by Ronan Manly, BullionStar:

When the words ‘Zimbabwe’ and ‘currencies’ are mentioned in the same sentence, many people will bring to mind the chronic hyperinflation period that Zimbabwe experienced from the early 2000s to 2009, and the infamous 100 trillion Zimbabwean dollar note which Zimbabwe’s central bank issued in a desperate attempt to cope with that hyperinflation.

That hyperinflationary period – which included Zimbabwe’s inflation rate peaking at an astronomical 89.7 sextillion percent in November 2008 – was only brought under control when the country abandoned the then Zimbabwean dollar in 2009 and moved to a multi-currency system of officially using the US dollar and other foreign currencies, a move which stabilised Zimbabwe’s inflation rates at more ‘normal’ levels between the years 2010 and 2018.

TRUTH LIVES on at https://sgtreport.tv/

But then in 2019, Zimbabwe introduced a new Zimbabwean dollar (ZWL), banned the use of foreign currencies, and began rampant ‘printing’ of the ZWL, a move which again torpedoed confidence in the country’s currency, destabilised the economy, and created spiralling levels of inflation from 2019 onwards, despite the backtracking reintroduction of foreign currencies such as the US dollar, as legal tender.

Backed by a Basket of FX Reserves and Gold

Which is why it’s very interesting that in early April 2024, Zimbabwe launched yet another new circulating currency as legal tender, its sixth attempt at creating a new currency since 2008, and the latest attempt to stabilise Zimbabwe’s economy and take control of a persistent inflation which in March 2024 had reached an annual rate of 55%.

However, this new currency, which is called the ZiG and which is issued in the form of circulating notes and coins, is quite different from preceeding currency attempts, as it bills itself as a gold-backed currency.

While colloquially being called a gold-backed currency, the new ZiG (which stands for Zimbabwe Gold) is more correctly, according to the legislation which launched it, a currency “backed by a basket of foreign currency reserves and precious metals (mainly gold) and valuable minerals held and maintained by the Reserve Bank [of Zimbabwe] in its vaults as part of the in-kind royalties.”

The ZiG is also known as a “structured” currency, which merely means that that it is backed or anchored by a basket of foreign exchange and gold, and linked to an exchange rate connected to the value of the backing. Under the rules of the ZiG, the Reserve Bank of Zimbabwe (RBZ) can only issue ZiG notes and coins against the value of the reserves assets which the central bank holds (foreign currency reserves and gold / precious metals held in its vaults).

At launch date on 5 April 2024, Zimbabwe’s commercial banks were required to convert all existing Zimbabwe dollar balances into the new ZiG currency, and as of that date, the ZiG became Zimbabwe’s legal tender (alongside the US dollar and other foreign currencies such as the South African rand, the Euro, and the pound sterling). Note that as of early April, the US dollar still accounted for about 85% of all transactions in Zimbabwe.

Currently, ZiG notes have been issued in denominations of 1, 2, 5, 10, 20. 50, 100 and 200 ZiG. On conversion date (5 April), 1 ZiG was deemed to have an equivalent value of 1 milligram of 99% pure gold valued at the spot price of gold on that day. The actual conversion (when banks converted all old ZWL account balances to ZiG) was done at the rate of ZiG 1 = ZW$ 2498.72 (ZWL).

Doing a quick spot check, 1 gram of gold at the close price on 5 April was US$ 74.91, and 1 milligram was US$ 0.07491, and the ZWL/USD rate was about 30530 ZWL for 1 US dollar, so this gives a conversion rate of (0.07491 * 0.99 * 30530) = 2264, which is pretty near the rate the bank used (and the FX rate was notoriously volatile during that time anyway).

With 1 Zig = (0.07491 * 0.99 = 0.0741609), that meant that 1 US dollar = ZIG 13.48. This is very near the ZiG 13.56 per US dollar quoted by Bloomberg in an article covering the subject on 5 April. But whatever way you look at it, you can see that at launch date, the value of the ZiG was connected to the gold price.

Going forward, the value of the ZiG is defined as “the inflation differential between ZiG and US dollar inflation rates, and the movement in the price of the basket of precious metals (mainly gold) and valuable minerals held as reserves by the Reserve Bank.” Again, the ongoing value of the ZiG is (at least in theory), related to the gold price.

Onshore and Offshore Gold

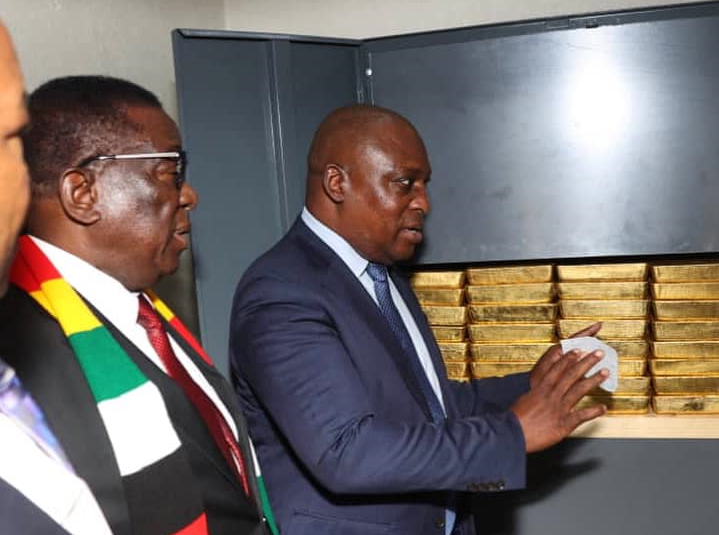

The RBZ claims, as of 5 April, to have held “reserve assets of USD 100 million in cash and 2,522 kgs of Gold (US$185 million)”, i.e. in total worth US$ 285 million. This US$ 285 million, said the RBZ, was more than 3 times cover for the total value of all ZiG currency which was converted and in issue at that time.