by Shane Trejo, Big League Politics:

As the BRICS nations move away from the U.S. dollar, renowned investor Robert Kiyosaki predicts that the United States will experience hyperinflation and plunge into a depression. He suggests that gold, Bitcoin, and tangible assets will be the only valuable investments.

TRUTH LIVES on at https://sgtreport.tv/

https://twitter.com/theRealKiyosaki/status/1789654937515053256

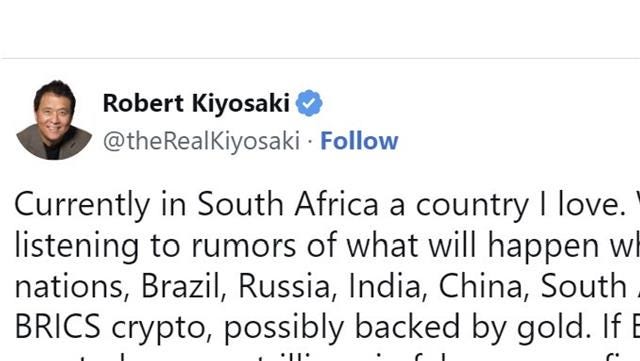

Kiyosaki shared his views on gold, fiat currencies, and Bitcoin from South Africa on Sunday. He mentioned rumors about the possible creation of a BRICS crypto, potentially backed by gold, which could lead to trillions of dollars returning to the U.S., resulting in hyperinflation.

Currently in South Africa a country I love. Watching and listening to rumors of what will happen when BRICS nations, Brazil, Russia, India, China, South Africa produce BRICS crypto, possibly backed by gold. If BRICS gold crypto happens trillions in fake money, fiat US dollars will come rushing back to home to America causing hyperinflation in America, ultimately destroying US dollar. Best Buy real gold, silver, and Bitcoin now, and protect yourself from the crash of US dollar.

To protect against the U.S. dollar’s collapse, Kiyosaki advised purchasing physical gold, silver, and Bitcoin. In a May 9 post, he predicted not just a recession, but a full-blown depression, stating that he is preparing for such a scenario despite not wishing for it.

https://twitter.com/theRealKiyosaki/status/1788496134870319602

Jonathan Rose, CEO of Genesis Gold Group, reiterated Kiyosaki’s warning based on reports he’s hearing in the United States.

“If the BRICS threat was the only warning sign, it’s still enough to be concerned,” Rose said. “Unfortunately, we’re seeing other indicators that back Robert’s assertions about precious metals and crypto.”

Before founding Genesis Gold Group, Rose worked in the crypto industry but returned to precious metals for one big reason.

“As much as I appreciate the decentralized nature of Bitcoin, I am always concerned about too much being tied into any asset that isn’t physical,” he said. “Between our Genesis Gold IRA that stores physical precious metals to back our clients’ retirement to having gold and silver stored in their safes through cash purchases, I’m far more comfortable with the tangible assets than I was with crypto.”

Read More @ BigLeaguePolitics.com