by Ronan Manly, BullionStar:

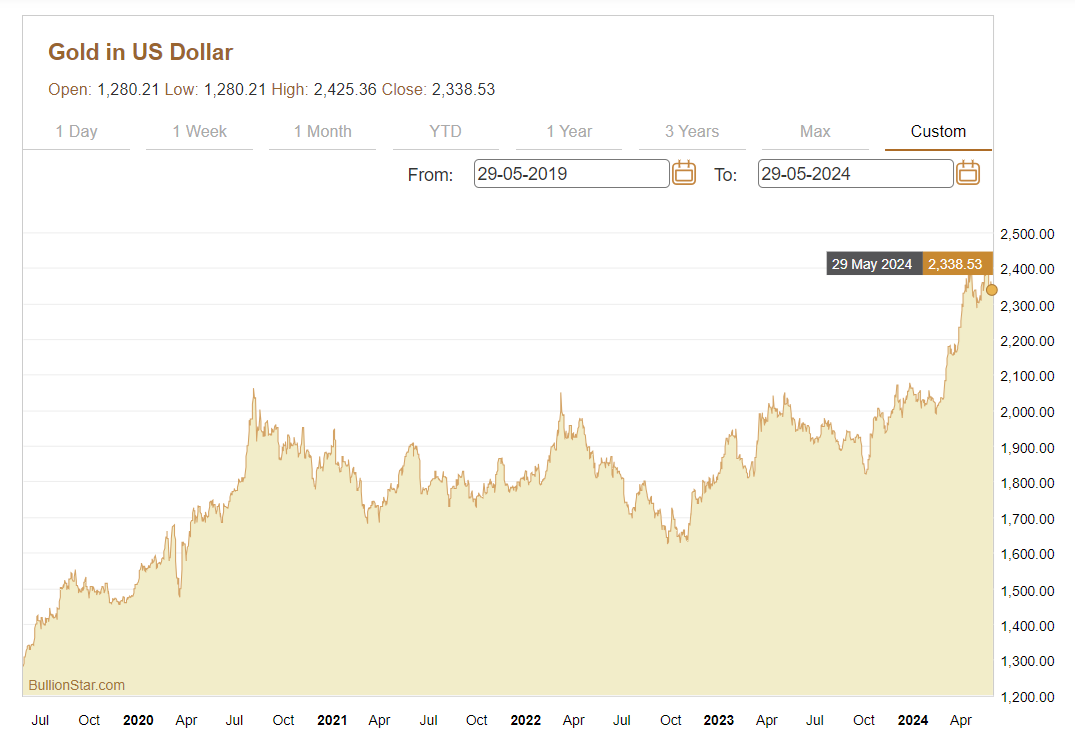

As we approach mid-year 2024 in the environment of an all-time high US dollar gold price, its notable that central bank gold buying continues to be one of the main themes dominating gold market discussion.

