by Craig Hemke, Sprott Money:

An easily-predictable short squeeze has lifted COMEX precious metal prices off their recent floor. Equally predictable is the current rush to proclaim that new highs for 2024 will soon be forthcoming.

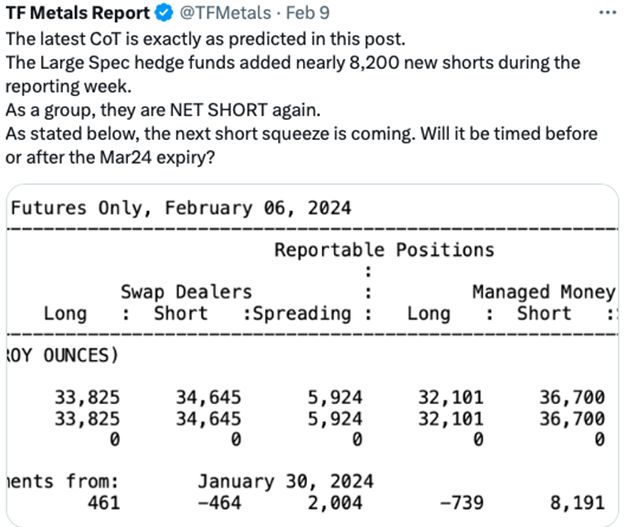

Let’s start with the latest Spec short squeeze. How can I say it was easily predictable? Below are X posts from yours truly on February 6 with follow up on February 9:

TRUTH LIVES on at https://sgtreport.tv/

The hedge fund short selling continued through Tuesday, February 13, when price fell 61¢ on the day while total COMEX silver contract open interest rose by 5,800 contracts. At that point, the stage was set for a short squeeze and price rallied $1.31 from Wednesday, the 14th, through Friday, the 16th.

But the reaction to this has been predictable too. Precious metal stackers and traders are so desperate for a breakout that most are prone to proclaim a new bull market to all-time highs any time a short-term low has been reached. Now please don’t get me wrong—I’m desperate for that breakout too. However, a small short squeeze of some overzealous, computer-driven hedge funds does not mean that COMEX silver is about to break over $28.

I’ve tried to warn you, my dear reader, of my 2024 expectations on several occasions this year, and it’s still only February! If you missed my annual macrocast, here again is the link:

Please read it, but if you’re short of time, I’ll cut to the chase: I’m just not looking for huge gains this year. Next year? YES! This year? I think we should be content with something closer to what has been “average” so far this century.

I could be wrong, of course, and there are myriad events that could compel Jerome Powell and his Fed to cut rates sooner and more aggressively than expected. Failing that, though, COMEX gold and silver will likely trade sideways for most of the year as the “market” waits for monetary policy changes.

And you can see this on the charts below too. Let’s start with the gold price. As 2023 ended, the spot gold price finished a month above $2000 for the first time EVER when it closed at $2036 on November 30, 2023. It then proceeded to close above $2000 at month end for December and January too. On a weekly basis, spot gold has closed above $2000 for thirteen consecutive weeks! This is all unprecedented, and it bodes very well for the long-term price trend.

Again, though, spending all of this time above $2000 does not mean that price is headed to $3000 by July. Instead, look at the long-term chart below. After reaching $1900 in 2011, price then spent the better part of eight years below $1800. Only in 2020 did it finally breech that level, and it has spent the three years since consolidating and preparing for the next leg higher.