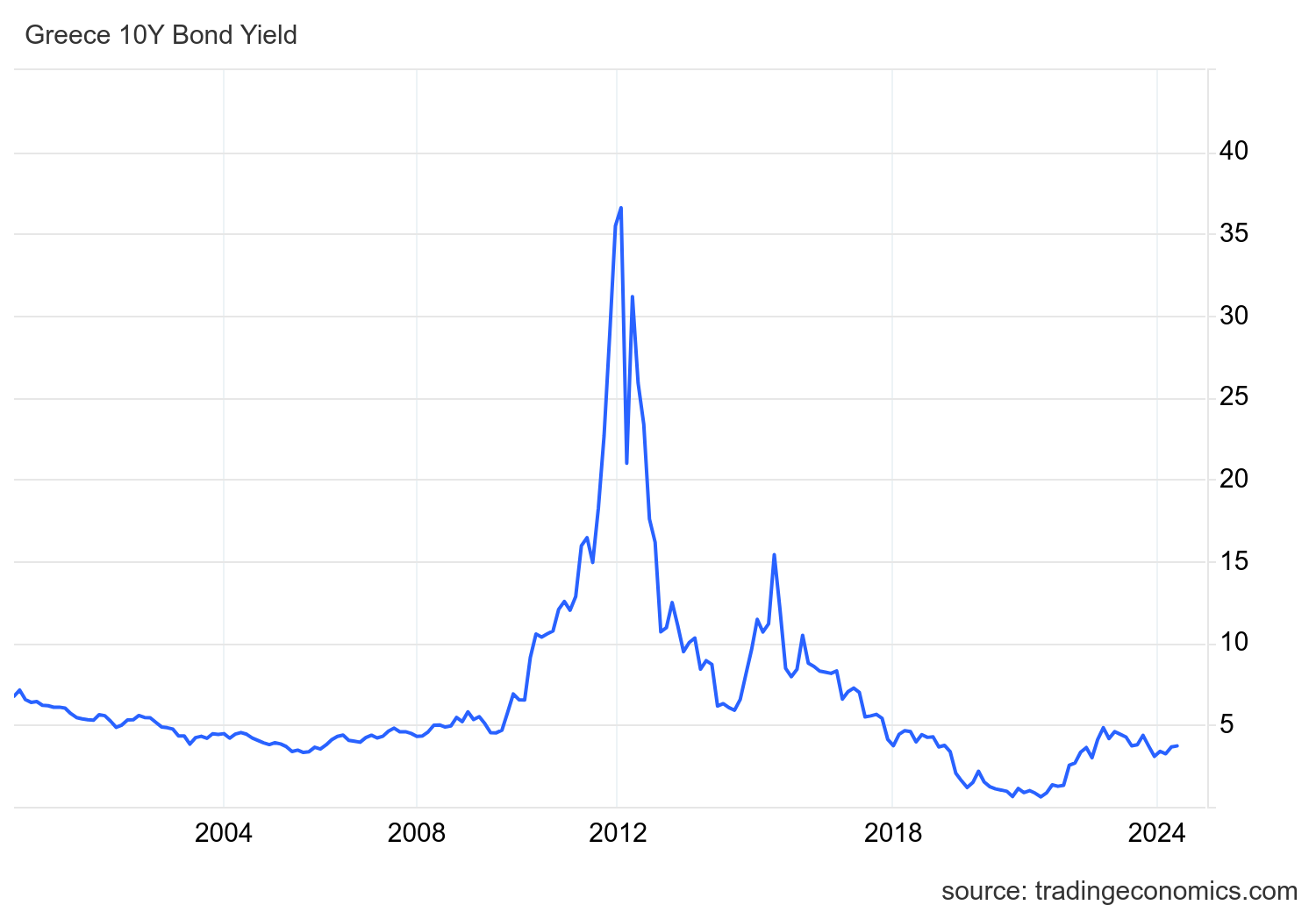

Greece’s sovereign debt crisis after the global 2008 implosion was characterized by an excessively high debt-to-GDP ratio, budget deficits, low growth, and an over-reliance on revenues from the tourism industry. Now, whispers abound in the Eurozone that in France, a similar crisis could be on the horizon.

TRUTH LIVES on at https://sgtreport.tv/

With its entry into the Eurozone, Greece’s central bank lost much of its ability to kick the can down the road by printing money. Long and short-term bond yields skyrocketed as the value of Greek debt plunged and bond investors fled to greener pastures. Greece’s 2015 default to the IMF totaled €1.6 billion.

France’s debt-to-GDP skyrocketed during COVID-19, and after etching downwards, it’s now trending back up and is expected to exceed COVID levels within a few years. The French economy is unsure of how to react to the policy promises of the left or the right, so whispers of a potential debt crisis have far from stopped just because volatile French markets are experiencing a momentary breath of relief.

Eyes are on the yield spread between France and Germany. Yields for “safe haven” German bonds have become the Eurozone benchmark, so the difference between German yields and those of other countries has become an indicator of the relative risk tolerance for investors in European government debt. Both France and Belgium were once considered low-risk “core” nations among European economies, but that narrative is now changing as the problem of overspending is recognized across what were once regarded as economically stable countries.

Meanwhile, the US has many of the same problems — raging deficits, low growth, rising debt-to-GDP ratio, and high inflation. The US also has more tricks to kick the can down the road, but few options for truly fixing the problem.

Source

Source