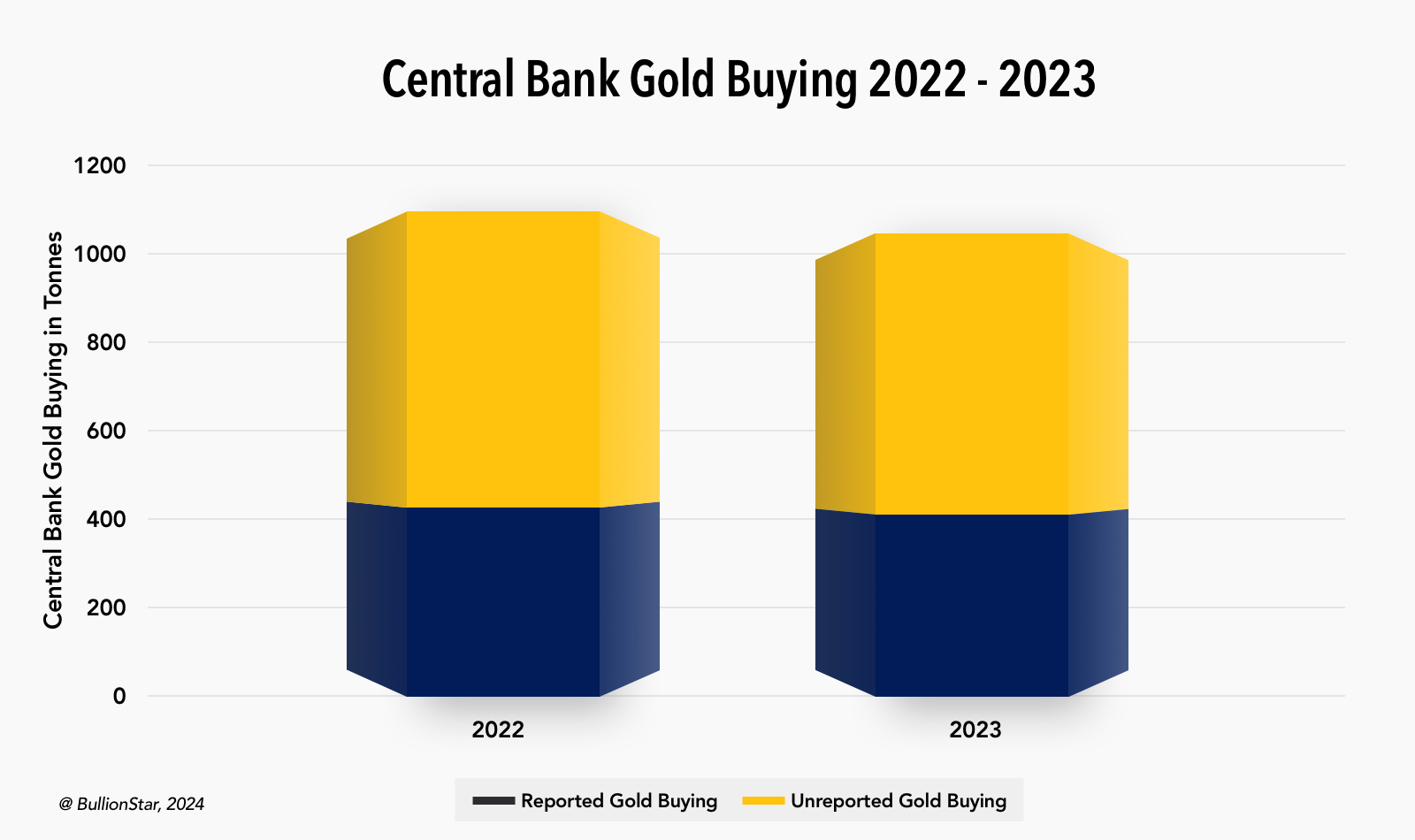

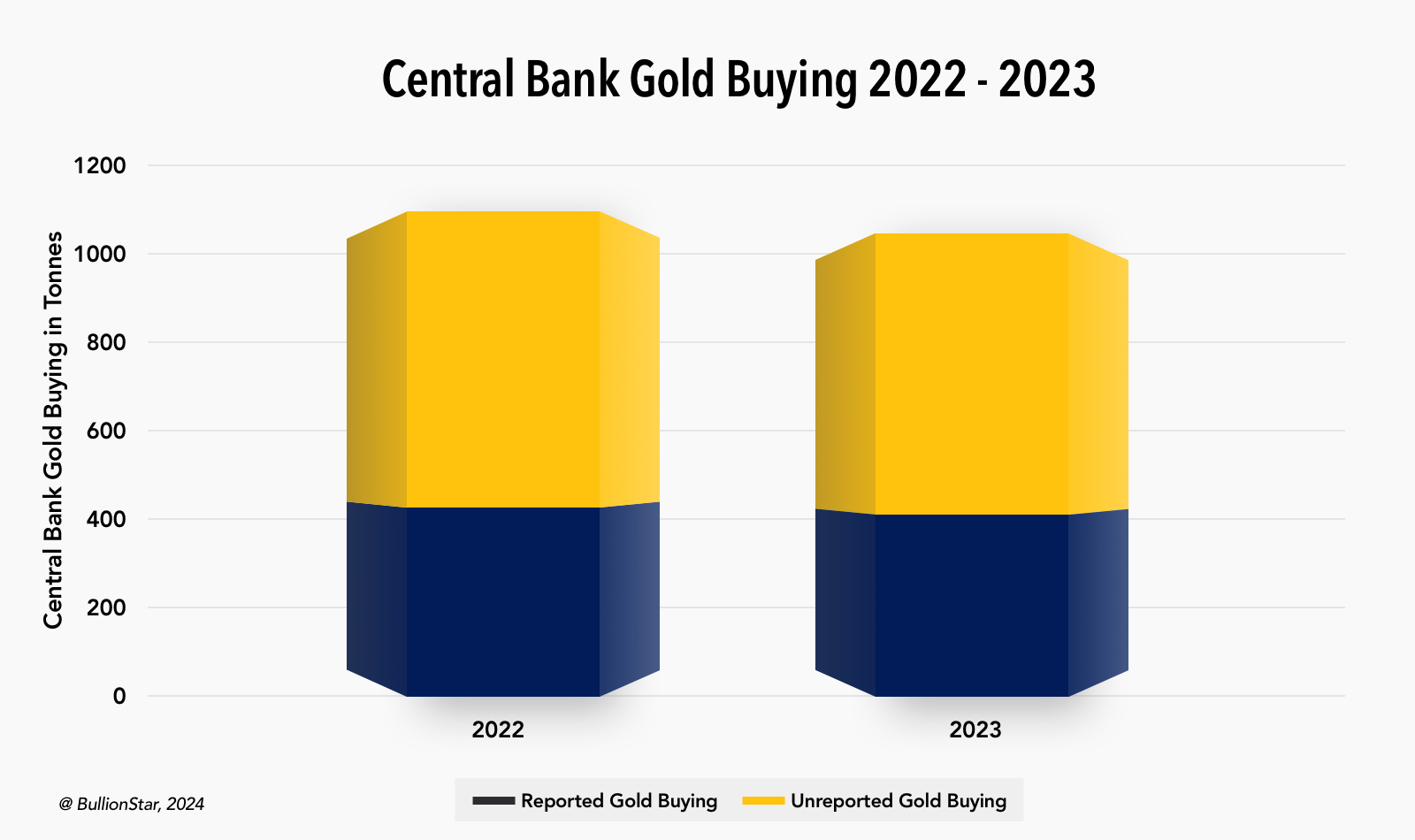

This is because following a record year in 2022, when according to the World Gold Council (WGC), central banks and official financial institutions across the world net purchased a massive 1082 tonnes of gold for their monetary gold reserves, the year 2023 was nearly as impressive, with central banks as a group buying a net 1037 tonnes of gold, just shy of the 2022 total.

TRUTH LIVES on at https://sgtreport.tv/

Given that total gold mining production was 3625 tonnes in 2022, and 3644 tonnes in 2023, it can be seen that central banks are now responsible for buying the equivalent of between 28 – 30% of all newly mined gold.

Additionally, the recent buying means that, as of the end of 2023, central banks and official financial institutions held a combined 36,700 tonnes of gold, which was 17% of the world’s above ground gold stockpile of 212,580 tonnes as per WGC estimates.

Monetary gold buying activity has now continued into 2024, with central banks purchasing a net 290 tonnes of gold between January and March 2024, which again according to the WGC, is the strongest first quarter on record.

Unreported Buying

Before looking at which of the world’s central banks are driving this influential gold demand dynamic, its important to note that the majority of annual central bank gold demand estimates published by the World Gold Council comprise ‘unreported buying’, i.e. buying which has not been reported by any central bank but which has been ‘guestimated’ by the World Gold Council’s data collection agent, the London headquartered consultancy “Metals Focus”.

As the WGC Gold Demand Trends report said for 2022, central bank gold purchases were “a combination of reported purchases and a substantial estimate for unreported buying”. Since reported purchases in 2022 were only just 412 tonnes, this left 670 tonnes in the ‘unreported buying’ category.

A similar anomaly exists for 2023, a year in which the World Gold Council Gold Demand Trends (GDT) 2023 report didn’t even address the unreported buying guestimates, but glossed over them. In that year, reported central bank buying was 403 tonnes, which left a gap of a 634 tonnes in the unreported category.

While ‘reported purchases’ are based on actual central banks submitting gold purchase data to the International Monetary Fund’s (IMF) International Financial Statistics (IFS) database, ‘unreported buying’ is described by Metals Focus as “confidential information regarding unrecorded sales and purchases”. As such, this unreported buying cannot be verified and adds a lack of transparency to the data, since while Metals Focus claims it knows of these gold purchases, it won’t provide any details.

