by David Haggith, Gold Seek:

Recently some interesting news in the banking sector. To start off with, Goldman Sachs failed its stress test last week. In addition to GS, the Fed’s Dodd-Frank stress test revealed problems in other banks as well. The Fed noted that its staff does try to work with the banks to make adjustments to the test. So, I would add, that if a bank can’t even pass the adjusted test, it must be in poor shape, should times become stressful.

Says one risk analyst who wrote about the failure in the links below:

Given the clear conflict by the Fed staff in Washington, the stress test results for GS are rather alarming. This is the test result for Goldman that the Fed assigned after the private consultations and hand-holding with Board staff?

TRUTH LIVES on at https://sgtreport.tv/

Well, maybe Goldman can be our next ivy-league Bear-Stearns or Lehman surprise. Wouldn’t that be fun?

You can read all the detail in the highlighted article below, but here’s a summary of the author’s concerns:

Just by coincidence, Stephen Gandel and Joshua Franklin of the FT wrote an important piece last week reporting on the results for Goldman Sachs. They suggest that the bank is attempting to change the Fed stress test results. “Goldman Sachs faces long odds in getting the Federal Reserve to reconsider its disappointing grade in this year’s bank stress tests, according to regulatory experts,” they relate.

We reminded readers in our last missive … that GS continues to have the worst credit performance of the group. We regret to say that the Fed test results confirm our view and more. If you page through the individual bank stress test results, you will see that GS is clearly the outlier in the group in terms of assumed credit and counterparty risk losses through to Q1 2026.

The article provides much more granular detail. Don’t worry about poor Goldman, though, they have plenty of well-appointed friends in congress to ream Powell out this week at his congressional meeting and press him to back off so that Goldman can pass with a D-. Today’s world of politicians always pray that God forbid the truth be known about the incompetency of presidents … or major banks. It’s better, they think, that we all live believing everything is fine.

The next article up says,

Regional bank failures have started again.

And … there goes “everything fine.” First Foundation is crumbling due to its poor footing in commercial real estate. In fact, its shares plunged a whopping 24% last Wednesday because it reported an unexpected need to raise almost a quarter of a billion in capital. Smaller regional banks heavily exposed to CRE are, of course, the ones I’ve been saying are most likely to fail, just as we saw a year ago last spring.

It’s the same ol’ news I’ve been sharing all along:

The announcement illustrated the struggles of banks with large exposure to commercial real estate as the Federal Reserve’s aggressive interest rate hikes and lower occupancies due to a shift in office work patterns trigger default fears.

Taking Stock

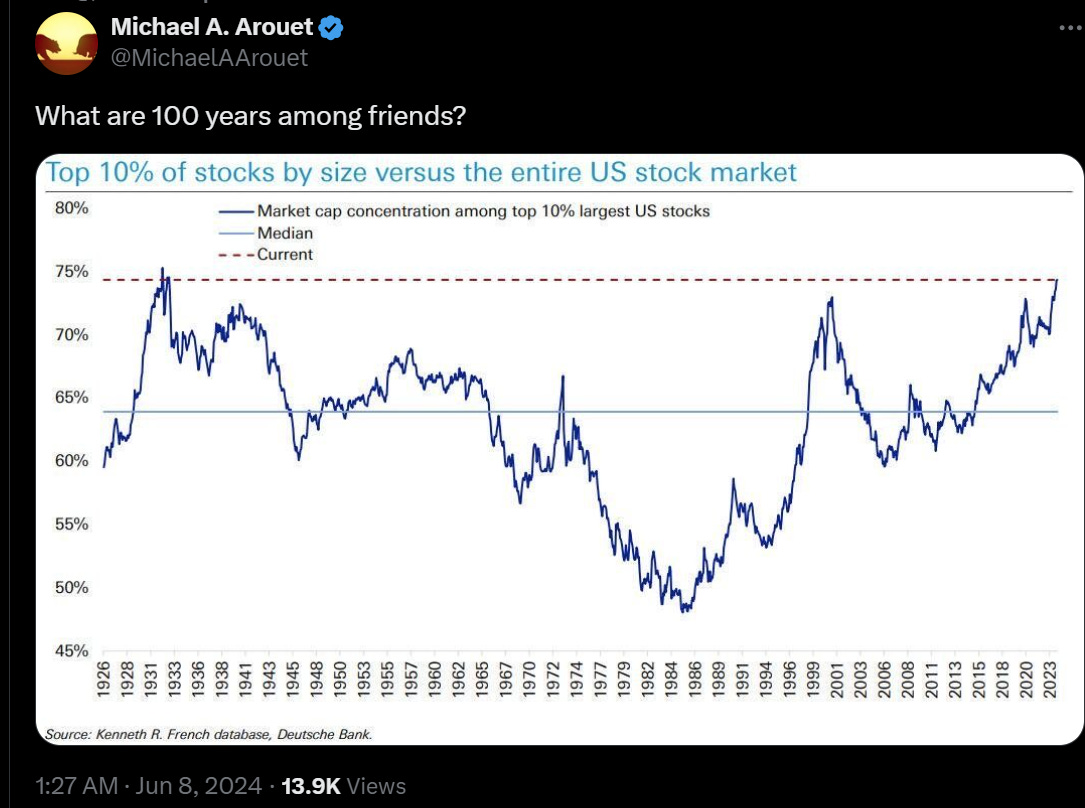

There is also an interesting interview in Quoth the Raven about how imminently and hard the stock market is about to crash, according to an investor who is taking his fund deep in shorting. He gives his reason why he thinks his loooong short is still the right move to make money, even though he’s been feeding it for some time. He notes, among many points, that the market has only twice before looked this extremely out of balance: