from ZeroHedge:

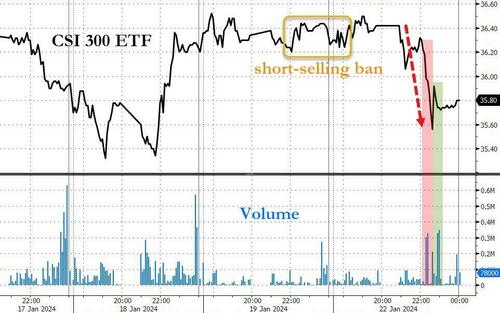

Earlier today, we lamented the latest implosion in Chinese markets, which we discussed in “China Stocks Crash Through ‘Snowball Derivatives’ Trigger Levels Overnight“, in which we pointed out the unprecedented failure of the centrally-planned market to halt its collapse be it through short selling bans, or even the latest impotent intervention by the “National Team”, China’s Plunge Protection Team, which today failed to spark even a modest rebound in the relentless selling which had triggered key liquidation levels.

TRUTH LIVES on at https://sgtreport.tv/

We then summarized just how badly Beijing had boxed itself, noting that “after short selling ban did nothing, China PPT stepped in… and couldn’t do jack. Beijing trapped.” We concluded that “either they watch liquidation cascade as snowball derivatives are knocked in sparking rout and leading to social unrest, or they stop talking and finally do something.”

This is bad: after short selling ban did nothing, China PPT stepped in… and couldn’t do jack. Beijing trapped: either they watch liquidation cascade as snowball derivatives are knocked in sparking rout and leading to social unrest, or they stop talking and finally do something pic.twitter.com/rMpV5UQVwr

— zerohedge (@zerohedge) January 22, 2024

Well, just a few hours later we were proven correct again, because shortly after China reopened on Tuesday, Bloomberg reported that according to “people familiar with the matter, asking not to be identified” – i.e., government sources eager to do a market test, China is considering a package of measures to stabilize the plummeting stock market, after earlier attempts to restore investor confidence fell short and prompted Premier Li Qiang to call for “forceful” steps.

Specifically, Beijing is reportedly seeking to “mobilize” about 2 trillion yuan ($278 billion), mainly from the offshore accounts of Chinese state-owned enterprises, as part of a stabilization fund to buy shares onshore through the Hong Kong exchange link; it has also earmarked at least 300 billion yuan of local funds to invest in onshore shares through China Securities Finance Corp. or Central Huijin Investment Ltd.

In other words, what was already a nationalized stock market is about to get even more nationalized, and instead of ad hoc interventions by the Plunge Protection Team, such market purchases by official state authorities will now become institutionalized.

Or maybe not: after all, China isn’t actually doing anythjing. Yes, it is mulling stuff, just like it has been mulling a 1 trillion yuan fiscal stimulus and a 1 trillion yuan “special “bond stimulus. but nothing has actually happened yet, because Beijing is absolutely terrified of the market reaction if and when the country with the 300% debt/GDP stats layering on more trillions in debt. Alas, at this point that’s just a matter of time, because either Beijing keeps mulling stuff and does nothing as it watches it cities burn amid the recent surge in strikes and protests…