For a background on this inadequacy in the Metals Focus data, see the BullionStar article from November 2022 titled “Gold Establishment Supports Central Bank Secrecy”.

However, the magnitude of these unreported central bank gold purchases is to be believed, it seems that central banks have been spooked by increased sanctions risk and the unprecedented confiscation of Russia’s FX reserves by US and G7 sanctions, and are now increasingly buying the ultimate monetary asset which cannot be confiscated if stored in their home country national vaults – gold.

Gold & Gold Receivables – Possible Double Counting

Another caveat when looking at central bank gold buying data and central bank gold holdings in general is that there is no way to verify the accuracy of the data as a) central banks do not allow independent physical audits and b) the whole world of central bank gold lending is murky, where Gold & Gold Receivables are counted as one line item in central banks’ balance sheets, and where central banks and their bullion bank counterparts closely guard data on gold loans, swaps and leases. As such, there could be a lot of ‘double counting’ going on in the central bank gold world, where specific gold can be two or more places at the same time.

Which Central Banks are Active as Gold Buyers?

Now, having been made aware of these deficiencies in central bank gold buying and gold holdings data, let’s look at the central banks which have been reporting gold buying over 2023 and into 2024. You will see that the trend is mostly one of emerging markets, Eastern buyers, and BRICS central banks dominating gold purchases, while Western central banks (except those in Eastern Europe) remain for the most part on the side-lines.

People’s Bank of China

First up is the world’s foremost central bank gold buyer – China. Through its central bank the People’s Bank of China (PBoC), the Chinese state has publicly and steadily been accumulating monetary gold for 18 consecutive months now, each month announcing gold purchases via its State Administration of Foreign Exchange (SAFE).

Over that 18 month period, China has officially added a colossal 316 tonnes to its gold reserves, taking its official total from 1,948 tonnes of gold at the end of October 2022, to 2,264 tonnes as of the end of April 2024. These huge purchases allowed China to rank as the largest sovereign gold buyer in 2023 (with 225 tonnes).