by Brien Lundin, Silver Seek:

Gold steals most of the headlines, but silver has stealthily set itself up for a potential run to $40.

After nearly 40 years in this business, I’ve read, listened to, watched, and talked with countless thousands of very smart people.

I was reminded of the value offered by the best analysts when I started noticing a number of people posting a chart of the silver price and how it’s setting up for a big breakout.

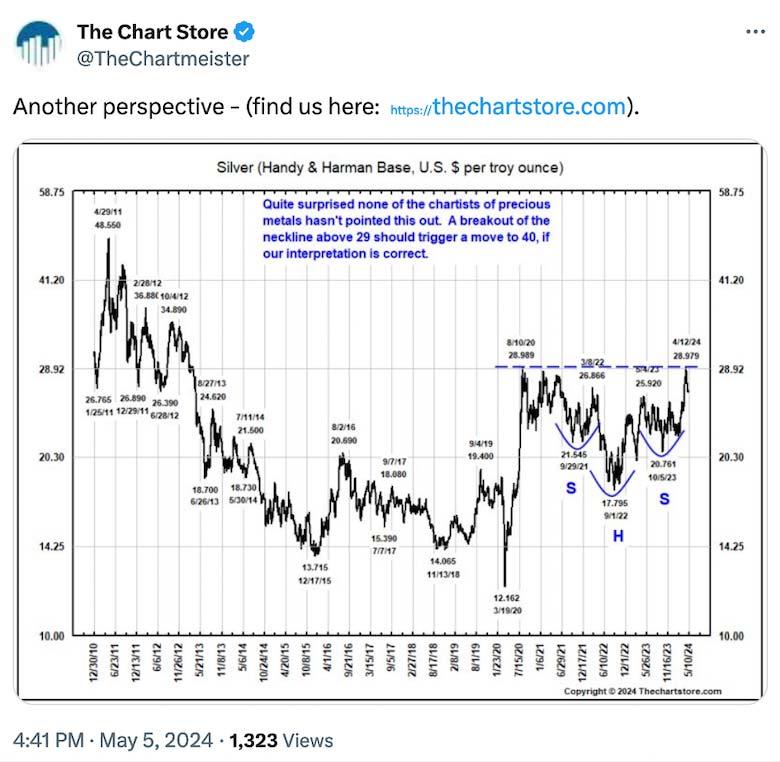

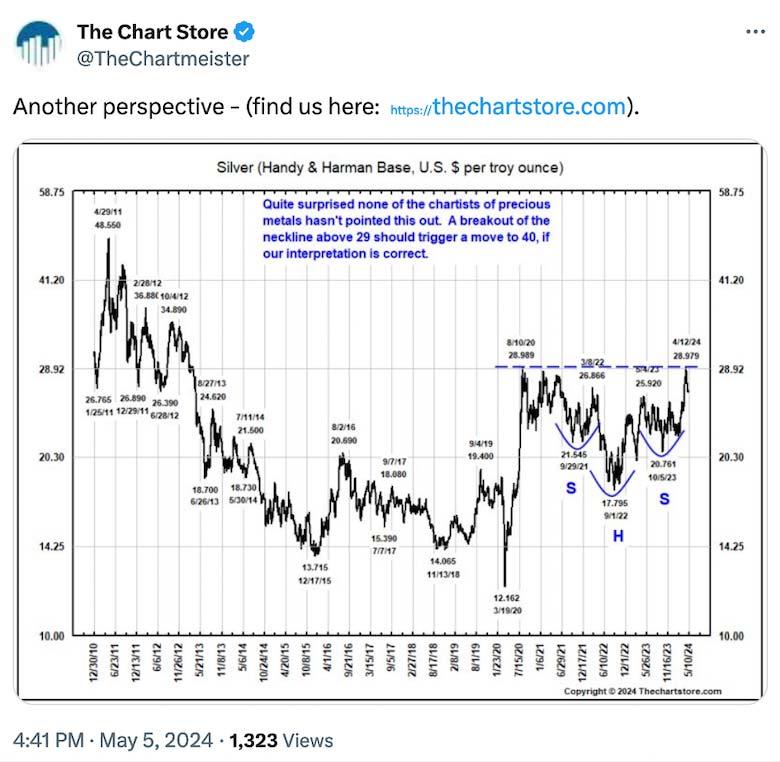

In fact, this chart and market observation was originally posted by Ron Griess of TheChartStore.com:

TRUTH LIVES on at https://sgtreport.tv/

As you can see, silver has essentially completed a reverse head-and-shoulders pattern that projects to a price of over $40.

While many others are now talking about this, it’s important to give credit where credit is due, because that tells us who we need to listen to going forward.

Ron and his service are among those, which is why I’ve relied on his observations for over a quarter century.

This particular note on silver is important because the metal has been trading very strongly since Ron posted that chart:

As I write, gold is trading lower, yet silver is up. You can see by this chart of the gold/silver ratio that silver has in fact been outperforming gold in recent days:

Silver’s outperformance hasn’t been limited to the last few days. Generally speaking, and counter to what most believe, silver has been leveraging gold’s gains since this rally began on March 1st.

Also note that over this period, the gold/silver ratio fell through both the 50-day and 200-day moving averages and that the 50-DMA is poised to fall through the 200-DMA. While the track record of so-called “death crosses” is mixed, this is yet another indication that silver could continue outperforming gold in the days ahead.

So “Hi ho silver, away!”