from ZeroHedge:

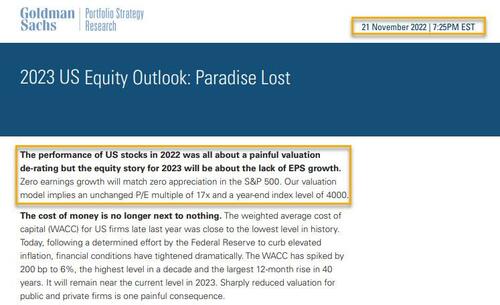

After getting his 2023 forecast catastrophically wrong in Nov 2022 when he predicted the S&P would close 2023 at only 4,000, or effectively unchanged for the year…

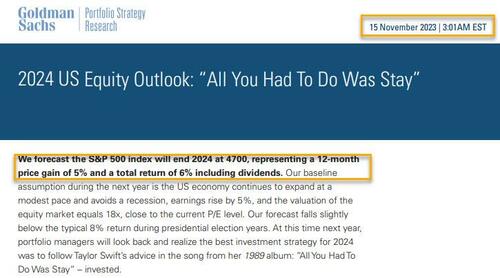

… Goldman’s chief equity strategist David Kostin scrambled to overcompensate in his next annual preview, first writing in his 2024 Equity Outlook note published in mid-November that he now expected the S&P to close at 4,700…

TRUTH LIVES on at https://sgtreport.tv/

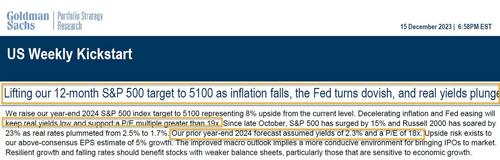

… only to change his mind exactly one month later when, in the middle of the biggest year-end meltup in decades, he revised his 2024 price target upward again this time to 5,100.

While it would be easy – and correct – to be cynical and observe that all Kostin was doing was chasing both market price, and the herd of other sellside analysts all of whom were suddenly outbulling each other like a waddle of penguins on meth, it is irrelevant what prompted Kostin to push the afterburners on his bullish take. Instead, what sparked our interest is what Goldman itself was doing during the time the bank was telling its clients to buy.

Because as we learned going through the bank’s latest quarterly investor presentation, we are confident that it will come as no surprise to regular readers (especially those who have read our previous notes on the matter such as “Goldman Quietly Sold Billions In Stocks In Q4 And 2021“, “Goldman Quietly Sells Billions In Stocks For The Third Quarter In A Row“. etc), Goldman was aggressively liquidating billions in its “principal investments” throughout 2023.

As the bank reveals in a chart on slide 16, revealing the details of its Asset & Wealth Management division, in a year when Goldman expected stocks to levitate modestly and, eventually, to soar higher, the bank was selling… and selling… and selling. Indeed, while the group, which was once better known as Goldman’s feared Prop Trading division, had “on-balance sheet alternative investments” of some $29.7 billion as of Dec 31, 2022, that number declined anywhere between $2 and $4 billion every quarter for the next four – with the bulk of sales taking place int he final quarter – before closing the year at just $16.3 billion!