from ZeroHedge:

Those who take their funds abroad risk “losing everything,” according to the president

Those who take their funds abroad risk “losing everything,” according to the president

New York during the inflationary surge of the late 70s and early 80s was a mythical place where one could purchase a Park avenue penthouse for $1 (while assuming the copious debt, of course). Now, thanks to the brutal bear hug of the highest interest rates in 40 years and the ongoing CRE crisis, those legendary days have made a comeback to the Big Apple, if only in the realm of commercial real estate for now.

TRUTH LIVES on at https://sgtreport.tv/

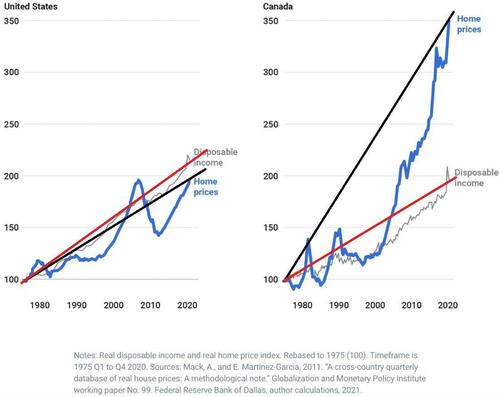

According to Bloomberg, Canadian pension funds – which until recently had been among the world’s most prolific buyers of real estate, starting a revolution that inspired retirement plans around the globe to emulate them because, in the immortal words of Ben Bernanke, Canadian real estate prices never go down…

… are finally realizing that gravity does exist . And so, the largest one among them is taking steps to limit its exposure to the most-beleaguered commercial property type — office buildings.

Canada Pension Plan Investment Board has recently done three deals at deeply discounted prices, selling its interests in a pair of Vancouver towers, and a business park in Southern California, but it was its Manhattan office tower redevelopment project that shocked the industry: the Canadian asset manager sold its stake for just $1. The worry now is that such firesales will set an example for other major investors seeking a way out of the turmoil too, forcing a wholesale crash in the Manhattan real estate market which until now had managed to avoid real price discovery.

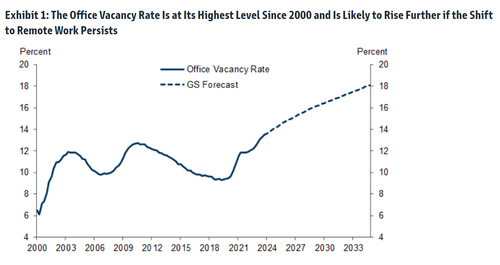

Indeed, as Goldman wrote earlier this week, while office vacancy rates are expected to keep rising well into the next decade..

… the average price of many nonviable offices has fallen only 11% to $307/sqft since 2019 (left side of Exhibit 6). The bank goes on to note that in the hardest-hit cities, as many as 14-16% of offices may no longer be viable, and their average transaction prices have already declined by 15-35%. However, because of lack of liquidity in this market, these recent transaction prices have not yet started to reflect the current values of many existing offices. Goldman ominously concludes that “alternative valuation methods, like those that are based on repeat-sales and appraisal values, suggest that actual office values may be far lower than the average transaction price.” Well, a $1 dollar price would certainly confirm that actual office values are far, far lower (more in the full Goldman note available to professional subscribers).