by Craig Hemke, Sprott Money:

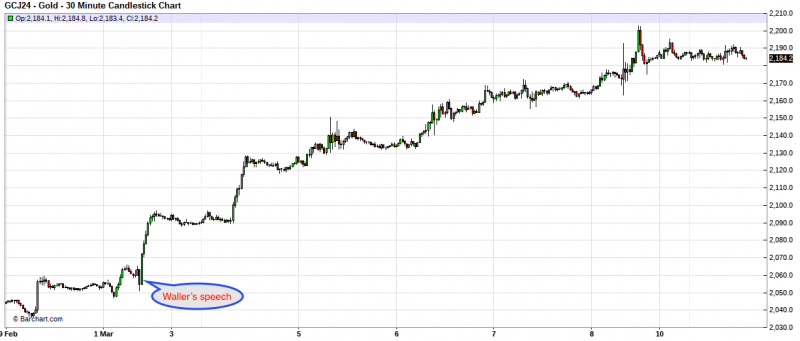

COMEX gold and COMEX silver have both seen terrific price rallies over the past two weeks. However, not all rallies are the same, so let’s take time today to dissect both types.

Over the past seven trading days, precious metal prices have soared, led by COMEX gold. What set off these rallies? Primarily, two things:

- Fed Governor Christopher Waller gave a speech on Friday, March 1, where he outlined his thoughts on the future of monetary policy and quantitative easing. If you missed the speech, a great summary can be found at this link: https://www.fastbull.com/newsdetail/fed-waller-reversed-operation-twist-3115363_0

TRUTH LIVES on at https://sgtreport.tv/

- The COMEX gold price surged $40 that day and finished the week at new all-time daily and weekly highs. The follow-on rally last week was simply momentum-based as speculator money came rushing in on the technical breakout.

The price rally for COMEX gold is shown below. It’s pretty impressive. Over just seven days, price has gained $145 or about 7%. You can see this below:

Over this same seven-day period, total contract open interest in COMEX gold has surged. A rising price combined with rising open interest is always a sign of increased speculator buying, and we wrote about how this can positively impact price last week. In case you missed it, here again is the link:

https://www.sprottmoney.com/blog/volume-precedes-price-for-gold

How much has open interest in COMEX gold surged? On Wednesday, February 28, total open interest stood at 411,698 contracts and very near a five-year low. As of Friday, March 8—and, again, with price $145 higher—total COMEX gold open interest had grown by 122,430 contracts to a total of 534,199. That’s nearly 30%!

In summary, what just took place? A technical breakout following some very gold-positive news led to a massive rush of speculator cash into COMEX gold futures. Price rose 7% as total contract open interest rose by 30%. Don’t believe me? See the latest Commitment of Traders report below. This report covers the five-day period of Wednesday, February 27, to Tuesday, March 5. This period alone saw the COMEX gold price rise by $97, driven by 49,200 new Large Speculator longs.

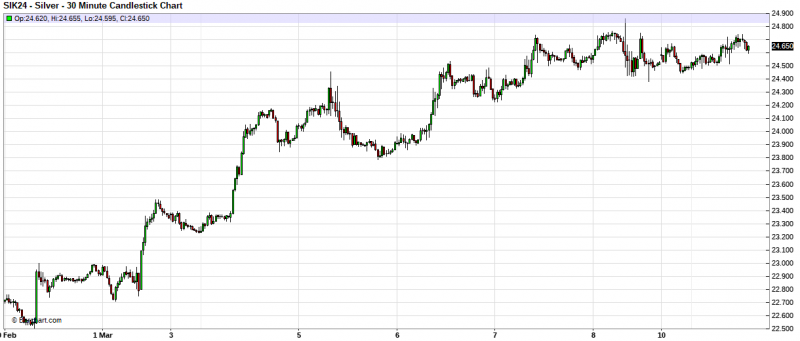

Now contrast that with the ongoing rally in the COMEX silver price. Over the same period of Thursday, February 28, to Friday, March 8, the COMEX silver price rose by $1.92 or about 8.5%.

However, total open interest in COMEX silver declined over the same period from 146,515 contracts to 142,481. So, unlike gold, where price and OI surged together, COMEX silver had a price rally while total contract open interest fell by 2.8%.

What’s going on in this case? You will almost always have a Spec short squeeze on your hands whenever you see price rising and open interest falling. This, too, is revealed in last week’s Commitment of Traders report. Note that there was some Large Speculator buying of the rally but it was far outweighed by the amount of Large Speculator short covering.