by Brandon Smith, Alt Market:

In light of the recent resurgence of inflation on top of increasingly rigged employments stats, declining manufacturing and stagnant wages I think it’s important to revisit a fundamental question: What does an economic collapse look like?

As I have said for years an economic collapse is NOT an event, it’s a process. When people think of a historic crisis they usually imagine something like the stock market crash of 1929 at the beginning of the Great Depression. However, there were numerous indicators and warning signs leading up to that crash that should have tipped people off. There were even a handful of economists that voiced concerns about impending instability, yet they were ignored.

TRUTH LIVES on at https://sgtreport.tv/

Then, after the crash occurred numerous establishment economists denied that the system was in any real danger. They continually claimed that recovery was “right around the corner”, but the recovery never materialized. Instead, the crash spiraled onward for over a decade until world war erupted, largely because the Federal Reserve raised interest rates into economic weakness (a disaster they have openly admitted to causing and a policy they are instituting right now).

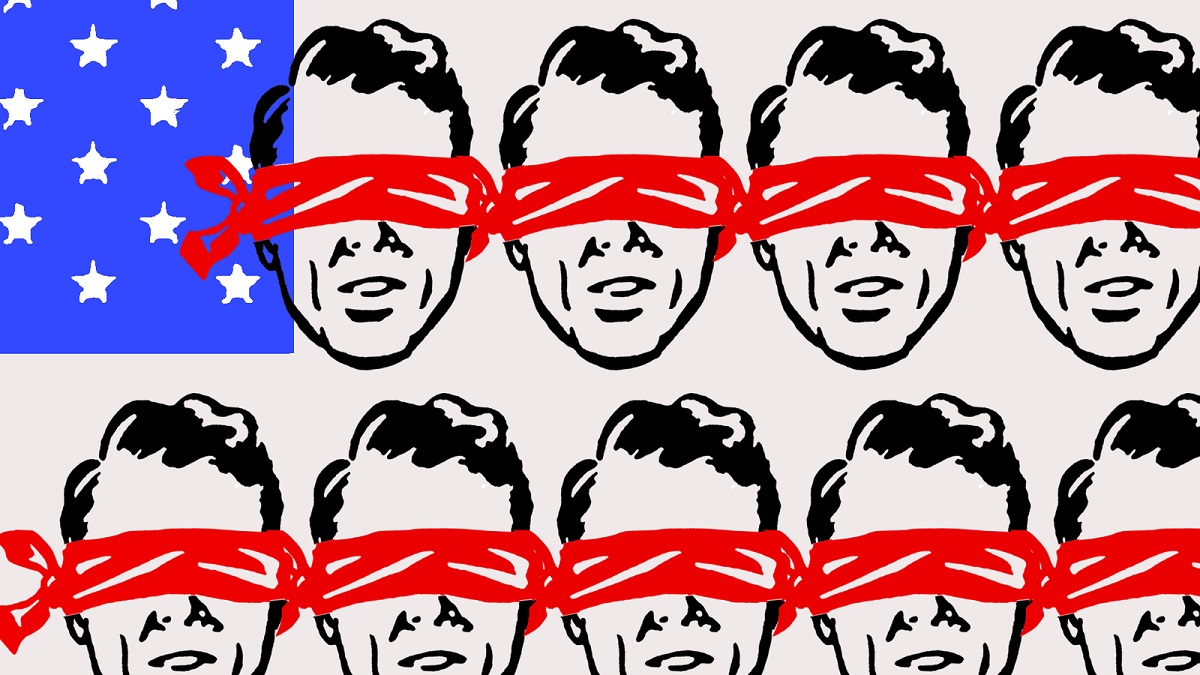

The point is, the mainstream “experts” are almost always wrong. The skeptics of collapse either ignore the evidence or they don’t comprehend the implications of events. They don’t want to believe that the economy is broken and that consequences are possible. They operate from the limited view of their own personal experience. For most of their lives the system has functioned without catastrophe so that must mean catastrophe is impossible. In truth, catastrophe has merely been deferred to a later date, not prevented.

Our present day predicament has not reached Great Depression levels yet. We are currently in a stagflationary phase similar to what happened in the 1970s. For those that think we have it bad now, the 70s were actually far worse.

House prices nearly TRIPLED from 1970 to 1980 (the median house price was $17,000 in 1970 compared to almost $50,000 in 1980). Annual inflation on most goods and services was in the double digits and the minimum wage was only $1.45 an hour. Unemployment was high and interest rates were eventually hiked to around 20% by 1981.

The point is that these breakdowns in financial structures happen slowly, and then all at once. Much like the build up of an avalanche. For those that know history the signs are easy to see. For those that don’t, they’ll assume that all is well even when the house is burning down around them.

Another factor that makes people oblivious to the danger is the moving of goalposts; they get used to poor economic conditions and the decline is entrenched as the “new normal.” For example, in 2015 the average house rental was $1100. Less than ten years later the average cost is $2150; that’s double the financial burden. But today this price is considered par for the course.

Nothing gets better, the situation only ever gets worse, but since it happens over a period of many years (the process of collapse) the public largely accepts it and will even accuse those of us sounding the alarm of “doom mongering.”

As with any collapse there eventually comes a point of popular intolerance – That moment where people finally realize that the “doom mongers” were right all along and that the weight of the implosion is too much to refute. I believe we’re approaching that moment very quickly. In the meantime. Here are the five stages of denial that people go through before they admit that a fiscal calamity is upon them…

Stage 1: “I Don’t Know What The Conspiracy Theorists Are Talking About – I’m Doing Fine”

There’s an old saying from the Great Depression that goes something like this: “It’s only a depression for the people without jobs.”

If you weren’t a part of the 30% unemployed in the US at that time, then in your narrow world the Great Depression might not have seemed all that bad. In other words, people will ignore the sinking of the Titanic as long as they still have their own lifeboat.

I will say that this is a major problem in the midst of the stagflation crisis today, and it’s the root of what many Zennials are complaining about. In their minds, this is the worst economy in history of the world and they blame “boomers” for their pain. It’s really not (at least not yet), but it’s true that many “boomers” are going into the crisis with the advantage of time. They have had the time to build a lifeboat while Zennials have not.

It’s not about what’s fair, there’s no such thing as “fair” in economics. But older Americans need to realize that even if stagflation is not a crisis for them personally, it is indeed a crisis for younger people in particular. Any person still denying the reality of the collapse because “they’re doing fine” needs to shut up and take stock of the bigger picture.

Stage 2: “They’ve Been Talking About Collapse For Years And We’re Still Here”

A lot of people out there have childish notions of what a collapse is, mostly derived from Hollywood films and television. They imagine stock market mayhem, endless soup lines, mass starvation and even Mad Max-style destruction. When these kinds of things do happen it’s always at the END of the collapse process, not at the beginning. The former nation of Yugoslavia suffered through multiple inflation events before it finally exploded with balkanization and war. It didn’t happen overnight, but all the signs were there.